- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

BIO Attorneys Address Patent Thicket Misconceptions

In this first part of a series, intellectual property attorneys from the Biotechnology Innovation Organization (BIO) contend that originator patents are not the formidable obstacles to biosimilars they are made out to be.

Patents protect intellectual property rights, especially in the realm of biologics, but is the level of patenting and patent litigation excessive and obstructive?

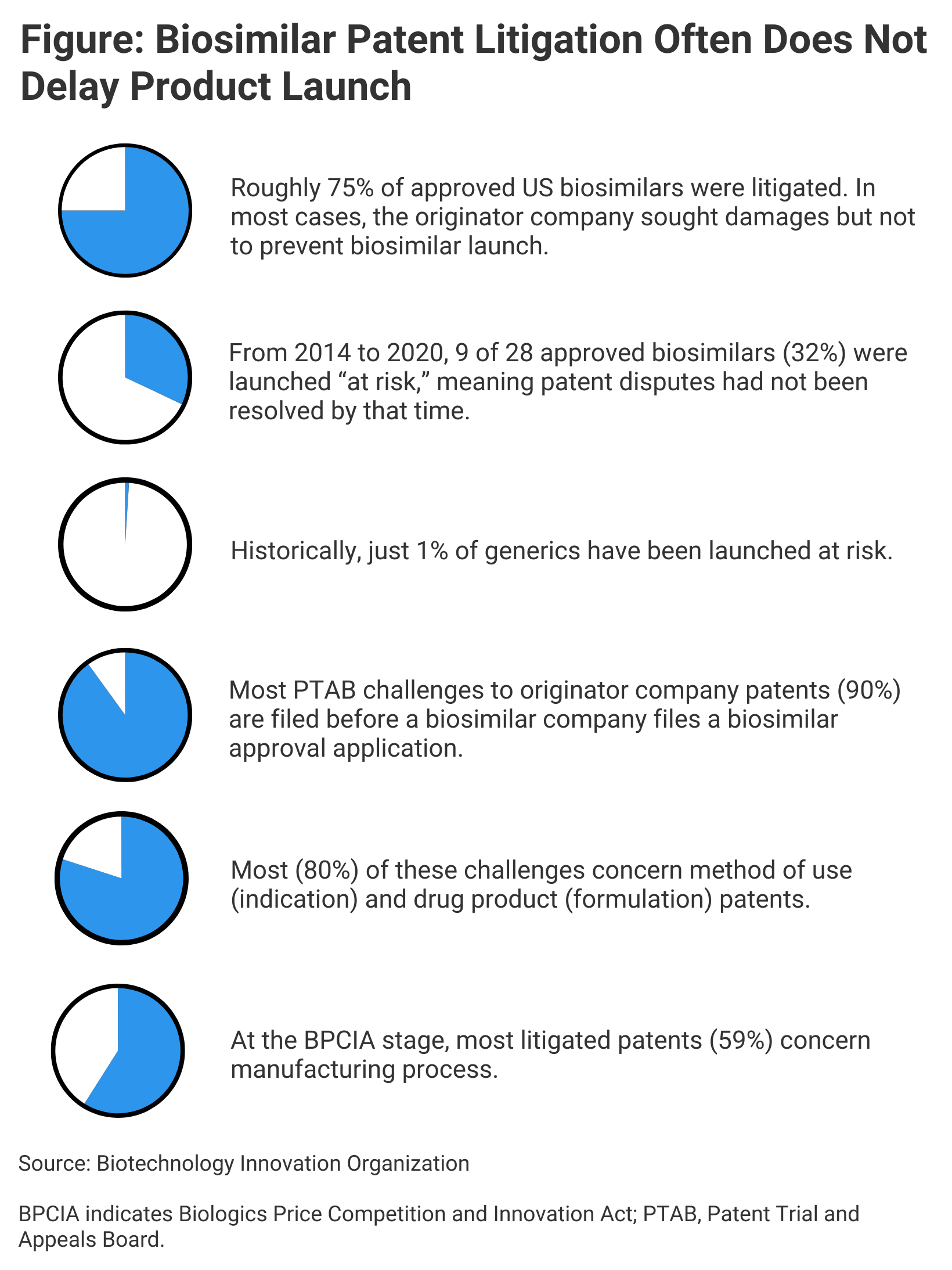

Two members of the Biotechnology Innovation Organization (BIO), a large trade group of pharmaceutical companies, argue that this is not the case. Basing their arguments in part on recent research into biosimilar litigation, Hans Sauer, deputy general counsel, and Melissa Brand, former assistant general counsel for Intellectual Property, contend that patents in general are not holding up biosimilar competition (Figure).

