- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

AbbVie CEO Is on Deck as Antitrust Hearings Heat Up

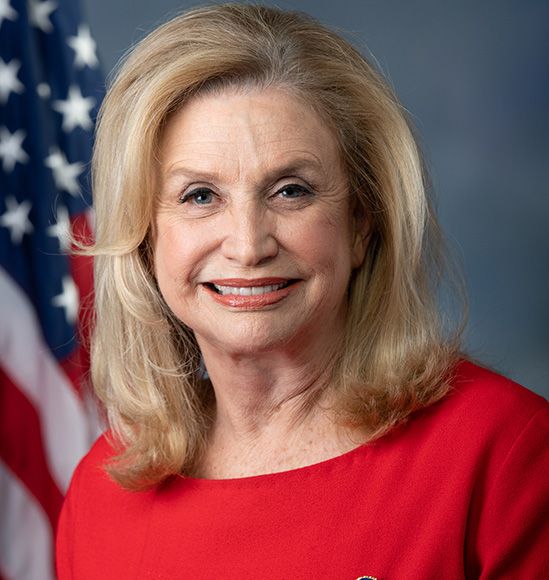

Representative Carolyn B. Maloney, D-New York, questions the use of pharmaceutical profits to defend against biosimilar competition.

Are pharmaceutical companies truly investing their profits in innovative products that extend the capabilities of medicine, or are they spending that money on fending off the competition so that their originator brand products enjoy longer periods of exclusivity?

Representative Carolyn B. Maloney (D-NY), chairwoman of the House Committee on Oversight and Reform, takes the latter position. In recent arguments before the House Subcommittee on Antitrust, Commercial, and Administrative Law, Maloney contended that a review of 1.3 million pages of internal pharmaceutical documents—part of an investigation initiated by the late Representative Elijah Cummings (D-MD) into prescription drug prices—has convinced her that an undercurrent of anticompetitive behavior is denying Americans fair access to vital medicines.

“We rely on the pharmaceutical industry to develop critical new therapies, cures, and vaccines. In exchange, our system grants these companies the exclusive right to sell their products for a limited number of years without facing competition from lower-priced generic and biosimilar drugs,” she said in testimony on April 29, 2021. "Unfortunately, brand name drug companies have abused this system by engaging in blatantly anticompetitive strategies to extend their monopoly pricing for far longer than our system intended.:"

The Cost to Consumers

As a result, health care consumers in the United States are paying far higher prices for medications than their counterparts in other parts of the world, she noted.

“Our investigation found that pharmaceutical companies dedicate significant portions of their research budgets to coming up with new ways to suppress generic and biosimilar competition, rather than focusing on developing new therapies,” Maloney said.

One company that is repeatedly held up as a poster child for blocking competitor access to the market is AbbVie, which has successfully stalled biosimilar competition in the US adalimumab market until 2023, allowing the company to increase the price of its originator adalimumab product, Humira. The anti-inflammatory drug was first approved in the United States in 2002.

AbbVie posted total first quarter 2021 Humira revenues of $4.87 billion, up 3.5% since the comparable first quarter of 2020, largely on the strength of US sales and price increases. In the United States, AbbVie raised the price of adalimumab 7.4% for 2021, according to health care research firm 46brooklyn.

Humira net revenues in the United States were $3.9 billion, up 6.9% vs international Humira revenues of $960 million, which were down 8.3% due to biosimilar competition in those markets. Adalimumab biosimilars have been available in Europe since 2017.

AbbVie’s relatively large “thicket” of patents protecting Humira has long been a source of contention, and AbbVie CEO Richard Gonzalez in 2019 testimony before the Senate Committee on Finance argued that although the patents are an obstacle to competition, the company has struck “a reasonable balance” with competitor companies by allowing them to license the use of inventions and technologies that concern the manufacture of adalimumab prior to the expiration of some patent protections.

At the time of that testimony, there were 136 patents for Humira, and Gonzalez explained that the company had generously allowed competitors to bring biosimilar versions of adalimumab to market “literally 10 years before the last patent expires in that portfolio.” The first adalimumab biosimilars will enter the US market in 2023, according to patent settlements between AbbVie and the biosimilar developers. Gonzalez is expected to appear before the House Oversight Committee on May 18, 2021, for more testimony about the Humira franchise.

Examples of Anticompetitive Behavior

In her committee report, Maloney said the internal reports her investigative team examined showed that Amgen and Novartis delayed generic drug market entry by negotiating with potential competitors rather than seeing patent disputes through to a court ruling.

“Amgen internally estimated that it collected $202 million in extra sales of the kidney drug Sensipar [cinacalcet] by delaying generic entry by just 10 weeks. Experts estimate that Novartis’ delay of generic competition for its cancer drug Gleevec [imatinib mesylate] cost the US market $700 million,” she said.

Maloney said a “product hopping” strategy by Teva Pharmaceuticals cost the US health care system $4.3 billion in “excess expenditures” when the company switched patients over to a higher dosage formulation (40 mg) of Copaxone (glatiramer acetate injection) just as the lower dosage (20 mg) formulation neared the end of exclusivity protection.

Among various maneuvers to support this product-hopping, “Teva even considered discontinuing its patient financial assistance program for 20-mg Copaxone to pressure patients to switch to the 40-mg version of the drug,” she alleged.

In the same hearing, Senator Amy Klobuchar (D-MN) noted that health care spending accounted for 17.7% of the US gross domestic product in 2019 and is projected to reach 19.7% by 2028 if curbs on drug price increases are not introduced.

“Nearly 20% of older adults report not taking their medicines as prescribed because of the cost,” she said.

Klobuchar said there is a need for Medicare Part D to be granted the ability to negotiate drug prices and that competition be promoted through importation of lower-priced drugs.

“The availability of generic drugs and biosimilars is critical to reducing drug costs. But branded drug companies have powerful financial incentives to delay the introduction of these more affordable alternatives to their own high-priced products,” she said.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.