- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

From Amjevita to Zarxio: A Decade of US Biosimilar Approvals

Since the FDA’s groundbreaking approval of Zarxio in 2015, the US biosimilars market has surged to 67 approvals across 18 originators—though the journey has been anything but smooth, with adoption facing hurdles along the way.

On March 6, 2015, the FDA issued its landmark decision to approve the first biosimilar: Sandoz’ filgrastim-sndz, also known as Zarxio.1 Ten years later, the number of approvals has grown to 67 total biosimilars across 18 originators.2

The US biosimilars market has seen several ebbs and flows in activity, with many biosimilars taking years to achieve significant collective market share vs their originators.3

In 10 years, the FDA has approved 67 total biosimilars across 18 originators products. | Image credit: ink drop - stock.adobe.com

Market Milestones and Current Market Status

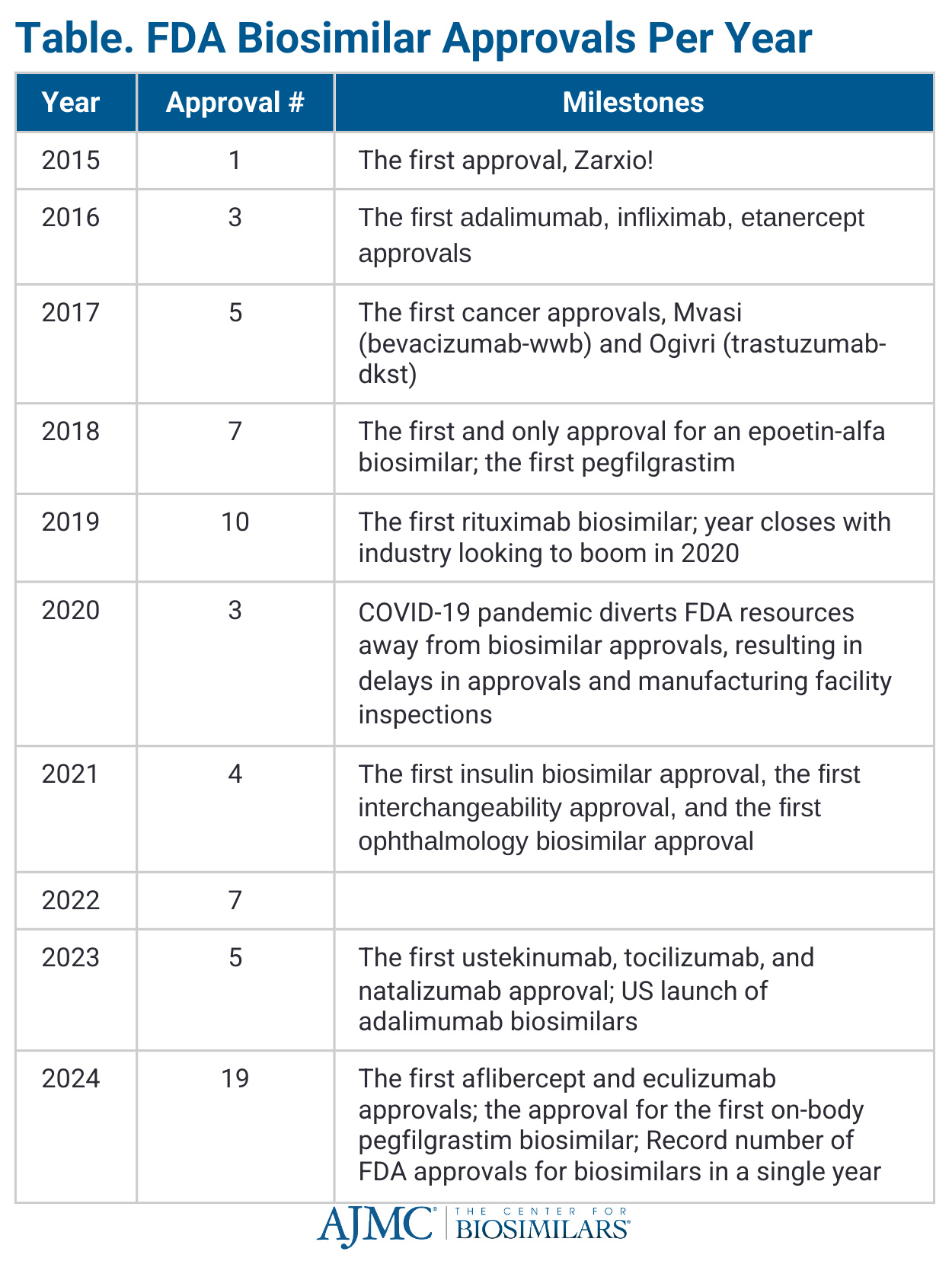

During the first 5 years after Zarxio’s approval, 25 other biosimilars received regulatory approval across the rheumatology, immunology, oncology, and supportive care spaces (Table).2

In 2020, a new rule went into effect reclassifying all insulin products from small molecule drugs to biologics, meaning all subsequent follow-on insulin approvals would automatically be granted status as biosimilars.4 While the rule did not reclassify follow-on insulin products already approved under the Hatch-Waxman Act (eg, Lyumjev, Basaglar), it did allow for the initial approval of Semglee in June 2020 as the first insulin biosimilar. In July 2021, it also became the first biosimilar to receive an interchangeability designation from the FDA, allowing it to be exchanged at the pharmacy for the originator without waiting for a provider to approve the change.5

2023 brought the largest number of products referencing the same originator (Humira; adalimumab).6 Since January 2023, beginning with Amgen’s Amjevita (adalimumab-auub), 10 adalimumab biosimilars have entered the US market.7 Some of these biosimilars offer key advantages to compete against the blockbuster originator, with some manufacturers offering citrate-free capabilities, high-concentration formulations, significant discounts compared with Humira, patient support programs, and various administration devices.

