- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

3 Ustekinumab Biosimilars Launch on US Market

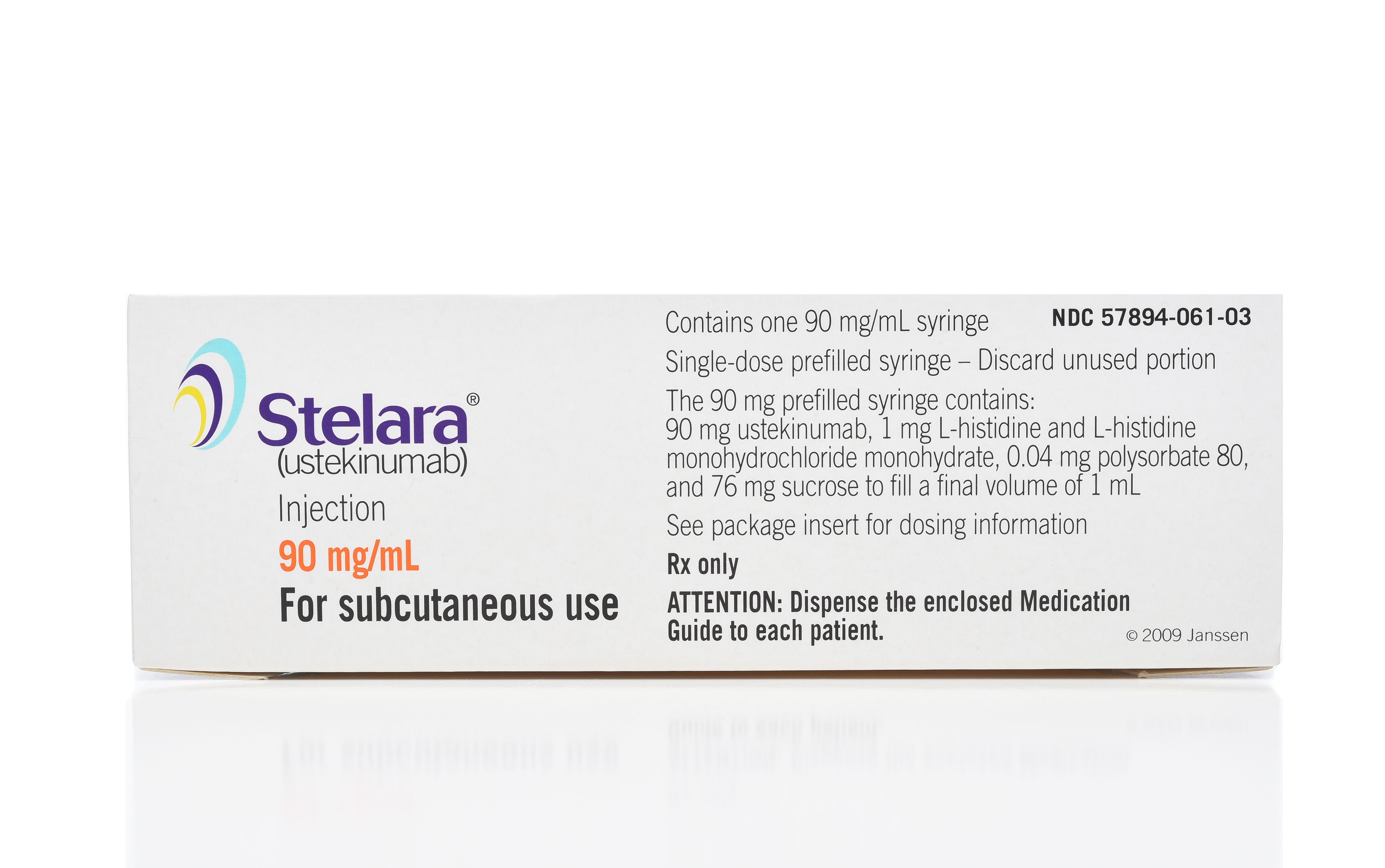

Three ustekinumab biosimilars enter the US market, expanding access to more affordable options referencing Stelara (ustekinumab), one of the most profitable drugs in the world.

After Wezlana (ustekinumab-auub) became the first ustekinumab biosimilar to enter the market in January 2025,1 3 others joined the fray, expanding access to lower-cost versions of blockbuster Stelara (ustekinumab).2-4

Samsung Bioepis/Sandoz, Biocon Biologics, and Teva/Alvotech launched their respective ustekinumab products: Pyzchiva (ustekinumab-ttwe), Yesintek (ustekinumab-kfce), and Selarsdi (ustekinumab-aekn).

Stelara, reference ustekinumab, generated $10.4 billion in sales in 2024, according to Johnson & Johnson’s most recent financial statement. | Image credit: Steve Cukrov - stock.adobe.com

Amgen's launch of Wezlana was part of an exclusive agreement with Nuvalia, Optum Rx’s biosimilar procurement business comparable to CVS Health's Cordavis and Cigna/Express Scripts' Quallent.1 Although Wezlana was the first ustekinumab biosimilar to receive FDA approval and first to launch, the Nuvaila deal partially limits access to patients, creating an opportunity for other FDA-approved biosimilars to fill the gap.

Overall, there are 7 ustekinumab. biosimilars approved by the FDA, all of which are slated to launch throughout 2025. In addition to the 4 on the market, there are Otulfi (ustekinumab-aauz), Imuldosa (ustekinumab-srlf), and Steqeyma (ustekinumab-stba).5 All 7 are approved for the treatment of plaque psoriasis, psoriatic arthritis, Crohn disease, and ulcerative colitis.

