- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

BioRationality: A Proposal to Create a New Association With Rational Scientific Agenda

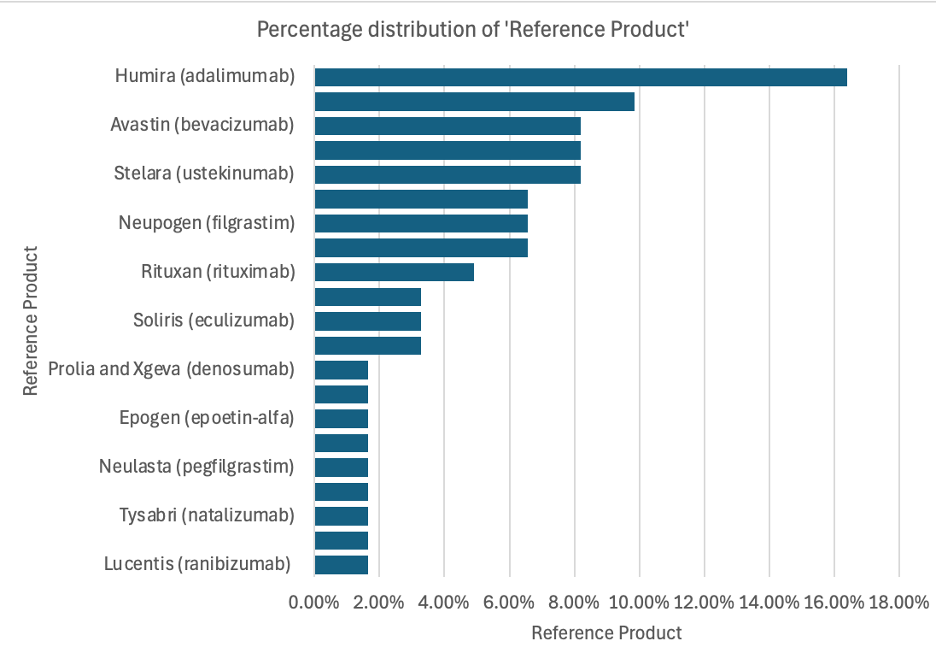

A decade and a half after biosimilars were recognized in the US, we have only 16 products as multiple biosimilars, while more than 100 molecules await entry. This disappointment is highly touted by the associations as a great success, quoting that adopting biosimilars saves money—this was expected, but how little this saving is rarely mentioned. The high cost of development is keeping biosimilars in the hands of big pharma, who will only pursue high-market products to allow them to make sales projections to keep their stocks high. (Figure 1)

Given below are recombinant products that could be candidates for biosimilars:

