- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Treating Biosimilars Equally With Brand Biologics in the Donut Hole

Can lower cost biosimilars create a policy solution for seniors enrolled in the Medicare Coverage Gap Discount Program?

Your physician is writing you a prescription for something called a biosimilar and tells you it is highly similar to, and has no clinically meaningful differences from, the FDA-approved reference product. After further discussion with your physician, you feel comfortable with the safety and effectiveness of the product and are excited to learn that biosimilars are less expensive than brand biologics.

The prescription is submitted to a specialty pharmacy that is covered under your Medicare Part D plan and the next day you receive a phone call from the pharmacy. The pharmacist talks with you about the biosimilar: the frequency of injection, potential side effects, and also offers to answer any questions you may have. You ask the pharmacist how much money will you be saving over the year and to your dismay you find out that despite the biosimilar being 25% less expensive than the $30,000-per-year brand biologic, you will be paying over $1500 more (39% higher) for your product. “What is going on?” you wonder.

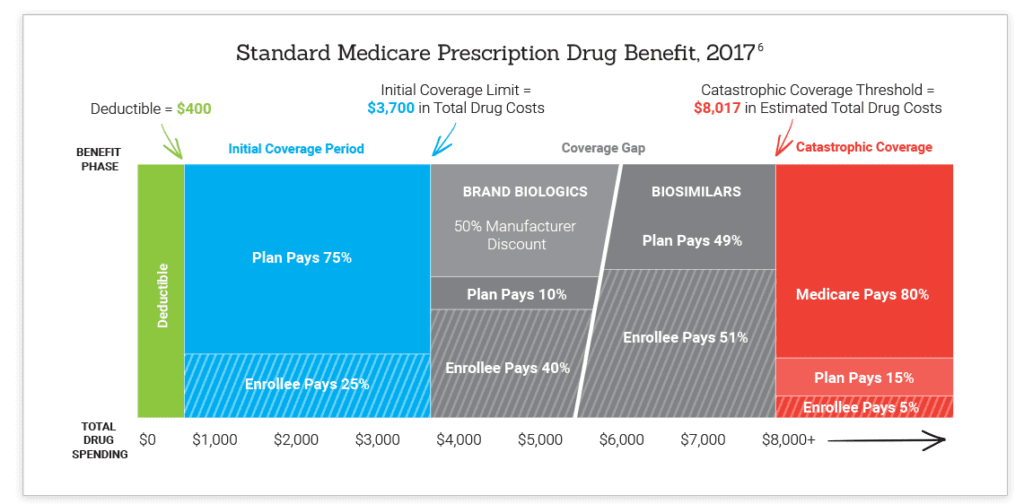

The standard Medicare Part D benefit, specifically the coverage gap or “donut hole,” has a significant unintended consequence that results in higher out-of-pocket (OOP) costs for biosimilars compared with their competing brand biologics. Under current law, seniors and individuals with disabilities who have prescription drug coverage under Part D will pay higher costs for biosimilars in the coverage gap because these products are exempt from the Medicare Coverage Gap Discount Program (CGDP) that requires manufacturers to provide a 50% discount on brand drugs and brand biologics.

In 2017, an enrollee would pay 51% of the total cost for a biosimilar while only paying 40% of the total cost for a brand biologic in the donut hole.

Chart courtesy of the Association for Accessible Medicines

The structure of the CGDP may encourage enrollees to use higher priced brand-name biologics in favor of lower cost biosimilars because of these lower enrollee OOP costs. Furthermore, the program may influence Part D plans to provide favorable plan design and coverage for brand biologics over biosimilars. These actions will threaten patient and taxpayer savings in Medicare Part D. Recent analysis from RAND estimates that biosimilars will provide potential cost savings of $54 billion over the next 10 years.

The solution to this unintended barrier to Part D enrollee use of biosimilars can be resolved by Congress who can provide a legislative fix by amending the Medicare CGDP that was originally enacted into law in the Affordable Care Act and codified in the Social Security Act. Legislation will need to modify the definition for “applicable drug” to include biosimilars along with brand drugs and brand biologics in order to allow biosimilar manufacturers to pay the same 50% discount paid by brand biologic competitors. This will result in reduced patient OOP costs and provide the federal government with at least $1 billion in savings over 10 years.

The legislative fix by Congress will complement the recent CMS proposal to lower Part D Low Income Subsidy (LIS) enrollee cost sharing and non-LIS enrollee catastrophic coverage cost sharing for biosimilars beginning in 2019. Collectively, these efforts by Congress and CMS will improve and better align incentives for all pertinent Medicare Part D enrollees to choose lower cost biosimilars over reference brand biologics and therefore result in higher savings for both enrollees and the Part D program.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.