- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

CVS Caremark Switches Up Biosimilar Coverage in 2024

As new biosimilars are added to CVS Caremark’s standard formulary, others are removed. One notable change is with the Humira biosimilars: the pharmacy benefit manager has removed Amjevita in favor of Hyrimoz and an unbranded biosimilar.

This was originally published on Managed Healthcare Executive®. This version has been edited.

Beginning in January 2024, CVS Caremark will implement many changes to its drug list. The pharmacy benefit manager (PBM) has removed 25 products and added more than 30 products to the Performance Drug List-Standard Control for January 2024, compared with the formulary list for July 2023. Many of the changes involve biosimilars, with new products being added and several being removed.

One of the more notable formulary changes is the removal of Amgen’s Amjevita (adalimumab-atto), the first-to-launch biosimilar that referenced the arthritis drug Humira. Amjevita became available in January 2023 and launched with 2 different price points: 5% below Humira and 55% below Humira. When Amjevita launched, CVS Caremark had indicated that it would place the biosimilar on a non-preferred brand tier on its commercial template formularies.

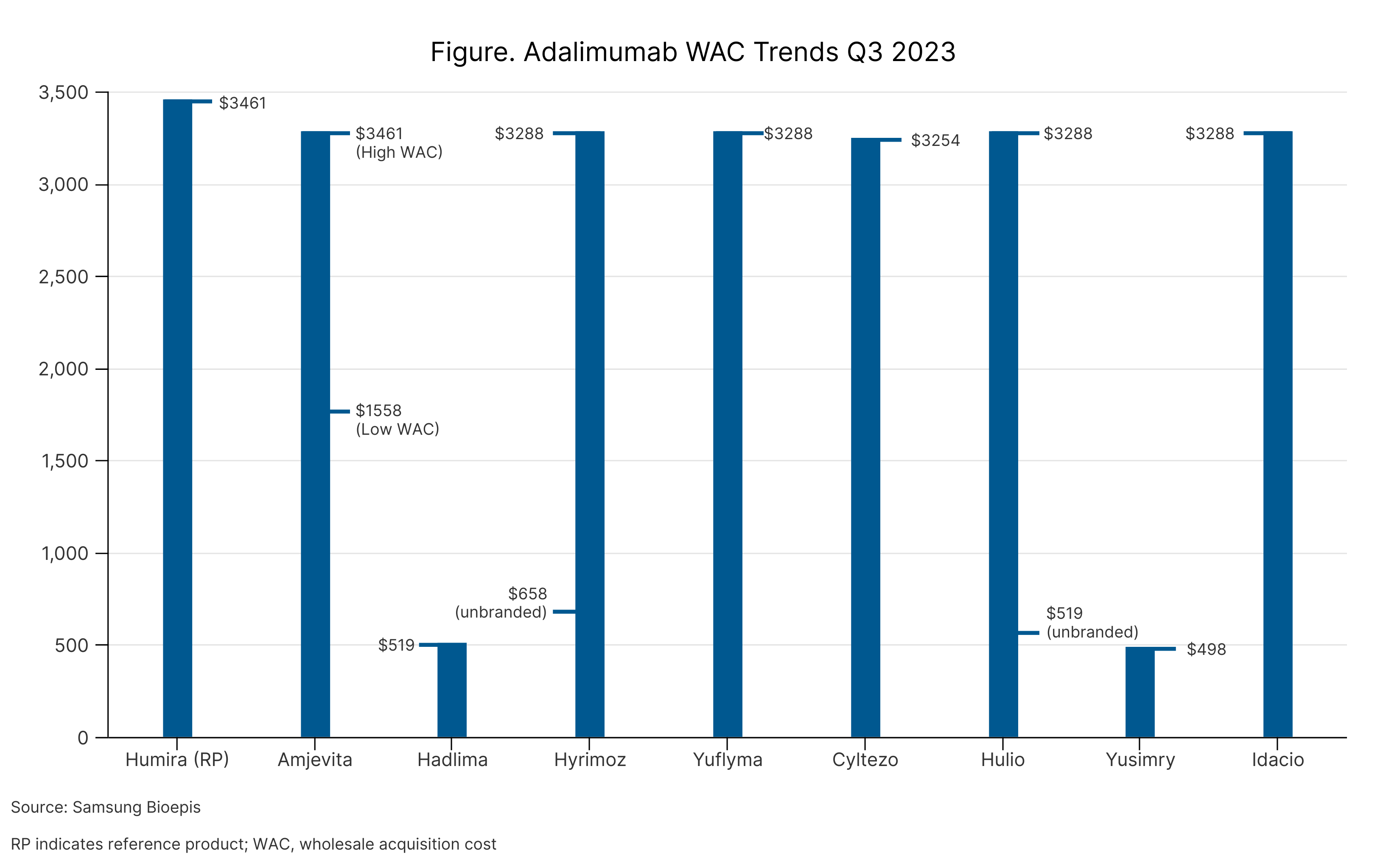

Beginning in January 2024, however, CVS Caremark will prefer instead Sandoz’s Hyrimoz (adalimumab-adaz), a citrate-free, high concentration formulation (HCF). Hyrimoz HCF is available at a list price, that is 5% below Humira’s list price. CVS Caremark also will include Sandoz’s unbranded adalimumab-adaz, which is available at a discount of 81% (Figure). Humira remains on the PBM’s drug list as well.