Despite contributing significantly to reduced drug costs and market growth, biosimilars account for only about 23% of the overall biologics market, ranging from 8% for insulin lispro to 82% for bevacizumab, according to IQVIA data.8 Uptake has proven to be higher in oncology spaces, where most patients are new-starts and are only on the biosimilar for a short period of time, and lower in spaces like rheumatology and gastroenterology, where patients with chronic conditions are often reluctant to switch medications for no medical reason, and newer markets like ophthalmology and neurology, where real-world data globally are scarce for now.

However, biosimilars are delivering on the savings that they promised. Data from the Association for Accessible Medicines (AAM) show that generics and biosimilars generated $445 billion in savings in the US by the end of 2023, bringing the total savings for the past 10 years to $3.1 trillion and showcasing the success of expansion policies for these products.9 In fact, biosimilars alone generated $12.4 billion in savings in 2023, bringing the total savings since their introduction in 2015 to $36 billion. Since then, patients have benefited from 2.7 billion days of therapy, with an additional 495 million days made possible due to biosimilar competition.

A Decade of Barriers: Market Entry and Fair Competition Challenges

According to a 2025 IQVIA report, the 5 main challenges affecting biosimilars in the US after 10 years of approvals are10:

- Regulatory barriers: The US biosimilar approval pathway requires extensive studies to prove biosimilarity and interchangeability, adding cost and complexity. Also, US policies on interchangeability vary by state, unlike Europe’s uniform approach.

- Market acceptance: Uptake remains low due to originator strategies, payer controls, and provider preferences. Misconceptions about biosimilar safety and efficacy slow adoption.

- High investment costs: Development costs range from $100 million to $250 million, making market entry risky. Companies have to recover expenses for clinical trials, manufacturing, and marketing.

- Reimbursement challenges: Pharmacy benefit managers (PBMs) and payers often favor originators due to rebate incentives. Limited formulary access can increase patient costs and discourage provider adoption.

- Market uncertainty: Biosimilar development takes years, during which new formulations or competing therapies may reduce demand.