Recombinant Proteins: Insulin human (1982-2019); somatropin (1976-2008); epoetin (1989-2018); antihemophilic factor viii (recombinant) (1992-2019); insulin lispro (1996-2020); sargramostim (1991-2015); filgrastim (2002-2024); interferon alpha-2b (1986-2008); coagulation factor viia (1999-2020); etanercept (1998-2019); insulin glargine (2000-2021); coagulation factor ix (recombinant) (1997-2017); lutropin alpha (1994-2014); hyaluronidase (human recombinant) (2005-2023); interferon alpha-2a (1986-2004); imiglucerase (1994-2010); interferon beta-1b (1993-2009); aflibercept (2011-2024); follitropin beta (1997-2005); follitropin alfa (1997-2004); drotrecogin alfa, activated (2001-2007); interferon beta-1a (1996-2002); alglucosidase alfa (2006-2010); efgartigimod (2021-2023); insulin degludec (2015-2016); alteplase (1987); aldesleukin (1992); dornase alfa (1993); reteplase (1996); becaplermin (1997); interferon alfacon-1 (1997); oprelvekin (1997); thyrotropin alfa (1998); denileukin diftitox (1999); interferon gamma-1b (1999); tenecteplase (2000); anakinra (2001); darbepoetin alfa (2001); rasburicase (2002); agalsidase beta (2003); alefacept (2003); laronidase (2003); insulin glulisine (2004); palifermin (2004); abatacept (2005); galsulfase (2005); insulin detemir (2005); mecasermin (2005); idursulfase (2006); methoxy polyethylene glycol-epoetin beta (2007); insulin aspart (2008); rilonacept (2008); antithrombin (recombinant) (2009); belatacept (2011); ocriplasmin (2012); taliglucerase alfa (2012); coagulation factor xiii a-subunit (2013); tc99m-tilmanocept (2013); antihemophilic factor viii (recombinant), fc-fusion protein (2014); antihemophilic factor viii (recombinant), porcine sequence (2014); conestat alfa (2014); elosulfase alfa (2014); asfotase alfa (2015); sebelipase alfa (2015); antihemophilic factor viii (recombinant), single chain (2016); factor ix albumin fusion protein (2016); cerliponase alfa (2017); calaspargase pegol (2018); cenegermin-bkbj (2018); elapegademase-lvlr (2018); tagraxofusp-erzs (2018); luspatercept (2019); avalglucosidase alfa (2021); lonapegsomatropin (2021); ropeginterferon alfa-2b-njft (2021); daxibotulinumtoxina (2022); eflapegrastim (2022); olipudase alfa (2022); tebentafusp (2022); antihemophilic factor , fc-vwf-xten fusion protein-ehtl (2023); cipaglucosidase alfa (2023); efbemalenograstim alpha (2023); somatrogon (2023); velmanase alfa (2023); nogapendekin alfa inbakicept (2024); sotatercept (2024);

Recombinant Engineered and Monoclonal Antibodies: active ingredient (approval years); clobetasol (1985-2024); muromonab cd3 (1992); abciximab (1994); capromab pendetide (1996); imciromab pentetate (1996); daclizumab (1997-2016); rituximab (1997-2020); basiliximab (1998); infliximab (1998-2023); palivizumab (1998); tc99m nofetumomab merpentan (1998); trastuzumab (1998-2024); gemtuzumab ozogamicin (2000-2017); alemtuzumab (2001); adalimumab (2002-2024); ibritumomab tiuxetan (2002); efalizumab (2003); omalizumab (2003); tositumomab (2003); bevacizumab (2004-2023); cetuximab (2004); natalizumab (2004-2023); technetium (99m tc) fanolesomab (2004); panitumumab (2006); ranibizumab (2006-2022); eculizumab (2007-2024); certolizumab pegol (2008); canakinumab (2009); golimumab (2009-2013); ofatumumab (2009); ustekinumab (2009-2024); denosumab (2010-2024); tocilizumab (2010-2024); belimumab (2011-2017); brentuximab vedotin (2011); ipilimumab (2011); pertuzumab (2012-2020); raxibacumab (2012); obinutuzumab (2013); trastuzumab emtansine (2013); blinatumomab (2014); nivolumab (2014-2022); pembrolizumab (2014); ramucirumab (2014); siltuximab (2014); vedolizumab (2014-2024); alirocumab (2015); daratumumab (2015-2020); dinutuximab (2015); elotuzumab (2015); evolocumab (2015); idarucizumab (2015); mepolizumab (2015-2019); necitumumab (2015); secukinumab (2015-2023); atezolizumab (2016); bezlotoxumab (2016); ixekizumab (2016); obiltoxaximab (2016); olaratumab (2016); reslizumab (2016); avelumab (2017); benralizumab (2017); brodalumab (2017); dupilumab (2017); durvalumab (2017); emicizumab (2017); guselkumab (2017); inotuzumab ozogamicin (2017); ocrelizumab (2017); sarilumab (2017); burosumab-twza (2018); cemiplimab (2018); emapalumab-lzsg (2018); erenumab (2018); fremanezumab (2018); galcanezumab-gnlm (2018); ibalizumab-uiyk (2018); lanadelumab (2018); mogamulizumab (2018); moxetumomab pasudotox (2018); ravulizumab-cwvz (2018); tildrakizumab (2018); brolucizumab-dbll (2019); caplacizumab (2019); crizanlizumab (2019); enfortumab vedotin (2019); fam-trastuzumab deruxtecan-nxki (2019); polatuzumab vedotin (2019); risankizumab (2019-2022); romosozumab (2019); ansuvimab (2020); atoltivimab (2020); belantamab mafodotin (2020); eptinezumab (2020); inebilizumab (2020); isatuximab (2020); maftivimab (2020); margetuximab (2020); naxitamab (2020); odesivimab (2020); sacituzumab govitecan (2020); satralizumab (2020); tafasitamab (2020); teprotumumab (2020); aducanumab (2021); amivantamab-vmjw (2021); anifrolumab (2021); dostarlimab (2021); evinacumab (2021); loncastuximab (2021); tezepelumab (2021); tisotumab vedotin (2021); tralokinumab (2021); faricimab (2022); mirvetuximab soravtansine (2022); mosunetuzumab (2022); relatlimab (2022); spesolimab (2022); sutimlimab (2022); teclistamab (2022); teplizumab (2022); tremelimumab (2022); ublituximab (2022); bimekizumab (2023); elranatamab (2023); epcoritamab (2023); glofitamab (2023); lecanemab (2023); mirikizumab (2023); nirsevimab (2023); pozelimab (2023); retifanlimab (2023); rozanolixizumab (2023); talquetamab (2023); toripalimab (2023); crovalimab (2024); donanemab (2024); tarlatamab (2024); tislelizumab (2024).

