- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Breaking Down Biosimilar Barriers: The Patent System

Part 1 of this 3-part series for Global Biosimilars Week focuses on legal barriers to biosimilar access in the US, including the patent system, and discusses ongoing legislative efforts to address these challenges.

Biosimilars offer critical savings and increased access to treatments, but they face substantial barriers before reaching patients. This series for Global Biosimilars Week, a worldwide online biosimilar advocacy event hosted by the International Generics and Biosimilars Association, focuses on 3 major areas where obstacles limit access in the US:

- The Patent System

- Interchangeability

- Payer and pharmacy benefit managers (PBMs) policies

The Center for Biosimilars® is a media partner for Global Biosimilars Week 2024. Each article in this series will shed light on these barriers and suggest steps to enhance biosimilar access, affordability, and equity.

Dancing With the Companies: The Patent Dance and Biosimilars

The "patent dance" is a structured legal process unique to the biosimilar landscape in the US, designed to help streamline patent disputes between biosimilar manufacturers and reference product sponsors.1 Created as part of the Biologics Price Competition and Innovation Act (BPCIA) in 2010, the patent dance aims to expedite biosimilar entry into the market while balancing the interests of innovators who initially developed these complex biologic therapies.

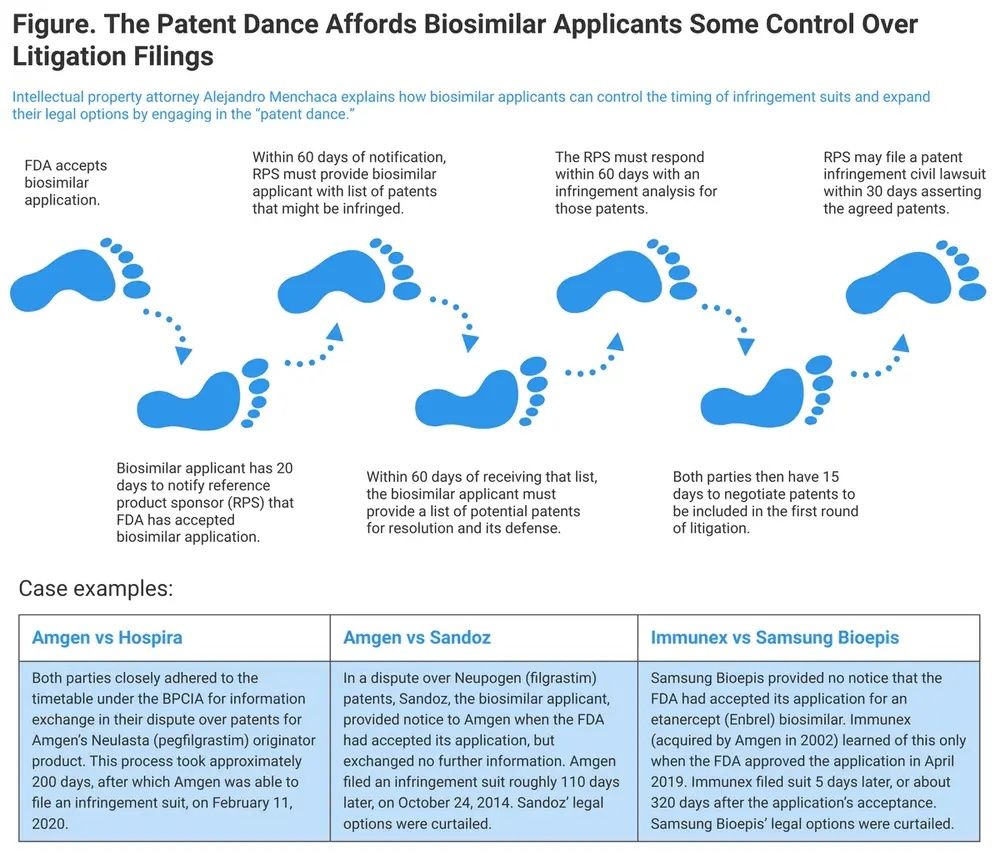

Currently, the patent dance is a required part of the biosimilar approval pathway and involves an exchange of information regarding patents, infringement, and validity positions (Figure). This early assessment, often initiated even before any litigation is filed, allows the involved parties to pinpoint and discuss specific patents that might be contested, facilitating earlier settlement discussions and minimizing the scope of costly litigation.

Figure. The Patent Dance steps. | Image credit: Skylar Jeremias

Patent litigation is often resource intensive on both sides. During an interview with The Center for Biosimilars, Ha Kung Wong, JD, an intellectual property attorney and partner at Venable, noted that the patent dance has been instrumental in promoting settlements, reducing the need for many cases to proceed to trial.2

“The patent dance allows for an early assessment of infringement and validity positions... If you don’t have a problem with the patents, then you can launch without any risk... It’s led to a great number of settlements, very few of them go to trial, which means we're not wasting resources on litigation,” he said.

