- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

COA's Okon Takes Aim at Biosimilar Misconceptions

Calls for price regulation and lopsided incentives are threats to biosimilar progress, Community Oncology Alliance (COA) Executive Director Ted Okon argues.

Are we there yet with biosimilars? That’s often the back-seat perspective, but this negativism is really based on “fiction” and biosimilars are rapidly gaining ground, according to Ted Okon, MBA, executive director of the Community Oncology Alliance, which advocates on behalf of community-based, nonhospital oncology clinics.

Misconceptions about biosimilars are numerous, Okon said, listing them at the recent Festival of Biologics 2021 biosimilars conference:

- Patients don’t want to take them

- Physicians don’t know about them

- Physicians won’t prescribe them because they’re not as efficacious as originator products or the doctors make more money on the most expensive products

- Biosimilar naming suffixes and CMS coding for them are stifling growth

- Biologics are “natural monopolies” that shut out biosimilars

There have been repeated calls from the Drug Pricing Lab at Memorial Sloan Kettering Cancer Center in New York to regulate the prices of originator drugs rather than trying to make biosimilar competition do the work of trimming the soaring costs of biologics, but Okon said there’s no justification for even considering throwing in the towel on biosimilars. “I think this is just not based in fact, it’s not workable, and it’s complete fiction,” he said.

Peter Bach, MD, MAPP, and Mark R. Trusheim, MSc, wrote an op-ed in The New York Times recently that said there was a need for a law requiring “that biologic drug manufacturers lower their prices to affordable yet still profitable levels when their market exclusivity expires.”

Okon in his talk said that proposed policy was “price fixing” under a disguise. “I just want to say that price fixing has never worked in the long-term history of humanity,” Okon said.

Such theories and “fictions” about biosimilars distract from the true facts of the case, Okon said. “The biosimilar market is growing. Yes, it’s taking a while, but it’s growing.” Although the United States is behind Europe in terms of biosimilars approved and launched, the FDA continues to add more approvals each year—29 since 2014—and 73 additional biosimilar candidates are in clinical trials and/or under FDA review, Okon said.

Physicians continue to prescribe more biosimilars, and price competition is improving. “At COA we have a biosimilars committee, and they are committed to the growth of biosimilars. There is price competition and the market could be stronger and produce more savings,” he said.

