- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Biosimilars Bring Value to Health Care

The rapid growth of prescription drug costs continues to be a great concern in health care. The increasing use of specialty drugs, which includes biologics and totaled $360 billion in 2019, is one of the main drivers of prescription drug spending in the United States.1 Biologics, used as primary treatment for various cancers and other serious conditions, represented only 2% of all US prescriptions in 2017, yet accounted for 37% of net drug spending.2

Given the vast amount of health care resources consumed by biologics, biosimilars are increasingly gaining attention as a viable option. As stakeholders evaluate biosimilars and their promised benefits, here’s a look at what biosimilars are bringing to health care today and the progress made so far.

No Longer a Theory: Cost Reductions and Increased Access

Even though the US biosimilar market is still in the early stages, promising signs are emerging demonstrating that biosimilars can bring value to health care. The theory behind biosimilars is that, much like generic drugs, they promote competition by competing with reference biologics on price. This leads to lower prices, increasing access to life-saving drugs with minimized financial toxicity for patients.

Because US biosimilars are in their infancy, there are many unanswered questions. However, significant price reductions in the European Union were documented when biosimilars entered the market.3 Price reductions for epoetins in 2015 following biosimilar competition were substantial: 25% to 29% in Scandinavia, 39% in France, and 55% in Germany. Price reductions for the reference biologic and biosimilar filgrastim after the 2015 launch of a filgrastim biosimilar ranged from 14% in France to 27% in Germany.3 Because of the differences in market conditions, pricing, and governmental policies, the European data do not predict exactly what might happen in the United States. However, they do suggest price reductions in the same drug class can be expected as biosimilars are launched.

When the United States finally created the regulatory framework for biosimilars in 2009, the Congressional Budget Office estimated the sales-weighted market average discount on biosimilars would be 20% to 25% relative to reference agents―a high bar to reach, but hopefully one that is attainable.3

The first US biosimilar, a granulocyte colony-stimulating factor (G-CSF) filgrastim, finally became available in September 2016, and data are clearly demonstrating significant cost savings. For example, for the fourth quarter of 2017, the payment limit for biosimilar G-CSF filgrastim was 28% lower than for filgrastim, based on CMS payment limits of average sales price (ASP) plus 6%.3

