- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Study: Employers Can Save With Biosimilars

Self-insured companies could have saved $407 million to $1.4 billion in 2018 had they switched completely from reference biologics infliximab and filgrastim to biosimilars.

Self-insured companies could have saved $407 million to $1.4 billion in 2018 had they switched completely from reference biologics infliximab and filgrastim to biosimilars, according to a report from the ERISA Industry Committee.

The study also estimated potential savings for Medicare programs at $279 million in 2018.

“For the biosimilars market to promote price competition and successfully generate savings, it is important that plan sponsors reconsider their options based on the full savings potential offered by each product. Increased transparency and greater access to information are an important first step,” study authors said.

Use at 13 of America’s Largest Companies

The analysis looked at 13 of America’s largest employers, including energy, hospitality, retail, transportation, and finance companies. The 2 study drugs, infliximab and filgrastim, were used by a very small percentage (0.06%) of each company’s beneficiaries, yet spending on these agents represented up to 2.7% of a typical company’s annual spending on drugs.

Infliximab is mainly used as an immunosuppressant to treat patients with autoimmune conditions, such as rheumatoid arthritis, Crohn disease, and ulcerative colitis. Filgrastim stimulates the production of blood cells and therefore is also used in other conditions where blood cell counts are too low.

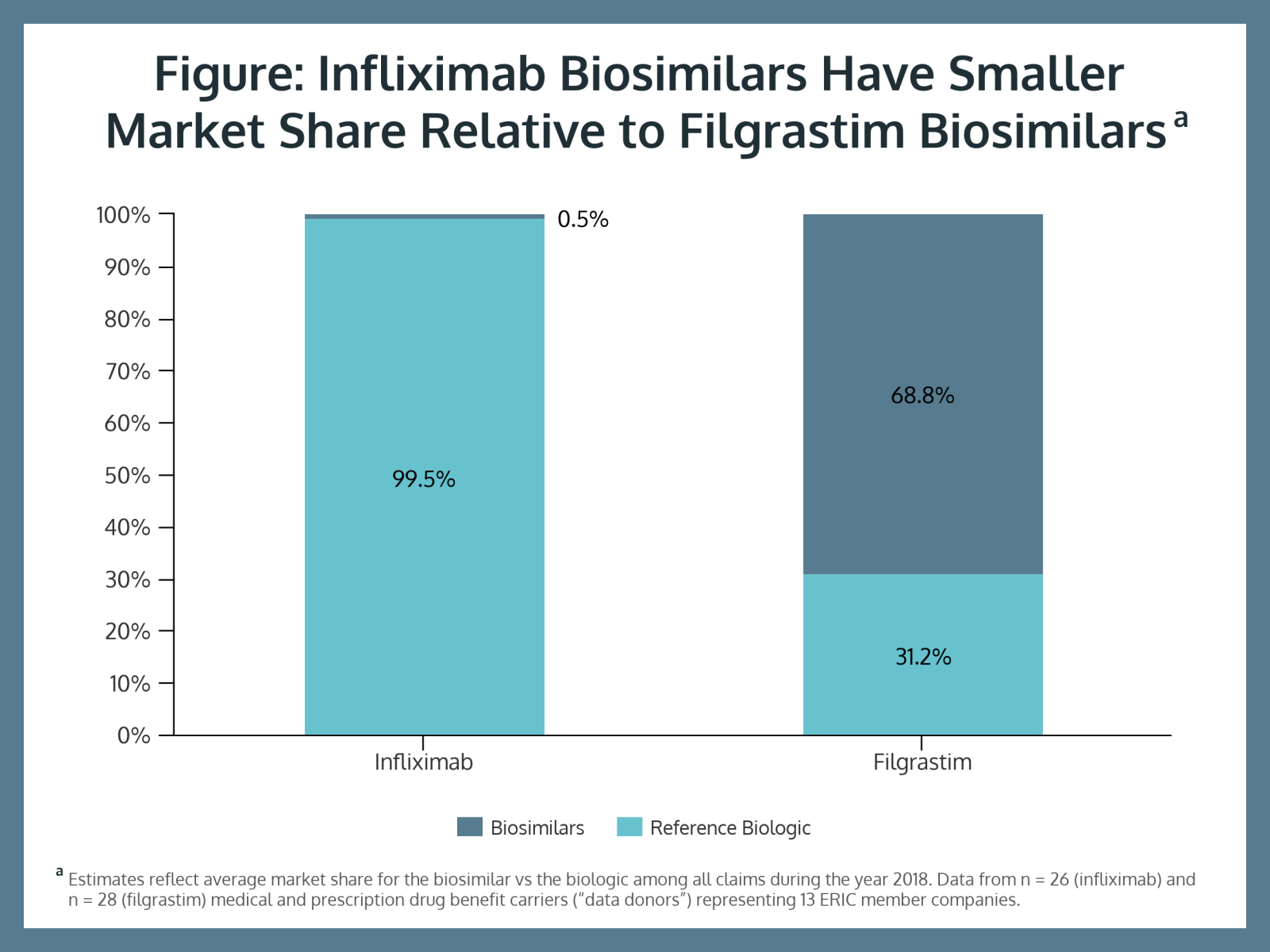

The study showed filgrastim biosimilar uptake is much more advanced than infliximab use. Biosimilars represented 68.8% of filgrastim claims and only 0.5% of infliximab claims (Figure). Study authors said this is due to plan sponsors making contracts with multiple vendors.

“This means that the likelihood of a beneficiary receiving a ‘better deal’ in their drug benefit does not depend on the company that they work for, but rather, on their choice of health plan or drug benefit carrier,” they said.

“Full biosimilar substitution on these 2 drugs, the companies that participated in this study could have saved, on average, $1.5 million in 2018,” the study said.

Focus Limited to Products With Competition

The study focused on infliximab and filgrastim because multiple biosimilar versions of these have been launched, allowing for price competition in 2018. For infliximab, biosimilar users paid on average 12% less (about $300) and filgrastim biosimilar users paid on average 45% less (about $600) out-of-pocket costs per year.

Because most biosimilars on the US market were released in 2019 and 2020, savings levels might be higher now, the authors said. Currently there are 26 biosimilars approved by the FDA and 16 that have launched. Multiple issues, including patent disputes, are responsible for preventing biosimilars from reaching market more quickly.