Hospital Incentives Undermine Biosimilar Progress

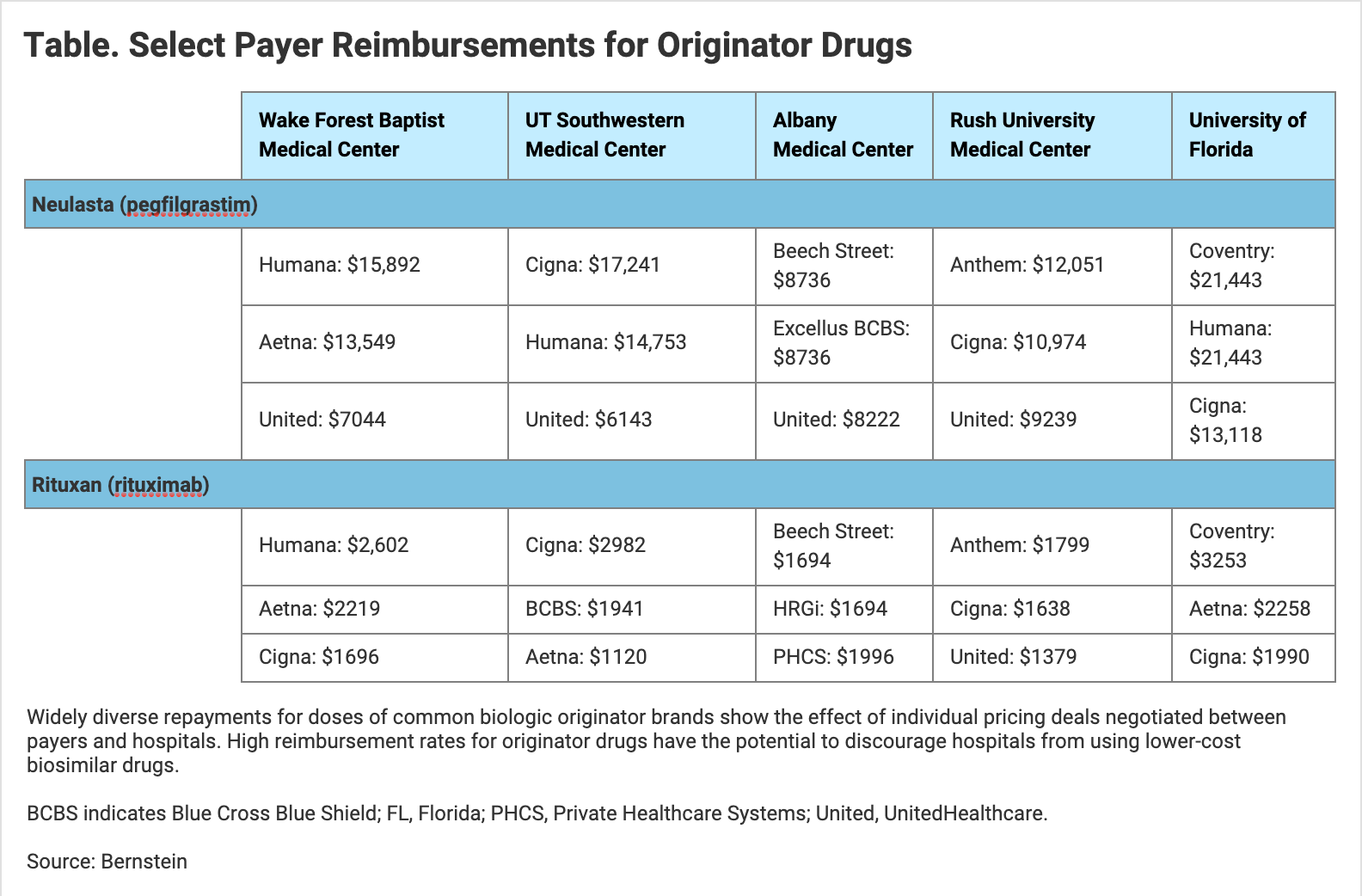

However, one place that biosimilars could be absorbed and appear to be snubbed instead is in the hospital community, where financial incentives are heavily weighted in favor of biologic reference products, which means biosimilars in many cases are not even considered, Okon said. He quoted from a January 2021 report from Bernstein, the financial advisory firm, which used a recent federal drug price disclosure mandate to probe what insurers are paying hospitals for the use of reference biologics.

For example, UT Southwestern Medical Center receives $17,241 from Cigna for administering a dose of the Neulasta originator brand of pegfilgrastim, whereas Aetna pays UT Southwestern $6474 per dose. Humana pays Wake Forest Baptist Medical Center $4370 for a dose of the Prolia originator brand of denosumab, whereas United Healthcare pays Wake Forest $2209, according to the Bernstein report. As these data show, because compensation levels can sometimes be high, 30% to 43% of hospitals only carry the innovator products, Okon said (Table).

Click to enlarge

Okon said the average markups over average selling prices on biologics are 250% although the markups are often much higher, as indicated by the Bernstein information, especially if the drugs are acquired through the 340B drug price subsidy program, which is intended to improve access to drugs for patients. Providing a scenario, Okon said it’s possible for a hospital to be paid almost $8000 for a drug whose wholesale cost is $4500, with the payer being charged over $8000 and the patient paying over $2000 out of pocket.

“You can see, especially with 340B, it makes drugs very, very economically attractive, and as a result, biosimilars are not attractive to use.”

Citing information from IQVIA, Okon said the US market for biosimilars stands at $4 billion annually. Okon called that “amazing growth.”

Growth trajectories for filgrastim biosimilars have been slow but market share growth curves for more recent biosimilars for other products, including bevacizumab, trastuzumab, epoetin, and rituximab, have been very steep, Okon noted. Similarly, price declines due to biosimilar competition are becoming steeper, too.

“It’s very, very interesting. It just took more competition,” he said.

There are culprits holding back the growth of biosimilars, he added. These include patent battles and restrictive deals that favor innovator products. Pharmacy benefit managers and payers are responsible for the latter, he said.

Although there are problems that prevent biosimilars from getting to patients, the following actions could help to improve access and lower prices, Okon said:

- Prioritize and streamline the FDA approval process for biosimilars

- Eliminate rebate waivers for biologics, including biosimilars

- Provide 340B drug discounts to patients, not hospitals

“The bottom line is this: the biosimilar market in the United States is growing and it’s producing savings,” Okon said. “Could it be growing more? Yes. Could it be growing faster? Yes. Could it be producing more savings? Yes. But the solution is not price regulating the market. That will destroy not only the biosimilars but also the biologics market.”

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.