- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Biosimilars Forum Launches State-by-State Savings Calculator

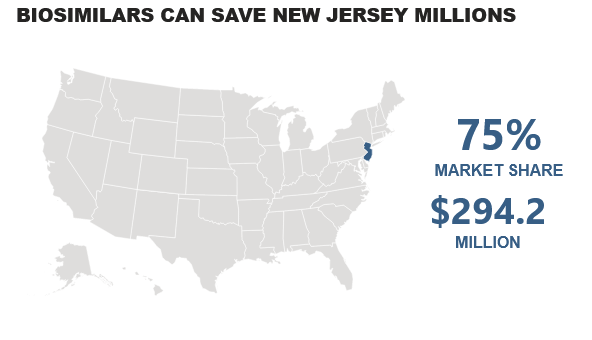

An interactive tool from Biosimilars Forum, an industry group, uses data from Pacific Research Institute to calculate potential biosimilar savings based on 75% market share.

How much could New Jersey save with biosimilars annually? The answer is $294.2 million, if biosimilars achieve a 75% market share, according to an interactive tool developed by Biosimilars Forum using Pacific Research Institute data.

The tool can provide similar savings information for every other state in the union, including Hawaii, California, Arkansas, and Florida ($45.1 million, $1.0 billion, $148.8 million, and $960.6 million, respectively).

In total, the tool predicts annual savings of $14.08 billion annually from biosimilars. The tool bases those savings on biosimilars achieving a 75% market share in each state.

The reality is that actual biosimilar market share is well below that level for many therapeutic and supportive care categories. Only in the filgrastim category is biosimilar share above 75%—the actual share is 78%—according to Amgen’s 2021 Biosimilar Trends Report.

Trastuzumab biosimilars have achieved a 70% share in the United States, relative to the reference product (Herceptin), and bevacizumab biosimilars are close behind with 69%, relative to the originator (Avastin), according to Amgen.

Infliximab, epoetin alfa, and pegfilgrastim biosimilars all have market shares under 40% relative to their originator products.

These hurdles are acknowledged in the Biosimilars Forum interactive tool report. “Misaligned incentives have made these medicines difficult for patients to access and physicians to prescribe. The current provider reimbursement system does not financially encourage the prescribing of lower-cost biosimilars," the report notes.

Sandoz in a recent report estimated US total biosimilar savings of $2.2 billion in 2019. The company was the first to bring a biosimilar to market (Zarxio, filgrastim; 2015). The Sandoz report was in agreement with the Biosimilars Forum in estimating potential 5-year savings of $100 billion from biosimilars.

The Biosimilars Forum called upon Congress and President Joe Biden to “enact commonsense policy changes” that would spur greater use of biosimilars and “unlock these savings.”

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.