Government policies for generics and biosimilars drive down prices too far and fail to incentivize the use of these lower cost medicines, the Association for Accessible Medicines (AAM), a manufacturers’ trade group, argues in a new position paper that calls for multiple revisions in public payer policy.

Top among challenges faced by generics and biosimilars are rapid price deflation, anticompetitive practices, and government policies that contribute to both shortages of older generics and slow adoption of new generics and biosimilars, the AAM argues. Among the report’s key recommendations is that policymakers update Medicare to better incentivize the use and production of generics and biosimilars.

Policy Recommendations

The Association for Accessible Medicines argues that “imprudent or out-of-date government policies” undermine the market for less expensive generics and biosimilars and recommended a list of changes, including:

- Place generic drugs in Medicare Part D on generic formulary tiers with lower cost-sharing than brand name drugs

- Ensure Medicare beneficiaries have access to new generics

- Update Medicare Part D to include a dedicated specialty tier for generics and biosimilars

- Reward Medicare health plans for encouraging use of lower-cost generics or biosimilars and eliminating barriers to access

- End brand “rebate traps” that prevent use of generics and biosimilars

- Increase the Medicare Part B add-on payment to providers who use biosimilars

- Encourage adoption of biosimilars with a shared savings program

- Repeal or amend the Medicaid drug price inflation penalty for generics

The report also made recommendations for emergency preparedness: to support the expansion of the Strategic National Stockpile; to include domestically produced medicines that will be necessary during public health emergencies; and to support local manufacturers of essential medicines “by ensuring the economic conditions exist to justify the use of currently existing local manufacturing capacity.”

The AAM also calls for beefing up domestic production of medicines so that the United States is better equipped to ride out supply disruptions, such as those that occurred during the early stages of the COVID-19 pandemic; however, a yet-unpublished IQVIA study cited by AAM reveals that the US pharmaceutical sector quickly increased supply in response to a demand spike shortly after the pandemic arrived.

Penalties for drug price inflation may apply to generics but not brand name drugs, the group argues, contending this is one reason manufacturers may not launch new generic products and, actually, may discontinue production of generic products, further contributing to supply shortages. Also, the AAM argues, a handful of large wholesaler purchasers in the United States dominate the marketplace and make business conditions even rougher by effectively blocking some drugs from market.

The Need for Competition

Noting brand specialty drugs and biologics make up approximately 2% of prescriptions but almost 50% of spending on prescription drugs in the United States, the AAM argued that competition from generics and biosimilars is “critical to the long-term affordability of these medicines.” The AAM noted biosimilars “lower the price of the brand-name biologic as a result of competition” and “are directly responsible for increasing patient access to therapy by as much as 5%.” They cited research estimating biosimilars and specialty generics saved patients and taxpayers more than $67 billion in 2019, with projected savings amounting to $100 billion between 2021 and 2025.

Prices for older, commoditized generics have fallen steadily, creating what the report termed “financial pressure” on their producers. The AAM blamed this price decline in part on government policies intended to control the costs of prescription drugs.

One example is a Medicaid inflationary rebate penalty that imposes financial penalties on manufacturers when generic prices under Medicaid increase faster than the average. The AAM contends generics manufacturers are often wrongly penalized because the formula for calculating price increases doesn’t take into account simple price variability caused by “changes in customer mix, not price increases.”