The products under development are all monoclonal antibodies with high market valuation. Whether any of the lower market products will ever see their entry as biosimilars arises. It will most likely not if the development cost remains hundreds of millions of dollars.

Over the years, regulatory agencies have modified their guidelines to reduce the burden, but only for a few classes of drugs that are also the lower market candidates with pharmacodynamic markers. Still, the requirement of comparative efficacy testing that becomes exorbitant for many classes of biological medications remains intact. While scientific literature supports waiting for efficacy testing as the UK’s Medicines and Healthcare products Regulatory Agency has adopted this, there remains strong opposition from big pharma companies. For example, the FDA guideline to allow interchangeable status upon asking was opposed by big pharma, and publishers, such as EndPoint News, blocked its opposition. It is not surprising that big pharma can control many publishing platforms.

A most surprising opposition to enhancing the entry of biosimilars was opposed by all biosimilar and generic associations unable to understand that the critical element of the Inflation Reduction Act removes price negotiations if biosimilars are available or anticipated to enter the market. My opposition came as a paper I published since I was engaged by the US Senate to help write this bill. Despite the efforts of the Biosimilars Council, the bill passed and became law. I am still surprised that anyone can read the details and oppose the bill unless there is a conflict of interest.

At the GRx+Biosimilars conference of 2024, no presentation or discussion addressed the regulatory constraints of biosimilars.

The only thing that matters is the regulatory guidance, and I am pleased to report that the 2024 Global Generics and Biosimilars awarded me the Regulatory Achievement of the Year Award among the most recognized largest pharma companies Biocon, Samsung Bioepis, Sandoz, and STADA Arzneimittel.

I am proposing that all companies currently engaged in developing biosimilars join hands with their regulatory and scientific teams to create a plan to push for rational regulatory guidelines.

The success of biosimilars will come when the development cost goes down by 70% to 80%. And even more the price of biosimilars. For those who may not be familiar, it is cheaper to manufacture biological drugs since it is entirely the cost of carbon going in; it is the capital expenditures that keeps the cost of goods higher added by the studies that are altogether redundant, and their requirements present a backward scientific understanding that is kept alive by so many conflicts of interests. It is time to be rational.

I have proposed another plan to the FDA that seems to be taking root: to create a biological Drug Master File for biosimilars. In this case, a biosimilar developer can distribute the drug to multiple clients who will not need to conduct any other study except a pharmacokinetic study of their finished product. The DS comes with all assurance of biosimilarity without having to share these data with clients and is provided to the FDA under a DMF.

I have no conflict of interest in making recommendations for biosimilar companies to establish a separate coalition group; this is an essential step in biosimilars' success.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.