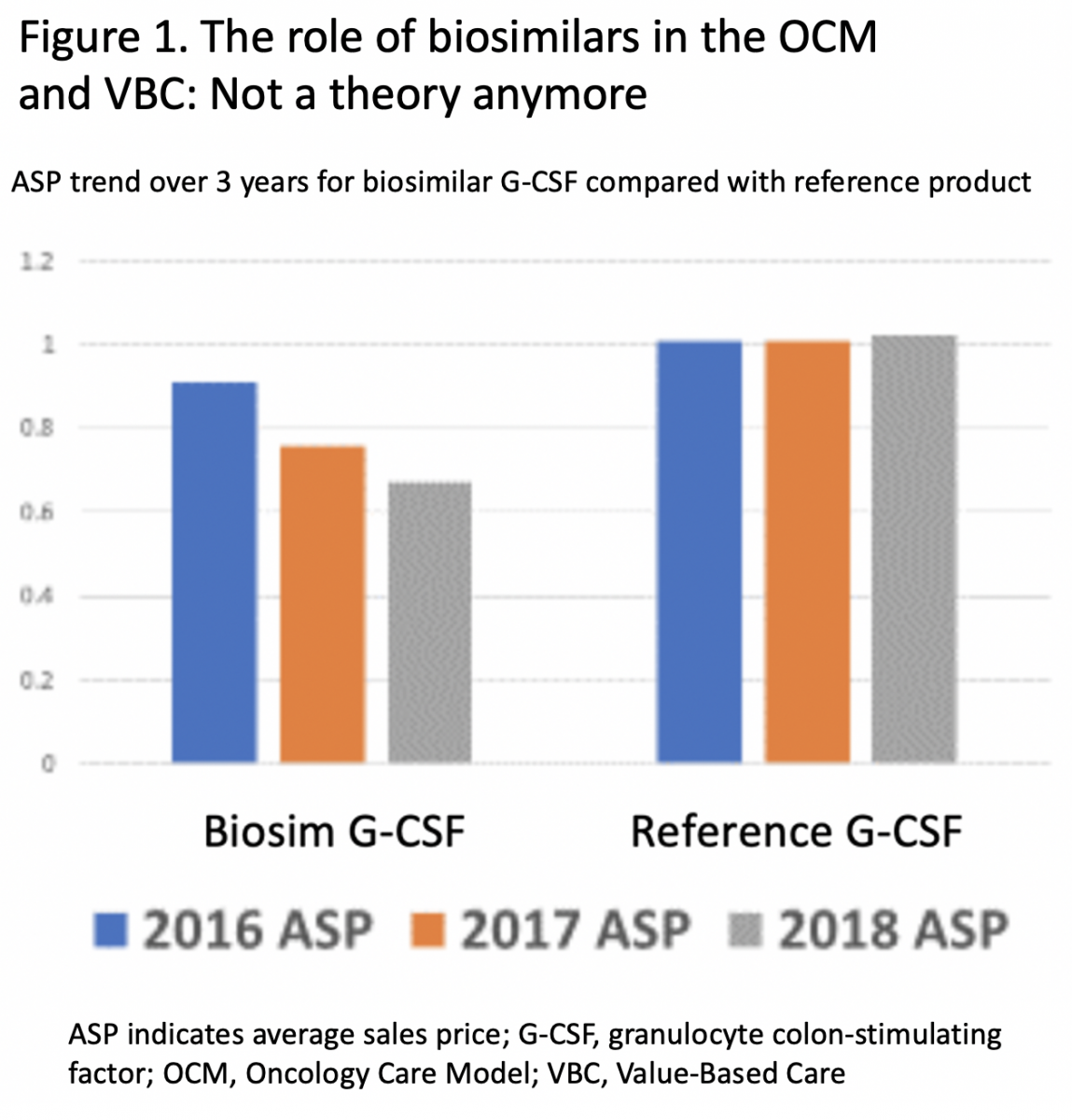

Similar results have been demonstrated across The US Oncology Network, a network of more than 1350 independent physicians who deliver value-based cancer care in the community setting. The ASP trend for G-CSF biosimilars over a 3-year period clearly shows substantial cost savings compared with the reference product, based on CMS data for the Oncology Care Model (Figure 1).

The declining ASP trend for G-CSF over this same 3-year period resulted in a progressive increment in savings.

If the results seen so far in the United States and Europe hold true, as more biosimilars enter the US market, price reductions in the same drug classes will happen. Examples of this are already emerging. Commercial payers and pharmacy benefit managers in the United States are leveraging the competition from the few biosimilars in the market to negotiate lower prices on biologics in the same class and, in some cases, prefer one product over another.4

The potential for biosimilars to deliver cost savings appears to be significant. The RAND Health Quarterly 2018 utilized 2016 sales data from a large selection of biologic drugs to project potential savings from biosimilars over a 10-year period, concluding “…biosimilars would lead to a $44 billion reduction in direct spending on biologic drugs from 2014 through 2024, or about 4% of total biologic spending over the same period, with a range of $13 billion to $66 billion.”4 The study noted the savings potential will be affected by various evolving features, such as payment rates, litigation, competition, and interchangeability.4

In addition to cost savings, biosimilars add value through increased access for patients. According to the European data, a substantial increase in use of therapeutic biologics and biosimilars occurred when a biosimilar entered the market, with the increase being attributed to reduced costs driven by competition.3

An analysis for the Biosimilars Council projected 1.2 million US patients could gain access to biologics by 2025 due to increasing biosimilar availability.5 Based on the data, women, lower-income patients, and the elderly would benefit more than others, although all individuals with health insurance would profit by having more treatment options.5

Adoption Remains Challenging

Many originator biologics will lose exclusivity over the next 5 years, generating projected savings of $78 billion as biosimilars enter the market.6 As several long-awaited therapeutic biosimilars for cancer finally launch, patients will have more treatment options and the potential for more affordable care. However, these benefits will be realized only if more stakeholders embrace biosimilars.