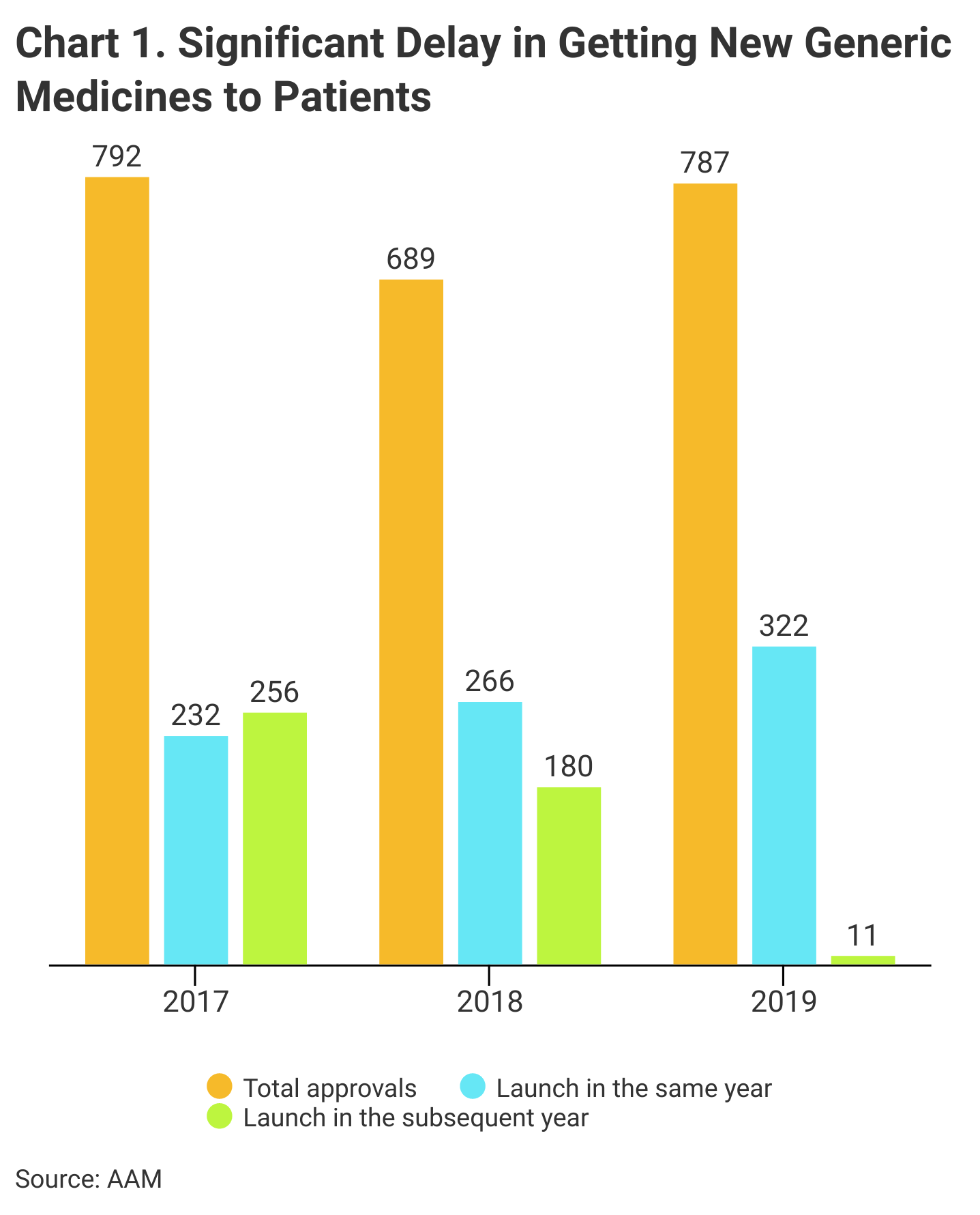

The AAM also blames heavy competitive pressure in markets crowded with producers. Often, newly approved generics simply fail to launch, or might be launched a year or more after they are FDA approved, it said (Chart 1).