“It's also important to increase price competition in the overall market because self-insured employers account for a very large portion of the market…and changes that are promoted by these contracts that are sponsored by self-insured employers can have ripple effects on the entire biosimilars market,” said Mariana Socal, MD, PhD, lead author of the report.

The authors also explained that actual prices paid for biosimilars and their reference products in the United States depend heavily on drug rebates and discounts that are negotiated confidentially between a plan sponsor’s pharmacy benefit manager or insurance provider and drug manufacturers.

Coupons and Rebates Skew the Picture

Coupons and patient assistance programs that are available to patients with employer-sponsored health insurance may appear to save money, but these programs can tend to incentivize use of expensive specialty drugs and branded drugs rather than generic or biosimilar versions.

Because information on rebates and discounts is not public, it’s possible that the true difference in price between reference biologics and biosimilars may be higher or lower than estimates found in the study. The authors urge that this information be made available to plan sponsors so they can better manage their drug spending.

“Responsible management including measures to control drug costs is important in order to preserve employees’ benefits while preventing premium and cost-sharing increases,” the authors said.

At the extreme, reimbursement incentives can generate “rebate gaps” where a plan sponsor may be better off exclusively purchasing the reference biologic, which could penalize beneficiaries with higher out-of-pocket costs.

Although “it's true that rebate data on these drugs were not available for this study…, every single piece of literature that is currently being written on biosimilars utilization and biosimilar spending…cannot account for rebates [either],” Socal said.

Off-Label Use Is High for Biosimilars

The biosimilars were used for off-label conditions almost as often as their reference products. Findings showed that off-label usage of these biologics compared with their generic version was equal for both study drugs (about 10% for all drugs), except when looking at tbo-filgrastim (Granix), an “alternative biologic” for reference filgrastim. Tbo-filgrastim accounted for 55% of off-label usage.

Tbo-filgrastim was approved before the US started approving biosimilars and unlike biosimilars “this drug is approved for only 1 out of the reference biologic’s 6 indications, and yet it seems to behave as a competitor to the reference biologic in more clinical situations than the FDA-label would allow,” the authors noted.

Socal called for legislative action to improve potential savings for employers.

“Our member companies play a key role in helping foster stability in both the economy and in healthcare. To do so we need Congress to move without delay to address the most worrisome strain on employer healthcare spending.”

The Congressional Budget Office has estimated that biosimilars could generate savings of roughly $25 billion over 10 years, about 0.5% of national drug spending.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.