There have been some high-profile litigations since the first US biosimilar was approved in 2015 (Zarxio), but since that time, 30 biosimilars have been approved and 21 have been marketed, or “launched.” Patent portfolios for 2 originator drugs in particular, adalimumab (Humira) and etanercept (Enbrel), have stalled the marketing of 9 biosimilars of these agents.

“One thing that characterizes this debate is that it’s very anecdotal,” Sauer said in an interview with The Center for Biosimilars®. “Discussions about patenting practices in the biologics space and how they affect biosimilar market entry usually focus on one drug for the most part, and we know which one that is.”

Sauer was referring to Humira, which has at least 136 patents that have been blamed for stalling biosimilar adalimumab competition until 2023 in the United States and enabling AbbVie to generate in excess of $170 billion in Humira revenues worldwide.

This product is very much the exception, Sauer and Brand said. Excluding continuing US market exclusivity for Humira and the etanercept originator, 21 biosimilars have launched referencing 8 other originator products. And for 20 of these biosimilars, the median time to launch post approval was 6.2 months, vs 13 to 14 months for generics approved between 2010 and 2014, according to BIO research.

“What we thought would be healthy for this debate was to look at what we know from the empirical literature about these patterns, and it paints a picture that I think is somewhere in between different narratives that we’re hearing,” Sauer said.

The Truth About Patent Thickets

It may be true that large “patent thickets” protect the innovations that went into developing and producing some of these originator biologics, but only select patents play a significant role in determining whether a competitor can bring a biosimilar to market, Brand said.

“The size of a patent portfolio doesn’t mean that those are the patents that actually matter for resolving disputes between an innovator and a biosimilar company,” she said. “Actually, if you look at the Humira litigations, there were only 18 patents asserted and litigated,” out of as many as 60 AbbVie identified as potentially being infringed.

“The average number of patents asserted in any [Biologics Price Competition and Innovation Act (BPCIA)] litigation was 12, and that is not out of line when you talk about other complex patent technological cases,” Brand said.

A launch half a year after FDA approval is not bad, Sauer and Brand said. “It’s not like these products are getting approved and just sitting there. They’re actually launching pretty quickly, and they’re launching ‘at risk,’” meaning there is a chance of further litigation with the originator company once the biosimilars are on the market, Brand said. This suggests confidence on the part of biosimilar companies that the patents aren’t the obstacles they’re made out to be.

Of course, these data exclude anomalies that would skew the averages by quite a bit. For example, there are 6 biosimilars approved for adalimumab in the United States, and these were approved from September 2016 to July 2020, and none of them will come to market until 2023 according to settlements with AbbVie. For the earliest approved of these biosimilars, that represents a 7-year delay from FDA approval.

In the case of etanercept, an Amgen product, 2 biosimilars were approved, one in 2016 and the other in 2019, and yet no launch date has been announced for either. Both have faced patent litigation from Amgen.

According to BIO, 59% of patents “asserted” by originator companies in litigation are manufacturing process patents, 23% have to do with product indications, and 9% with formulation, according to BIO research.

“There’s this notion that there are these giant patent portfolios out there that people can’t get through. That doesn’t really align with the fact that biosimilar companies are launching at risk. If they had this overwhelming fear that they’re going to get sued on all of these patents, they probably wouldn’t be doing that,” Brand said.

For an opposing viewpoint:

The Center for Biosimilars® recently interviewed Tahir Amin, Dip LP, a former intellectual property attorney who is now co–executive director of I-MAK, which lobbies to overcome unfair trade practices and make medicines more widely available to patients. Amin presented an insider's perspective on the patent mill process that originator companies use to build protective walls of exclusivity around their most lucrative products.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.