Ustekinumab biosimilars were originally expected in 2023; however, patent lawsuits brought about by Janssen and its parent company Johnson & Johnson (J&J) resulted in every biosimilar company looking to bring a Stelara biosimilar competitor to market being forced to delay their launches until the first half of 2025, with Amgen winning the first launch spot.6

Additionally, these products are looking to compete in a market where the reference drug generated $10.4 billion in sales in 2024, according to J&J’s most recent financial statement.7

Over 58.5 million American adults have been diagnosed with a rheumatic disease, with some estimates predicting psoriatic arthritis affects between 6% and 41% of patients with psoriasis.8-9 Additionally, inflammatory bowel disease, which includes Crohn disease and ulcerative colitis, is estimated to impact between 2.4 million and 3.1 million Americans, according to the CDC.10

“The burden of Crohn’s disease and ulcerative colitis on patients’ daily lives is substantial. This is a meaningful advancement for eligible chronic disease patients, who now have more treatment options available,” Laura Wingate, chief education, support, and advocacy officer of the Crohn’s and Colitis Foundation, commented.3

Biocon Biologics said that Yesintek will have commercial payer coverage at launch, as well as a patient assistance product that includes verification and co-pay support, among other services. The program is similar to the one offered for the reference product, and eligible patients could pay as little as $0 for the biosimilar.

Pyzchiva and Selarsdi were developed as part of exclusive commercialization agreements between a smaller international company and a larger American corporation. In the case of Pyzchiva, Samsung Bioepis oversaw development, registration, intellectual property, manufacturing, and supply, while Sandoz manages commercialization.2 Similarly, Selarsdi was developed by Alvotech and is commercialized by Teva.4

Of the 3 newly launched products, only Pyzchiva provisionally determined Pyzchiva to be interchangeable, but it can’t officially have the dedication until Wezlana’s 1-year exclusivity for being the first interchangeable ustekinumab biosimilar has lapsed.11 Once it has the full designation, pharmacists will be able substitute the reference drug with the Pyzchiva without waiting for provider approval, allowing patients to have easier access to their medications, particularly in the event of a drug shortage or supply chain issue.

References

1. Jeremias S. Welcome Wezlana: the first Stelara biosimilar to launch in the US. The Center for Biosimilars®. January 31, 2025. Accessed February 24, 2025. https://www.centerforbiosimilars.com/view/welcome-wezlana-the-first-stelara-biosimilar-to-launch-in-the-us

2. Samsung Bioepis announces US launch of Pyzchiva (ustekinumab-ttwe), biosimilar to Stelara. Press release. Samsung Bioepis. February 24, 2025. Accessed February 24, 2025. https://www.businesswire.com/news/home/20250223623917/en/Samsung-Bioepis-Announces-US-Launch-of-PYZCHIVA%C2%AE-ustekinumab-ttwe-Biosimilar-to-Stelara

3. Biocon Biologics launches Yesintek (ustekinumab-kfce) biosimilar to Stelara in the United States. Press release. Biocon Biologics. February 24, 2025. Accessed February 24, 2025. https://www.bioconbiologics.com/biocon-biologics-launches-yesintek-ustekinumab-kfce-biosimilar-to-stelara-in-the-united-states/

4. Teva and Alvotech announce Selarsdi (ustekinumab-aekn) injection now available in the U.S. Press release. Teva Pharmaceuticals. February 21, 2025. Accessed February 24, 2025. https://www.tevapharm.com/news-and-media/latest-news/teva-and-alvotech-announce-selarsdi-ustekinumab-aekn-injection-now-available-in-the-u.s

5. Biosimilar approvals. The Center for Biosimilars. Updated February 24, 2025. Accessed February 24, 2025. https://www.centerforbiosimilars.com/biosimilar-approvals

6. Jeremias S. Amgen’s Stelara biosimilar delayed until 2025 after settling with J&J. The Center for Biosimilars. May 29, 2023. Accessed February 24, 2025. https://www.centerforbiosimilars.com/view/amgen-s-stelara-biosimilar-delayed-until-2025-after-settling-with-j-j

7. Johnson & Johnson reports Q4 and full-year 2024 results. J&J. January 22, 2025. Accessed February 24, 2025. https://www.investor.jnj.com/news/news-details/2025/Johnson--Johnson-Reports-Q4-and-Full-Year-2024-Results/default.aspx#:~:text=2024%20Fourth%2DQuarter%20reported%20sales,quarter%20and%20full%20year%202024

8. American College of Rheumatology Releases 2022 Rheumatic Disease Report Card. Press release. American College of Rheumatology. September 15, 2022. Accessed February 24, 2025. https://rheumatology.org/press-releases/american-college-of-rheumatology-releases-2022-rheumatic-disease-report-card

9. Ogdie A, Weiss P. The epidemiology psoriatic arthritis. Rheum Dis Clin North Am. 2015;41(4):545-568. doi:10.1016/j.rdc.2015.07.001

10. IBD facts and stats. CDC. Accessed February 24, 2025. https://www.cdc.gov/inflammatory-bowel-disease/php/facts-stats/index.html

11. Jeremias S. FDA approves Samsung Bioepis’ Pyzchiva, a biosimilar to Stelara. The Center for Biosimilars. July 1, 2024. Accessed February 24, 2025. https://www.centerforbiosimilars.com/view/fda-approves-samsung-bioepis-pyzchiva-a-biosimilar-to-stelara

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.