Additionally, IQVIA revealed that 90% of the 118 biologics losing exclusivity in the next decade—valued at $234 billion overall—currently have no biosimilars in development, spelling trouble for the sustainability of the biosimilar market as gene therapies along with other blockbuster medications come off patent.

Another major challenge is the patent legal system, which has been overutilized by reference manufacturers to stall biosimilar competition from entering the market.11 The biggest instance of this has been seen in the adalimumab market, where patent infringement cases resulted in the delayed launches of 10 biosimilars in exchange for settlement payments.6

At the 2023 Festival of Biologics conference, Julie Reed, executive director of the Biosimilars Forum, warned that if barriers to biosimilar uptake are allowed to continue, companies will start to question the value of investing in biosimilar development.12

“We need to do [something] soon because it’s a question of the long-term sustainability of this marketplace…. People need to recognize that this industry is maturing and the developers in this marketplace have been developing across many countries,” she said.

Biosimilar Policy Evolution

Additionally, the policy landscape has drastically changed since the passage of the legislation that established the US biosimilar approval pathway—the Biologics Price Competition and Innovation Act of 2010, which was signed into law as part of the Affordable Care Act (ACA) under then-President Barack Obama.13

Since then, 3 presidential administrations have come, each having its own set of challenges that have tested the industry’s optimism for biosimilar adoption and savings. The FDA’s focus on addressing the COVID-19 pandemic in 2020, as part of the Trump administration’s Operation Warp Speed, led to only 3 biosimilars being approved that year—a dramatic drop from 2019, when the agency approved 10 biosimilars.14

Additionally, the COVID-19 pandemic led to an intense backlog in FDA inspections required for drug approvals, contributing to further approval delays that wouldn’t resolve until 2024 (n = 4 in 2021 vs 19 in 2024) (Table).15

Regarding working with FDA officials to help them catch up on the inspection backlog, Reed said in a 2022 interview with The Center for Biosimilars®, “We're asking them to be sure that biosimilars inspections are always treated equitably, that we're not put on the bottom of the list and we're not deprioritized, and to use the process and procedures for remote inspections.… We are cheering them on and also going to hold them accountable, especially with biosimilars because they're so important for patients and cost savings.”16

Additionally, the journey for the ACA, including the biosimilar approval pathway itself, has been rocky, with the Supreme Court having to weigh in on the constitutionality of the provision in June 2021. The then–liberal-leaning court ruled 7-2 to keep the ACA intact.17

"The ACA isn't perfect," Ha Kung Wong, an intellectual property attorney and partner at Venable, commented when the decision was announced, "but this holding perhaps allows us all to refocus on finding ways to improve the ACA to better provide necessary health coverage for Americans."17

In response to the COVID-19 pandemic, President Joe Biden signed the Inflation Reduction Act (IRA) into law, which had several provisions that would impact biosimilar development, the first of which went into effect in October 2022.18

The IRA will impact biosimilars in 4 main ways:

- CMS will negotiate Medicare Part D prices for originators with the manufacturers. Although products expected to face biosimilar competition in the next 2 years were supposed to be excluded from negotiations, 2 of the first 10 selected medications have FDA-approved biosimilars in the pipeline.19

- Out-of-pocket caps are in place on all insulin products, including biosimilars, for Medicare Part D. A study from HHS found that if this policy had been implemented in 2020, Medicare Part D and Part B beneficiaries could have saved a total of $734 million and $27 million, respectively, on insulin.20

- A redesigning of Part D began in 2024 that would establish changes to the cost-sharing system and cap beneficiaries’ premiums at 6% in the first few years of the program.

