- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

BioRationality: A Critical Analysis of Pfizer Views on Sustainability of Biosimilars

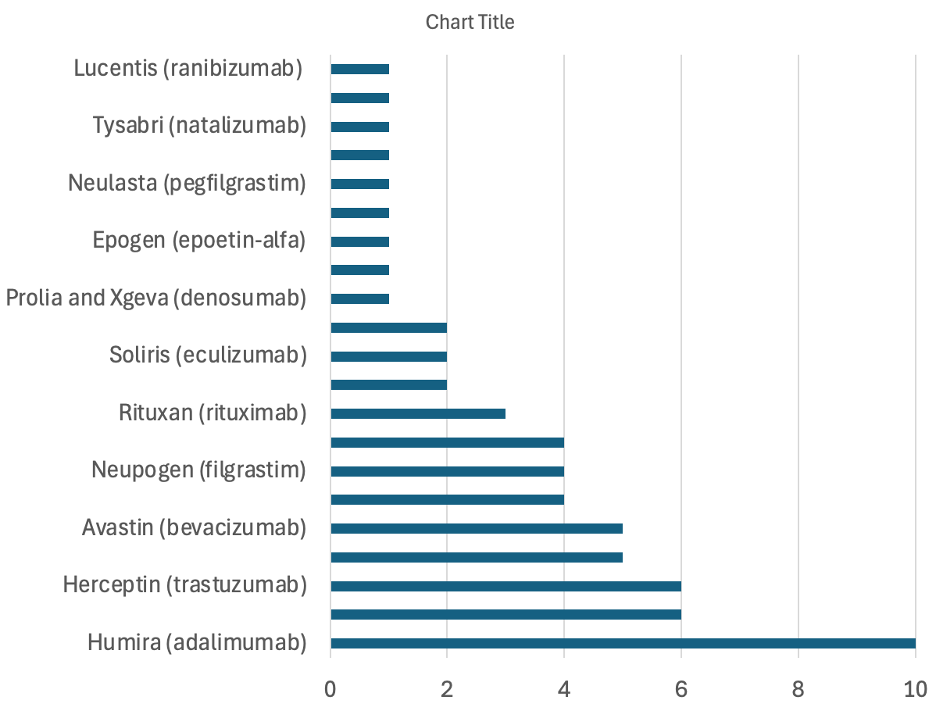

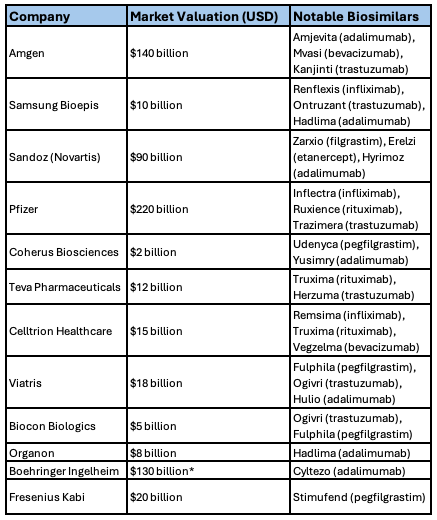

As of December 2024, the FDA has approved 62 biosimilars (Figure 1). Companies that own biosimilars in the US are listed in Table 1.

Figure 1. Approvals by Reference Product as of 2024 | Source: Sarfaraz K. Niazi, PhD

Pfizer, being the top company, published its views on the sustainability of biosimilars in an article titled “Stakeholder perspectives on the sustainability” on July 16, 2024; now, 6 months later, no other article has cited this paper. There is a reason for it. The article highlights the estimated $23.6 billion in savings in the US since biosimilars were introduced, a statement that is redundantly repeated by all biosimilar associations. This savings is less than 5% of what generic drugs have saved. This should not be news since that is the primary purpose of biosimilars. The biologics market in the US has been experiencing significant growth, driven by advancements in biotechnology and an increasing prevalence of chronic diseases. In 2024, the US biologics market was valued at approximately USD 190.3 billion. Projections indicate that this market will reach around USD 371.0 billion by 2033, exhibiting a compound annual growth rate of 7.4% from 2025 to 2033.

Table 1. Companies that own biosimilars in the US | Source: Sarfaraz K. Niazi, PhD

The Pfizer paper identifies key threats to the sustainability of the biosimilar market, including price volatility, perverse economic incentives favoring costly reference products, complex rebate structures, and evolving regulatory requirements for interchangeability status. Stakeholders in a multistakeholder roundtable emphasized the value of biosimilars in fostering competition, enhancing supply chain robustness, and improving patient access. To address sustainability challenges, proposed solutions include policy reforms to stabilize pricing, modify reimbursement practices, and ensure equitable sharing of cost savings among manufacturers, payers, providers, and patients. The authors advocate for collaborative efforts to overcome these barriers and build a robust, patient-centered biosimilar market that benefits all stakeholders.

In my opinion, none of Pfizer's suggestions are of any value. Unfortunately, Pfizer does not allow comments in its LinkedIn postings. Otherwise, I would have told them that the endpoint is when the cost of development drops down significantly, and thus, the price of biosimilars is not reduced by 25% as the Pfizer paper states but by more than 80%; at this point, none of the issues that Pfizer has identified will have any standing. If Pfizer is genuinely interested in bringing the value of biosimilars to Americans, it should work with the FDA in bringing the regulatory guidelines into better scientific grounds,

Interestingly, big pharma companies only concentrate on biosimilars that can claim a large market. Take the example of adalimumab; by posting that they are developing biosimilars with significant market potential, their stock price goes up; why wouldn’t they build somatropin, other 300 products that should enter the market as biosimilars?

I suggest that all stakeholders concentrate only on forcing the FDA to admit that clinical efficacy testing is not necessary, as has been done by the UK’s Medicines and Healthcare products Regulatory Agency. Then, the doors will open wide, but several companies identified above will also get out of the market, including Pfizer and Amgen. This is how it will end. But this is not in the interest of big pharma holding biosimilars in the US. Their views do not concord with what biosimilars are supposed to bring to patients—rational pricing. We must welcome smaller companies to enter the market with biosimilars to enable the entry of hundreds of products that the big pharma ignores.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.