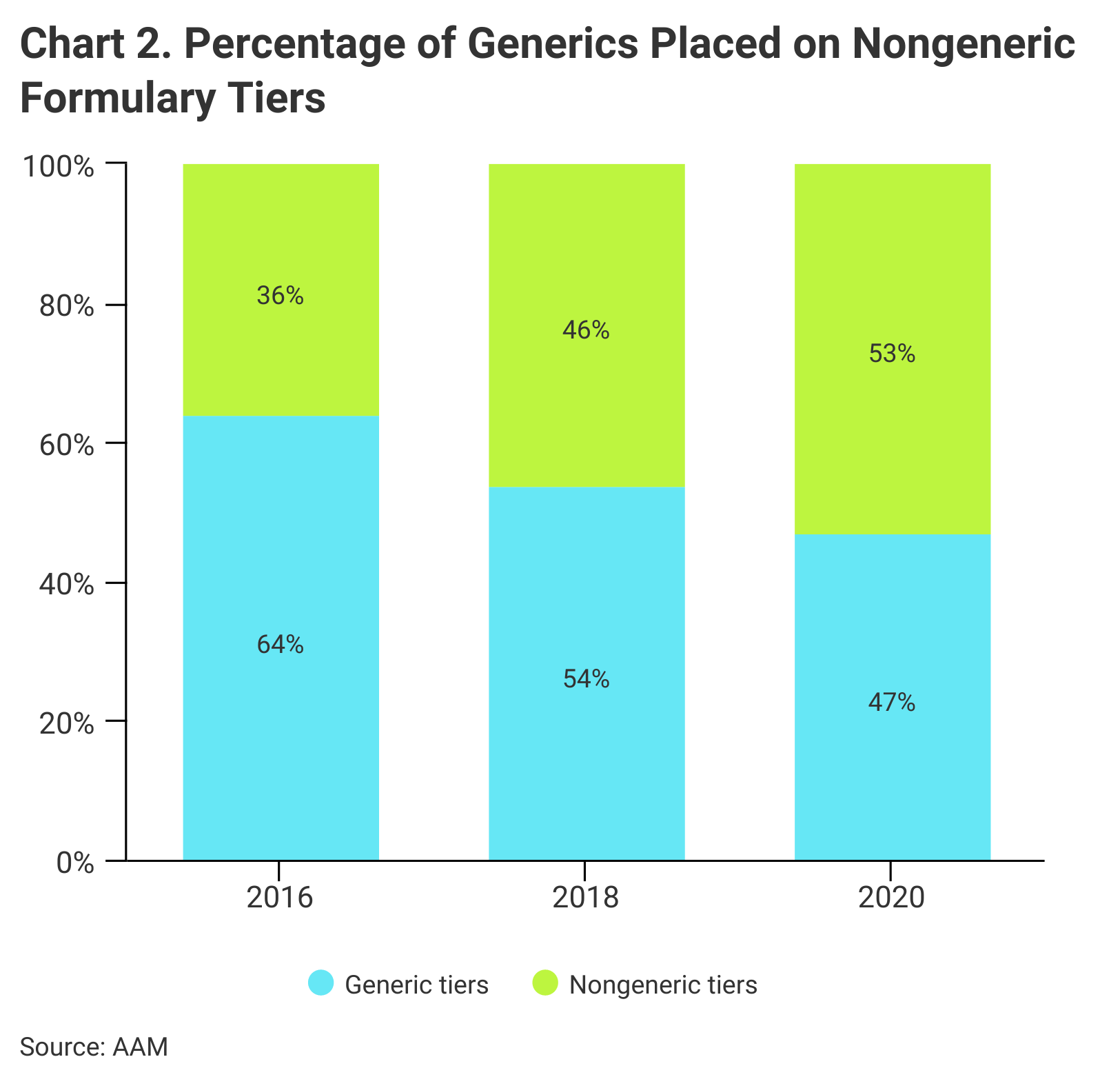

Medicare Part D formulary placement is another challenge to a sustainable market for generics, according to the report (Chart 2). Patients may pay more at the pharmacy even if the price of their generic drug has fallen, the AAM said, “because Medicare plan formularies now place more generics on brand formulary tiers with higher cost-sharing requirements.”

Barriers to Adoption

According to AAM, Medicare Advantage and Part D formularies may prefer brand name drugs over generics and biosimilars. An AAM examination of launches of newly approved generics “found that only about half were included on formularies of Medicare Part D plans.” They found that even when these medicines are added to formularies, they are routinely placed on expensive brand drug tiers with higher patient copays, and that it typically takes nearly 3 years after introduction to the market before first generics are covered on 50% of Medicare Part D formularies.

AAM says that biosimilars, despite being “on average 30% less expensive” than their reference biologics, “have yet to realize the full potential of savings through broad adoption.” The report noted new biosimilars face adoption barriers that “stem largely from payment policies that do not encourage biosimilar adoption or that actively reward use of higher-priced brand drugs.”

Despite their competitive cost, biosimilars in some cases have been slow to win significant market share, which the report attributed largely to rebate traps and other Medicare payment policies. The report singled out Medicare Part B for paying providers the same administration fee regardless if they prescribed more expensive treatment.

“While this ensures providers are not penalized for using a lower-cost biosimilar, it also means providers have no incentive to use the lower-cost option,” the report noted.