“The rate of biosimilar uptake is generally increasing over time....Additionally, first-to-launch biosimilars tend to capture a greater portion of [market share] compared with later entrants.

- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Amgen US Biosimilar Trends Report Highlights Price Discounts

Biosimilars are launching at significant discounts to reference products and capturing increasing market share, according to an Amgen report.

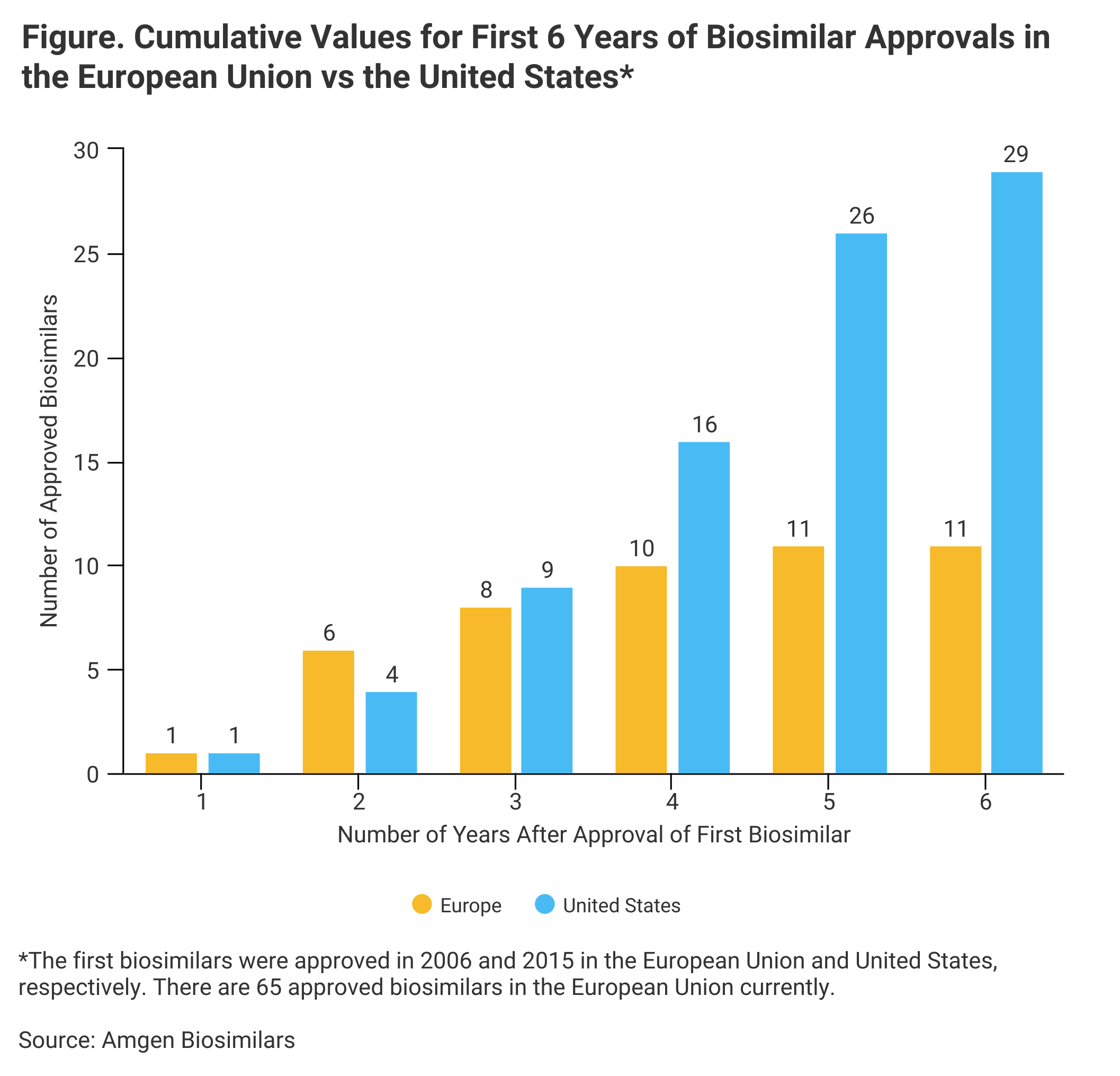

No new biosimilars have been approved so far in 2021, and the number of approvals in 2020 (3) was low compared with previous years; but 6 years after its first biosimilar launch, the United States is ahead of where the European Union was, according to a preview of Amgen’s 2021 Biosimilar Trends Report.

Further, biosimilars are launching at deep discounts to reference products and capturing increasing market share, the preview states.

The European Union approved its first biosimilar in 2006 (somatropin), and 6 years later, the European market had just 11 biosimilars approved vs 29 for the United States (Figure).

Although 8 of the 29 approved US biosimilars won’t be launched before 2023, that still leaves 21 biosimilars in the marketplace so far. The only biosimilar launched in 2021 has been Riabni, Amgen’s rituximab agent. The FDA approved Riabni for marketing in December 2020.

“Data show that the US biosimilar landscape is advancing faster than the European Union biosimilar landscape [did]", according to the Amgen preview. There are currently 65 biosimilars approved in the European Union.

The full 2021 Biosimilar Trends Report is expected to be published in the autumn of 2021.

Pricing Trends

The preview measures the difference in wholesale acquisition costs (WACs) for biosimilars vs originator drugs. WACs are the list prices that manufacturers charge wholesalers, although these do not include rebates and discounts provided by the manufacturer, which are important for a precise understanding of what wholesalers are paying.

WACs for biosimilars are sometimes well below WACs for reference products, according to Amgen. For example, the WAC for Avsola (infliximab; Amgen) was 57% below the reference product (Remicade) price WAC when the biosimilar was launched in July 2020.

Four pegfilgrastim biosimilars were launched from July 2018 to June 2020, and these were issued at WAC discounts of 33% to 37%, according to the preview. During that time, the average selling price (ASP) for the originator product, Neulasta, dropped by 35%. The ASP is the manufacturer average price minus rebates and discounts.

In the case of infliximab biosimilars, the discounts have been significantly deeper with each successive biosimilar introduced to market; however, the time period involved (late 2016 to mid-2020) was longer and ASP prices for the reference product, Remicade, have dropped roughly 45% since the first infliximab biosimilar launch.

The introduction of trastuzumab biosimilars, from July 2019 to April 2020, was marked by significantly more modest WAC discounts of 10% to 22%, according to the report. Meanwhile, the reference product (Herceptin) ASP dropped 5% or less, Amgen said.

Amgen also compared biosimilar WACs with reference product ASPs, demonstrating that, at the wholesale level, biosimilars were introduced for less than reference product prices net of discounts or rebates.

The most dramatic example was for the filgrastim biosimilar Nivestym, which was introduced at a WAC 24% below the reference product (Neupogen) ASP.

The preview notes that biosimilar prices are decreasing at an annual rate of 10% to 15%.

Market Share

The report also states that biosimilars launched in the past 2 years have achieved a significantly larger average market share (61%) vs biosimilars launched prior to 2019 (13%). “The rate of biosimilar uptake is generally increasing over time.... Additionally, first-to-launch biosimilars tend to capture a greater portion of [market share] compared with later entrants,” Amgen said.

Filgrastim biosimilars have captured the largest share of their respective market (73%) and infliximab biosimilars, the lowest (23%).

For an interview with Christophe Bourdon, senior vice president and general manager of US Oncology for Amgen, about the rollout of Riabni, click here.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.