Although this system has proven effective in fostering negotiation and settlement—ultimately helping to speed up biosimilar market entry—it is not without its criticisms. Some industry stakeholders argue that the BPCIA framework could be further streamlined to make the process less cumbersome and more predictable for biosimilar developers.3 As it stands, however, the patent dance remains a pivotal aspect of the biosimilar approval process, as it narrows down relevant patents and reduces potential legal roadblocks, benefiting both biosimilar manufacturers and original biologic developers.

In essence, the current state of the patent dance in the biosimilar landscape reflects an ongoing effort to balance innovation protection with the need to improve market access and affordability for biologic therapies. This system, while complex, is considered one of the primary drivers of efficient biosimilar development in the US, fostering a competitive landscape that promises greater access to these critical medicines for patients.

But, is the patent dance working? Is it helping biosimilars? What needs to be done to ensure innovation and competition aren’t hindered?

Patent Disputes Leading to Delayed Entries

The US patent system allows drug companies to obtain preliminary patents to obtain market exclusivity on a particular product, as well as patents on aspects like the manufacturing process, device design, development process, and others. This enables companies to create a wall of patents—in some cases, over 100 patents—that can be very difficult for biosimilar and generic manufacturers to comb through.1 This creates an environment where originator companies are almost guaranteed to sue their future biosimilar competitors, resulting in launch delays.

Product launch delays leave the door open for companies to enact product hopping, when drug companies shift demand from an innovator drug facing or about to face generic or biosimilar competition to new, patented versions.4

Although the first patents for the reference product Humira expired in 2018, biosimilar versions were not allowed to enter the market until 2023, with most not being able to launch until the second half of the year.5 Why?

Humira’s maker, AbbVie was able to use patent legislation and pay-for-delay deals to get biosimilar companies to postpone launch dates.6 These lawsuits resulted in mass settlements with all adalimumab biosimilar manufacturers coupled with the promise not to launch until 2023, with Amgen’s Amjevita (adalimumab-atto) being the first to launch. Amjevita launched at the end of January 2023, followed by 7 products in July, 1 in October, and 1 in 2024.7

The adalimumab biosimilar market has the highest number of products competing against a single originator, and most of the products launched in a 6-month span, the effects of which the US is still trying to observe. Already the delays have enabled AbbVie to convert a lot of its patients from Humira to Skyrizi (rizankizumab-rzaa), another one of its products.8 Although adoption of adalimumab biosimilars has grown significantly throughout 2024, the adalimumab market as a whole is shrinking due to patients switching to another AbbVie product instead of a biosimilar, leaving the sustainability of biosimilars in this space and others in limbo.

Similarly, this has happened with ustekinumab biosimilars, which, thanks to multiple settlements with reference manufacturer Johnson & Johnson, will not launch in the US until early 2025.9 This was pushed back from the initial launch prediction of late 2023 or early 2024.

Patent litigation in the US biosimilar space often results in settlements and promises to postpone the launch of the lower-cost agent. | Image credit: onephoto - stock.adobe.com

Aflibercept biosimilars also have been postponed due to litigation. However, in September 2023, a federal judge in West Virginia ruled that originator manufacturer Regeneron cannot immediately restrict Amgen’s US sales of a biosimilar to Eylea (reference aflibercept).10 Aflibercept biosimilars were supposed launch in 2024 but are now expected to start launching in 2025.

The postponement of ustekinumab, aflibercept, and other molecules creates an opportunity for companies to stifle competition and savings for patients by preventing access to lower-cost medications.

Additionally, patent litigation is very expensive for biosimilar manufacturers. Negotiation for settlements coupled with delayed profits from postponing a market launch can make pursuing biosimilar development very unattractive. In fact, 47% of the originator molecules with the potential to have biosimilars in the future do not have biosimilars in development, raising the question of whether companies will continue to see revenue potential from the biosimilar space.11

Without policy reform and action, how can biosimilar companies keep up? And how can industry leaders prevent companies from feeling so discouraged by patent hurdles and delayed returns that they consider leaving the biosimilar market for good?

What Needs to Be Done?

