- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

AAM Report: Biosimilars, Generics Generated Billions of Dollars in Savings in 2021

Biosimilar and generic drugs accumulated $373 billion in savings in 2021, $7 billion of which can be attributed to biosimilars alone, according to a report from the Association for Accessible Medicines (AAM).

Biosimilars accounted for $13 billion in savings since 2015, $7 billion of which occurred in 2021 alone, according to the Association for Accessible Medicines’ (AAM) “The U.S. Generic & Biosimilar Medicines Savings Report” as of September 2022.

The report provided an overview of the biosimilar and generic markets, including how these lower-cost therapies have impacted patient out-of-pocket costs as well as how savings have accumulated in each therapeutic category.

In addition to overall biosimilars savings, biosimilar and generic medications accounted for 91% of all prescriptions and accumulated $373 billion in savings for patients, consumers, employers, and taxpayers in 2021. Of that amount, $119 billion was from Medicare, amounting to $2447 in savings per enrollee, and $178 billion was from commercial plans. Savings from biosimilar and generic drugs increased about $33 billion between 2020 and 2021, about 7% to 10%. The report estimated that the US health care system saved over $2.6 trillion over the past decade because of the availability of generic and biosimilar medicines.

“There are many large numbers in this report, savings in the ‘billion’ and ‘trillions’ of dollars. While those figures show the significant impact on our nation, what must be remembered is that those enormous values are created by millions of individuals — you, your family, your neighbors, your constituents — saving $5, $50, or $500 by filling a prescription with a generic or biosimilar medicine instead of an expensive brand name drug,” the authors wrote.

Since biosimilars entered the market in 2015, medicines facing biosimilar competition have experienced greater adoption, contributing to 150 million more days of patient therapy. The greater adoption is a result of robust price competition, which led to lower prices of other biosimilars and their reference products. The average sales price of a biosimilar is over 50% lower than the price of the reference product prior to biosimilar competition entering the market.

Prices of reference products with biosimilar competition have decreased over 1 quarter since biosimilar market entry.

Although hospital spending growth was expected to accelerate from 5.7% to 6.9% from 2021 to 2022, prescriptions drug spending is projected to decrease from 4.7% to 4.3% as a result of greater adoption of lower-cost generics and biosimilars.

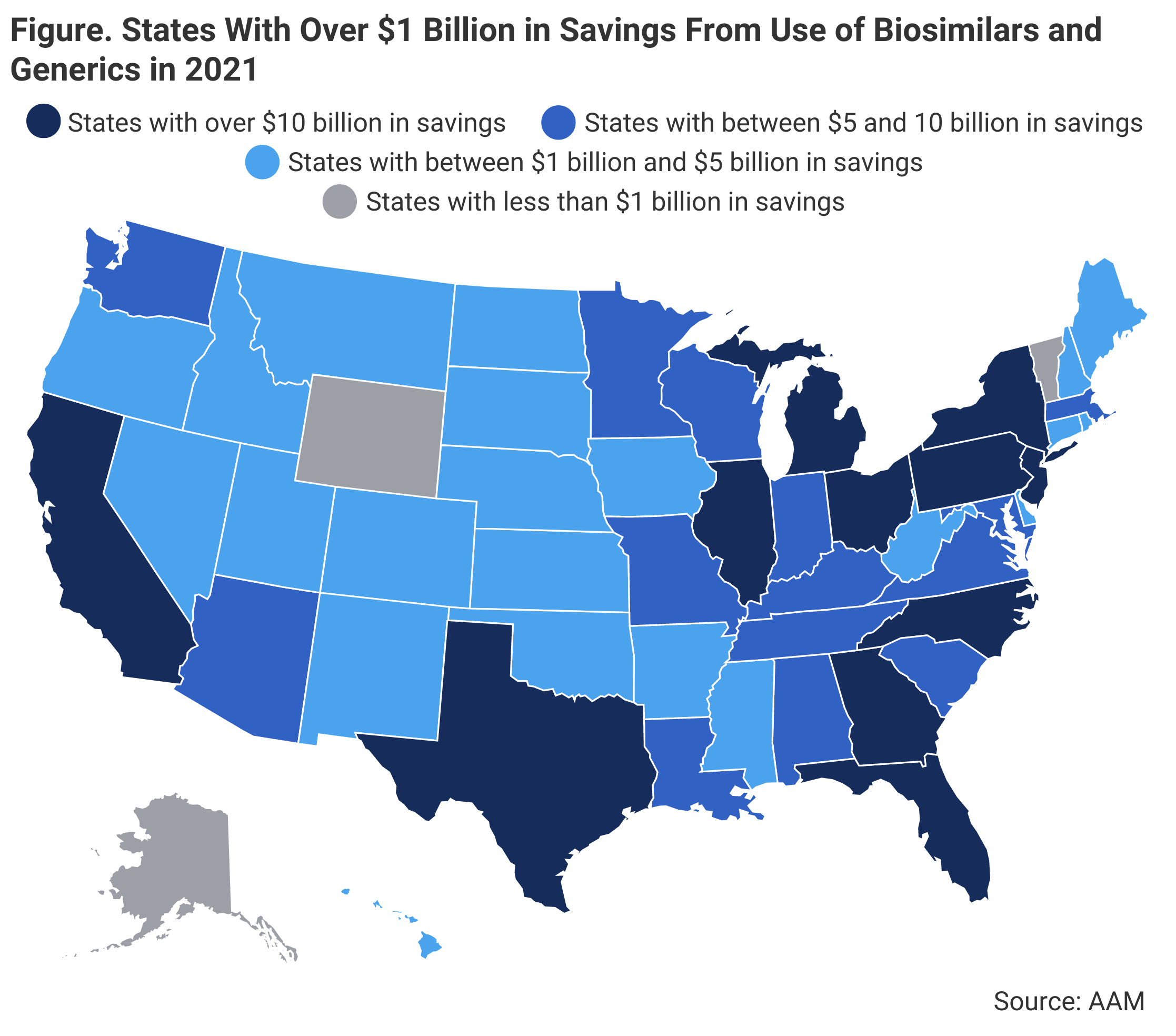

Out of all 50 states, 11 states saved over $10 billion in 2021 from using generic and biosimilar medications, with the highest amount of savings being attributed to California ($33.1 billion), followed by Texas ($29.7 billion) and New York ($29.6 billion). On average, states saved an average of $7.3 billion. Additionally, some smaller states had high per capita savings. (Figure)

A map of the United States showing the states that have saved over $10 billion or had a high per capita savings from using generic or biosimilar drugs in 2021.

The report predicted that the entry of new biosimilar competition in 2023 and 2024, such as the introduction biosimilars for Humira (adalimumab) and Stelara (ustekinumab), will further produce significant savings on spending for drugs used in treating autoimmune conditions and slow spending growth.

“These medicines maintain and save lives not just because they are safe and effective medicines, but because they are affordable. Despite the ongoing advances in modern medicine, if a patient can’t afford to fill their prescription at the dose and interval prescribed by their doctor, the patient’s health will suffer. Collectively, these attributes lead to increased adherence which culminates in the health system’s shared goal: successful patient outcomes, and fewer expensive and invasive medical interventions,” the authors explained.

The current biosimilar pipeline contains 95 biosimilar development programs in progress, marking an almost 50% increase over the last 4 years.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.