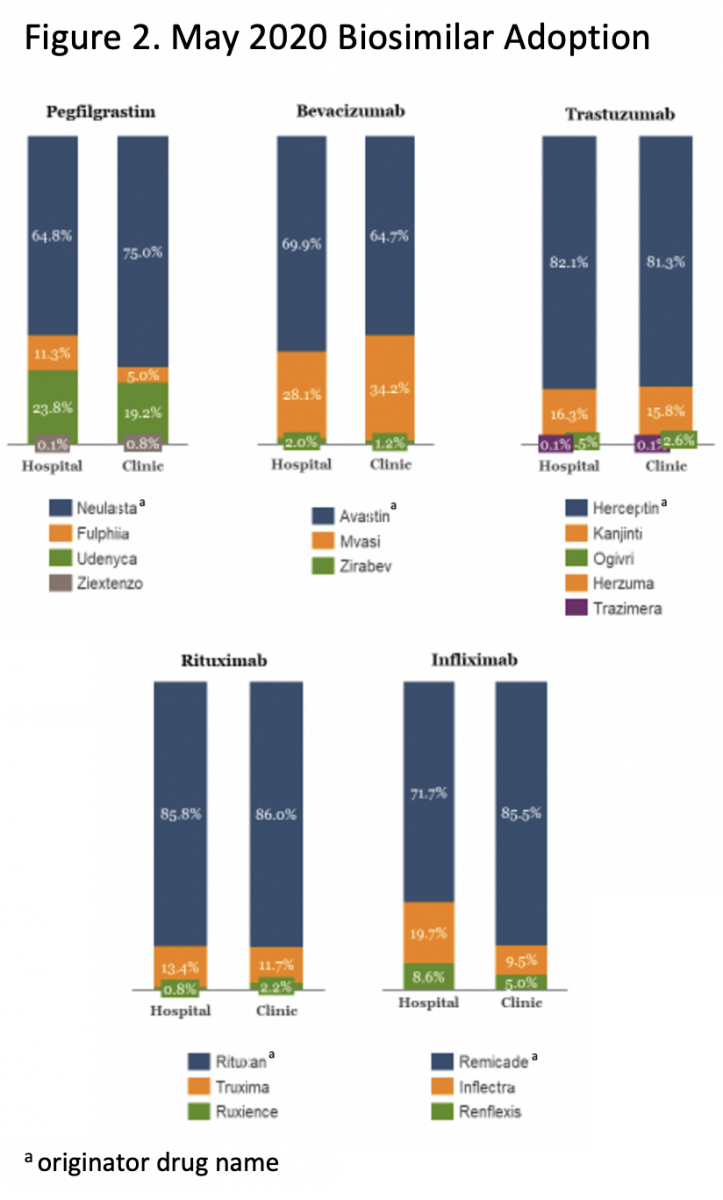

Progress so far has been slow. For instance, it has taken 5 years for the first US filgrastim biosimilar, Sandoz’s Zarxio, to achieve a 32% market share.6 Unfortunately, biosimilars do not take off quickly, mainly because displacing products that are firmly entrenched in the market is not easy (Figure 2).

Those of us involved in biosimilar development, including the Center for Biosimilars®, are collaborating and working hard to drive better education for all stakeholders, especially physicians, because they play a key role in recommending and prescribing biosimilars for their patients. There is much work to be done, as demonstrated by a recent physician survey in which 74% of respondents indicated “physician confidence” was one of the biggest barriers to biosimilar adoption.6 It will be critical to help providers understand the vital role biosimilars can play in achieving success with value-based care. Even in the face of declining ASPs, providers can succeed in the value-based world by utilizing biosimilars that hold down costs while increasing access.

Preparedness Can Overcome Operational Hurdles

Successfully integrating biosimilars into a cancer practice requires careful preparation. This is especially critical for the therapeutic biosimilars that are now emerging, because they impact virtually all aspects of the practice. Strategies must be defined to ensure the delivery of high-quality care and operational efficiency. Practices can begin by examining various biosimilar brands and then refining their choices. Technology and workflow tools should be modified to minimize errors, and processes should be developed for updating providers and staff as the biosimilar market evolves.

Operational excellence and clinician and patient confidence can be achieved by developing strategies that integrate biosimilars with each phase of the patient journey, including diagnosis and treatment selection, insurance authorization, patient education, treatment scheduling, treatment admixture, and finally, treatment administration. Careful planning and execution of each phase will ensure a seamless patient experience, resulting in satisfied patients and secure reimbursement. It also is critical to educate all staff, including prescribers, revenue cycle employees, nurses, pharmacists and admixture personnel, so they understand the role they play in delivering quality care when a biosimilar is involved.

A Promising Future

With health care transitioning away from fee for service—style practice, the future looks bright for biosimilars. Because they can increase access and decrease costs, biosimilars are poised to play a vital role in value-based care. As patients take on an increasing share of rising health care costs, biosimilars may become a valuable tool in minimizing financial toxicity while maintaining quality of care and stretching limited health care dollars. With the advent of coronavirus disease 2019, stakeholders may enthusiastically embrace biosimilars as they pursue ways to curb costs. Empowering the value biosimilars bring to health care just might be a big part of the solution everyone is seeking.

References

1. Statista. Prescription drug expenditure in the United States from 1960 to 2020. Accessed June 15, 2020. https://www.statista.com/statistics/184914/prescription-drug-expenditures-in-the-us-since-1960

2. Roy A. Biologic Medicines: The biggest driver of rising drug prices. Forbes. May 8, 2019. Accessed June 15, 2020. https://www.forbes.com/sites/theapothecary/2019/03/08/biologic-medicines-the-biggest-driver-of-rising-drug-prices/#553ba24918b0

3. Patel KB, Arantes LH, Tang WY, Fung S. The role of biosimilars in value-based oncology care. Cancer Manag Res. 2018;10:4591-4602. doi:10.2147/CMAR.S164201

4. Mulcahy AW, Hlavka JP, Case SR. Biosimilar cost savings in the united states initial experience and future potential. RAND Health Q. 2018;7(4):3. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6075809/

5. Biosimilars in the United States: Providing more patients greater access to lifesaving medicines. The Biosimilars Council. 2017. Accessed June 15, 2020. http://biosimilarscouncil.org/wp-content/uploads/2019/03/Biosimilars-Council-Patient-Access-Study.pdf

6. McGowan S. 5 years of biosimilars in the US: what have we learned? Pharmaphorum. January 29, 2020. Accessed June 15, 2020. https://pharmaphorum.com/views-analysis-market-access/5-years-of-biosimilars-in-the-us-what-have-we-learned/

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.