- Increased reimbursement for biosimilars and generics to help offset inflation caused by the pandemic. However, a 2024 white paper from Centara found that this policy only had a modest boost on adoption of oncology biosimilars, despite rises in overall market share.21

Now that Donald Trump has returned to the Oval Office, much of the concern surrounds reports of mass layoffs from federal health agencies and the implementation of tariffs on Canada, Mexico, and China, which could impact the biosimilar and active pharmaceutical ingredient supply chains.22,23

In response to the tariffs, the AAM released a statement. “The global supply chain for generic and biosimilar medicines is critically important for U.S. patients. From the base ingredients to the finished products, U.S. medicines rely on a global supply chain that is already stressed and in need of strengthening,” said John Murphy III, president and CEO of the AAM.24 “Tariffs on products from Canada, Mexico, and China could increase already problematic drug shortages.”

Overall, there remains hope for biosimilar policy progress, with the FDA expressing a change of heart in the form of draft guidance that may remove switching study requirements for biosimilars to obtain interchangeability status, which could make biosimilar development more affordable.25 Additionally, the European Union and UK regulatory agencies have declared all biosimilars as interchangeable, igniting hope that one day the US could do the same.26,27

On the legislative side, the Federal Trade Commission and Congressional leaders have begun investigating and addressing access barriers posed by PBM reimbursement policies that prioritize originators over biosimilars and generics.28 The results of the investigation have already caused a stir among large PBMs and sparked hope that even in times of great divisiveness in the US, lowering the cost of drugs remains a bipartisan goal.29

Time will tell how the next 10 years will go, but there’s no doubt that biosimilars are here to stay.

References

1. FDA approves first biosimilar Zarxio (filgrastim-sndz) from Sandoz. Sandoz. March 6, 2015. Accessed March 6, 2025. https://www.novartis.com/news/media-releases/fda-approves-first-biosimilar-zarxiotm-filgrastim-sndz-from-sandoz

2. Biosimilar Product Information. FDA. Updated March 3, 2025. Accessed March 6, 2025. https://www.fda.gov/drugs/biosimilars/biosimilar-product-information

3. Lanton R. New rule: transition to BLA pathway is complete. The Center for Biosimilars. March 23, 2020. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/new-rule-transition-to-bla-pathway-is-complete

4. Hagen T. Semglee insulin gains automatic approval under BPCIA. The Center for Biosimilars. June 13, 2020. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/semglee-insulin-gains-automatic-approval-under-bpcia

5. Hagen T. FDA approves Semglee insulin glargine as the first interchangeable biosimilar. The Center for Biosimilars. July 28, 2021. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/fda-approves-semglee-insulin-glargine-as-first-interchangeable-biosimilar

6. Jeremias S. US welcomes first adalimumab biosimilar, Amjevita. The Center for Biosimilars. January 31, 2024. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/us-welcomes-first-adalimumab-biosimilar-amjevita

7. Jeremias S. Happy birthday adalimumab biosimilars: reflecting on the first year of US competition. The Center for Biosimilars. January 31, 2024. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/happy-birthday-adalimumab-biosimilars-reflecting-on-the-first-year-of-us-competition

8. Jeremias S. Biosimilars account for 23% market share, with wide uptake disparities across molecules. The Center for Biosimilars. May 22, 2024. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/biosimilars-account-for-23-market-share-with-wide-uptake-disparities-across-molecules

9. Jeremias S. AAM report: generics and biosimilars savings reach $445 billion in 2023, part 1. The Center for Biosimilars. September 18, 2025. Accessed March 6, 2024. https://www.centerforbiosimilars.com/view/aam-report-generics-and-biosimilars-savings-reach-445-billion-in-2023-part-1

10. Jeremias S. The biosimilar void: 90% of biologics coming off patent will lack biosimilars. The Center for Biosimilars. February 5, 2025. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/the-biosimilar-void-90-of-biologics-coming-off-patent-will-lack-biosimilars

11. Jeremias S. Breaking down biosimilar barriers: the patent system. The Center for Biosimilars. November 11, 2024. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/breaking-down-biosimilar-barriers-the-patent-system

12. Jeremias S. Uptake barriers will deter future competitors from investing in biosimilars, Julie Reed warns. March 21, 2023. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/uptake-barriers-will-deter-future-competitors-from-investing-in-biosimilars-julie-reed-warns