Several policy initiatives aim to promote fair competition in the pharmaceutical market, which is a start. In 2022, Congress directed the Federal Trade Commission (FTC) to address product hopping, leading to an FTC report that highlighted antitrust concerns with brand name companies’ efforts to obstruct competition between original and reformulated drugs.12

In January 2023, Senators John Cornyn (R, Texas) and Richard Blumenthal (D, Connecticut) introduced the Affordable Prescriptions for Patients Act of 2023 (S 150).13 The bill, which passed the Senate in July 2024, would ban product hopping and cap the number of patents a brand company can assert against a generic or biosimilar manufacturer at 20, with specific rules for adding new patents. However, Wong questioned whether this would have a practical effect, noting that most lawsuits are based on fewer than 10 patents.2

Alas, like most biosimilar reforms in Congress, these pieces of legislation have been stalled, often trapped in committee hearings or on desk holds. Wong commented on the prospect of policy reforms making it out of congressional limbo to address ongoing challenges with the patent system and biosimilars: "Predicting whether there will be statutory shifts or reform in patent law is like trying to predict what will happen in the next Fast & Furious movie—you have no idea what specifically is going to happen but it's probably going to have some explosions that ultimately, will not be applicable to the real world."2

Wong recommends that policymakers and other industry leaders keep in mind how patent reforms will impact the entire system and ensure that new policies aren’t implemented haphazardly.

"Reforms, like limiting the number of patents that can be asserted in a patent litigation, might have some effect, but we haven't seen significant changes yet. The challenge is that patents are often filed early in the development process, so it's unclear whether reform would make a big difference for biosimilars unless there are substantial follow-through actions."

References

1. Menchaca A. The inner workings of the BPCIA patent dance. The Center for Biosimilars. July 24, 2021. Accessed November 7, 2024. https://www.centerforbiosimilars.com/view/the-inner-workings-of-the-bpcia-patent-dance

2. Jeremias S, Santoro C. Patent dance insights: a Q&A on reducing legal battles in the biosimilar landscape. The Center for Biosimilars. August 18, 2024. Accessed November 6, 2024. https://www.centerforbiosimilars.com/view/patent-dance-insights-a-q-a-on-reducing-legal-battles-in-the-biosimilar-landscape

3. Jeremias S. Biosimilars Council Position paper calls for end to clinical efficacy trials for biosimilars. The Center for Biosimilars. June 4, 2024. Accessed November 7, 2024. https://www.centerforbiosimilars.com/view/biosimilars-council-position-paper-calls-for-end-to-clinical-efficacy-trials-for-biosimilars

4. Hagen T. Biopharmaceutical industry representatives discuss product hopping legislation. The Center for Biosimilars. September 24, 2020. Accessed November 5, 2024. https://www.centerforbiosimilars.com/view/biopharmaceutical-industry-representatives-discuss-product-hopping-legislation

5. Vaidya M. AbbVie’s successful hard-ball with Humira legal strategy unlikely to spawn similar efforts; potential appeals outcome unclear. Pharmaceutical Technology. February 19, 2021. Accessed November 6, 2024. https://www.pharmaceutical-technology.com/comment/abbvies-successful-hard-ball-with-humira/?cf-view

6. Jeremias S. The age of adalimumab is upon us: how stakeholders can prepare. The Center for Biosimilars. June 28, 2023. Accessed November 6, 2024. https://www.centerforbiosimilars.com/view/the-age-of-adalimumab-is-upon-us-how-stakeholders-can-prepare

7. Jeremias S. Happy birthday adalimumab biosimilars: reflecting on the first year of US competition. The Center for Biosimilars. January 31, 2024. Accessed November 6, 2024. https://www.centerforbiosimilars.com/view/happy-birthday-adalimumab-biosimilars-reflecting-on-the-first-year-of-us-competition

8. Jeremias S. Skyrizi Overtakes Humira: “Product hopping” leaves biosimilar market in limbo. The Center for Biosimilars. November 7, 2024. Accessed November 7, 2024. https://www.centerforbiosimilars.com/view/skyrizi-overtakes-humira-product-hopping-leaves-biosimilar-market-in-limbo

9. Jeremias S. Amgen’s Stelara biosimilar delayed until 2025 after settling with J&J. The Center for Biosimilars. May 29, 2024. Accessed November 6, 2024. https://www.centerforbiosimilars.com/view/amgen-s-stelara-biosimilar-delayed-until-2025-after-settling-with-j-j

10. Jeremias S. Eye on Pharma: aflibercept legal drama; PBM, Humira biosimilars; denosumab regulatory review. The Center for Biosimilars. October 15, 2024. Accessed November 7, 2024. https://www.centerforbiosimilars.com/view/eye-on-pharma-aflibercept-legal-drama-pbm-humira-biosimilars-denosumab-regulatory-review

11. Biosimilars in the United States 2023–2027. IQVIA. January 31, 2023. Accessed November 7, 2024. https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/biosimilars-in-the-united-states-2023-2027

12. Federal Trade Commission Report on Pharmaceutical Product Hopping. Federal Trade Commission. October 2022. Accessed November 7, 2024. https://www.ftc.gov/system/files/ftc_gov/pdf/p223900reportpharmaceuticalproducthoppingoct2022.pdf

13. Affordable Prescriptions for Patients Act of 2023, S 150, 118th Cong (2023). Accessed November 7, 2024. https://www.congress.gov/bill/118th-congress/senate-bill/150

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.