- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

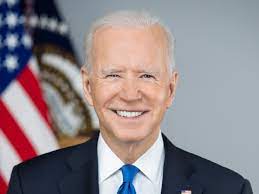

Biden Asks Congress for Support on Pharmaceutical Price Controls

Passage of HR 3 is shaping up as a centerpiece of President Biden's effort to bring pharmaceutical prices under control. If drug companies won't negotiate prices, international reference pricing would kick in.

After issuing a number of directives in July targeted at lowering the cost of prescription drugs and getting biosimilars into play, President Biden has clarified his intentions with a request for Congress to take action on specific measures.

The request endorses passage of the Elijah E. Cummings Lower Drug Costs Now Act, which would enable HHS to negotiate prescription drug prices for Medicare beneficiaries and, if companies refuse to negotiate, would limit drug prices to 120% of average prices in Australia, Canada, France, Germany, and the United Kingdom.

The request also refers to an investigative report from the House Committee on Oversight and Reform that noted steep price increases for the rheumatology drug adalimumab (Humira) and contended these were excessive and unjustifiable.

In a July executive order, Biden directed the FDA to set up a means by which lower-cost pharmaceuticals could be imported from Canada. It directed HHS to increase support for generic and biosimilar drugs and asked HHS to develop a comprehensive plan for combating high prescription drug prices and price gouging. It also called upon the Federal Trade Commission to ban so-called pay-for-delay tactics that originator companies use to forestall competition for their most lucrative products.

Under the timeline Biden gave HHS to submit a plan for lowering drug costs, the report would be due in about 10 days, or August 23.

“For every other type of health care service, Medicare works to get the best prices for American seniors. But for prescription drugs–and only prescription drugs–Medicare is prohibited by law from negotiating for the best deal. This needs to change,” the Biden letter to Congress states.

Biden also calls for caps on out-of-pocket costs for Medicare beneficiaries and recommends a penalty for drug companies “that raise their prices faster than inflation.”

The Cummings bill, HR 3, was first introduced in 2019 and reintroduced in April 2021. It would allow HHS to negotiate with pharmaceutical companies over the prices of high-cost drugs for which there is no generic or biosimilar competition. HHS would start in 2024 by negotiating prices for 25 of the drugs with the highest spend and at least 50 more drugs “in following years.” These negotiations would include insulin products.

“If pharmaceutical companies refuse to negotiate, they would face civil and tax penalties,” according to the Center for American Progress (CAP), a liberal research and advocacy group cited by Biden in his message to Congress.

According to CAP, US drug prices are on average 2.56 times those in 32 peer counties. Under HR 3, if international prices cannot be obtained for drugs HHS wishes to negotiate, the agency would be permitted to set the price at 85% of the average manufacturer price.

The Congressional Budget Office estimates that savings from HR 3 would amount to almost $500 billion over a decade, according to CAP. Specifically, the cost for a 30-day supply of adalimumab and etanercept would be reduced by $2161 and $2086, respectively.

CAP said HR 3 would cap out of pocket drug costs for Medicare beneficiaries at $2000, down from the current $6550 out-of-pocket limit before catastrophic coverage kicks in under Medicare Part D.

The Biden letter to Congress was applauded by the Biosimilars Forum, a group of biosimilar manufacturers. We urge Congress to pass meaningful legislation that gives more patients access to lifesaving, lower-cost biosimilar therapies so we can realize the Affordable Care Act’s full potential to lowering drug costs,” said Meaghan R. Smith, executive director of the Biosimilars Forum.

For a legal perspective on Biden's pharmaceutical pricing initiatives, click here.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.