13. About the Affordable Care Act. HHS. Updated March 17, 2022. Accessed March 6, 2025. https://www.hhs.gov/healthcare/about-the-aca/index.html

14. Operation Warp Speed: accelerated COVID-19 vaccine development status and efforts to address manufacturing challenges. US Government Accountability Office. February 11, 2021. Accessed March 6, 2025. https://www.gao.gov/products/gao-21-319

15. Jeremias S. A banner year for biosimilars: the 19 FDA approvals from 2024. The Center for Biosimilars. January 21, 2025. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/a-banner-year-for-biosimilars-the-18-fda-approvals-from-2024

16. Jeremias S, Mulrooney L. Julie Reed on how the Biosimilars Forum is helping FDA catch up on biosimilar inspections. The Center for Biosimilars. July 17, 2022. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/julie-reed-on-how-the-biosimilars-forum-is-helping-fda-catch-up-on-biosimilar-inspections

17. Hagen T. Supreme Court ruling leaves BPCIA intact. The Center for Biosimilars. June 17, 2021. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/supreme-court-ruling-leaves-bpcia-intact

18. Inserro A. Biosimilar Medicare Part B payment boost begins. The Center for Biosimilars. October 3, 2022. Accessed March 5, 2025. https://www.centerforbiosimilars.com/view/biosimilar-medicare-part-b-payment-boost-begins

19. Jeremias S. CMS announces new drug prices under the IRA, including for Stelara and Enbrel. The Center for Biosimilars. January 24, 2023. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/cms-announces-new-drug-prices-under-the-ira-including-for-stelara-and-enbrel

20. Jeremias S. IRA insulin cap could have saved Medicare beneficiaries millions in 2020. The Center for Biosimilars. January 24, 2023. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/ira-insulin-cap-could-have-saved-medicare-beneficiaries-millions-in-2020

21. IRA reimbursement impact on biosimilars minimal despite rising market share. September 25, 2024. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/ira-reimbursement-impact-on-biosimilars-minimal-despite-rising-market-share

22. Fact sheet: President Donald J. Trump proceeds with tariffs on imports from Canada and Mexico. White House. March 3, 2024. Accessed March 6, 2025. https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-proceeds-with-tariffs-on-imports-from-canada-and-mexico/

23. Health agencies lose staff members in key areas as Trump firings set in. NPR. February 17, 2025. Accessed March 6, 2025. https://www.npr.org/sections/shots-health-news/2025/02/17/nx-s1-5300052/federal-employees-layoffs-cdc-nih-fda

24. Association for Accessible Medicines comments on new tariffs. AAM. February 2, 2025. Accessed March 6, 2025. https://accessiblemeds.org/resources/press-releases/aam-comments-new-tariffs/

25. Jeremias S. FDA draft guidance removes switching study requirements for biosimilar interchangeability. The Center for Biosimilars. June 20, 2024. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/fda-draft-guidance-removes-switching-study-requirements-for-biosimilar-interchangeability

26. Biosimilar medicines can be interchanged. EMA. September 19, 2022. Accessed March 6, 2025. https://www.ema.europa.eu/en/news/biosimilar-medicines-can-be-interchanged

27. Guidance on the licensing of biosimilar products. UK MHRA. Accessed March 6, 2024. https://www.gov.uk/government/publications/guidance-on-the-licensing-of-biosimilar-products/guidance-on-the-licensing-of-biosimilar-products

28. Jeremias S. FTC releases second report on PBMs meddling in generic drug markets. January 19, 2025. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/ftc-releases-second-report-on-pbms-meddling-in-generic-drug-markets

29. Jeremias S, Wisniewski J. Will the FTC be more PBM-friendly under a second Trump administration? The Center for Biosimilars. February 23, 2025. Accessed March 6, 2025. https://www.centerforbiosimilars.com/view/will-the-ftc-be-more-pbm-friendly-under-a-second-trump-administration-

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.