Designed by Skylar Jeremias, senior editor, The Center for Biosimilars®.

Two other drugs removed from CVS Caremark’s drug list are Regeneron’s Eylea (aflibercept) and Genentech’s Lucentis (ranibizumab). Both treat ophthalmic conditions, including age-related macular degeneration, diabetic retinopathy, diabetic macular edema, and macular edema following retinal vein occlusion.

Eylea is also approved to treat retinopathy of prematurity. Eylea is approved in 2 doses: an 8 mg dose for a list price $2,625 per single-use vial and a 2 mg dose is available with a wholesale acquisition cost of $1,957.55.

No biosimilars have yet been approved that reference Eylea, but several are waiting for FDA approval, including one from Biocon Biologics and another from Formycon, and Sandoz announced in August 2023 positive results from a phase 3 of its biosimilar. Lucentis has a price of about $1,242 for 6 mg dose and $2,062.85 for a 10 mg dose.

CVS Caremark suggests its preferred alternatives are the Lucentis biosimilars Byooviz and Cimerli, both of which have been added to the formulary list for January. The FDA approved Cimerli (ranibizumab-eqrn) in August 2022. Developed by Coherus BioSciences, Cimerli is available in both 0.3 mg and 0.5 mg dosages and launched with a list price of $1,360 for the 0.5 mg dose single-use vial and $816 for the 0.3 mg dose vial. Biogen’s Byooviz launched in June 2022 with a list price of $1,130 per 0.05 mg single use vial to be administered by injection to the back of the eye.

CVS Caremark also will remove 2 biosimilars of Herceptin (trastuzumab), which is approved to treat HER2 positive breast and stomach cancer: Kanjinti (trastuzumab-anns) and Trazimera (trastuzumab-qyyp). Amgen’s Kanjinti was approved in June 2019 and has a price of about $1,441 for 150 mg, according to Drugs.com. Pfizer’s Trazimera was approved in March 2019 and has a price of $1,285 for 150 mg, according to Drugs.com.

The PBM instead prefers Teva’s Herzuma (traztuzumab-pkrb) and Biocon Biologics’ Ogivri (traztuzumab-dkst), both of which have been added beginning in January. All four products are biosimilars of biosimilars of Herceptin. Herzuma was approved in December 2018 and has a price of about $1,486 for 150 mg, according to Drugs.com. Ogivri was approved in December 2017 and has a price of about $1,400 for 150 mg, according to Drugs.com.

Another biosimilar Herceptin biosimilar, Organon’s Ontruzant, is not mentioned on CVS Caremark’s list.

In terms of additions to the CVS Caremark’s formulary, 1 Remicade (infliximab) biosimilar has been added. Amgen’s Avsola (infliximab-axxq) is approved to treat patients with Crohn disease, ulcerative colitis, rheumatoid arthritis, plaque psoriasis. It has price of around $536 for a 100 mg, according to Drugs.com. Remicade remains on the CVS Caremark list and has a price of $1,239 for 100 mg, according to Drugs.com.

Another biosimilar, Pfizer’s Inflectra (infliximab-dyyb), is excluded from Caremark’s drug list. It has a price of $1,005.94 for 100 mg, according to Drugs.com. A third biosimilar, Organon’s Renflexis (infliximab-abda) is not mentioned on the formulary list. It has a price of $802.82 for 100 mg, according to Drugs.com.

Within the cancer area, CVS Caremark has excluded Sandoz’s Ziextenzo (pegfilgrastim-bmez), a biosimilar that references Neulasta and used to prevent infections after chemotherapy. It has list price of $4,143 for 0.6 mL, according to Drugs.com. Instead, CVS Caremark prefers 2 other recently added biosimilars: Fylnetra (pegfilgrastim-pbbk), from Amneal Biosciences and $2,642 for 0.6 milliliters, according to Drugs.com, and Pfizer’s Nyvepria (pegfilgrastim-apgf), which has a price of $4,141.53 for 0.6 milliliters, according to Drugs.com.

Beyond biosimilars, CVS Caremark has excluded several other products but doesn’t include a preferred alternative. For example, Vyvanse (lisdexamfetamine dimesylate) has been excluded without an alternative. But earlier this year, the FDA approved at least 15 generics for Vyvanse, which treats people 6 years and older who have attention-deficit/hyperactivity disorder.

Another excluded product is Zioptan (tafluprost ophthalmic solution) to treat patients with glaucoma. Although no alternative has been suggested by CVS Caremark, at least 2 generics have been approved.

Additionally, Rhofade (oxymetazoline), which treats patients with rosacea, has also been excluded. CVS Caremark provides no alternatives, and there are no generics available. Ilaris (canakinumab) is a biological to treat patients with gout and other inflammatory conditions that CVS Caremark excludes without an alternative. No biosimilars are available for Ilaris.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.