- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Global Biosimilar Market Projected to Reach $1.3 Trillion by 2032

The global biosimilar market is projected to surge from $25.1 billion in 2022 to approximately $1.3 trillion by 2032, with a compound annual growth rate of 17.6%, driven mainly by the increasing prevalence of cancer and the cost-effectiveness of biosimilars, as outlined in a report by Towards Healthcare.

The size of the global biosimilar market is expected to grow from $25.1 billion in 2022 to about $1.3 trillion by 2032, a compound annual growth rate of 17.6%, according to a report published by Towards Healthcare.

“The use of biosimilars in cancer treatment has the potential to increase access to life-saving treatments for patients, particularly in low- and middle-income countries where cost is a major barrier to treatment,” the authors wrote. "Biosimilars can also help reduce the financial burden on healthcare systems, allowing more patients to receive the treatment they need. Biosimilars have become an important part of cancer treatment as they offer more affordable and accessible options for these critical therapies."

The report specified that the rising prevalence of cancer and cost-effectiveness of biosimilars will be the main reasons behind the growth. However, concerns about the safety and efficacy of these drugs has been questioned because biosimilars are not exact copies of their reference products, with some experts arguing more real-world evidence is needed to understand the long-term impact of these products on patients. The authors emphasized a need for ongoing research and monitoring to ensure that biosimilars are safe for all patients.

As of March 2023, 49 biosimilars have been approved in the US—24 for use in cancer—and 38 have launched. In 2021, biosimilars accounted for $7 billion in savings, and 91% of the 6.4 billion prescriptions written for patients in the US were for generic or biosimilar medicines. Additionally, in the first 10 years on the market, FDA-approved biosimilars could save consumers and the health care system up to $250 billion.

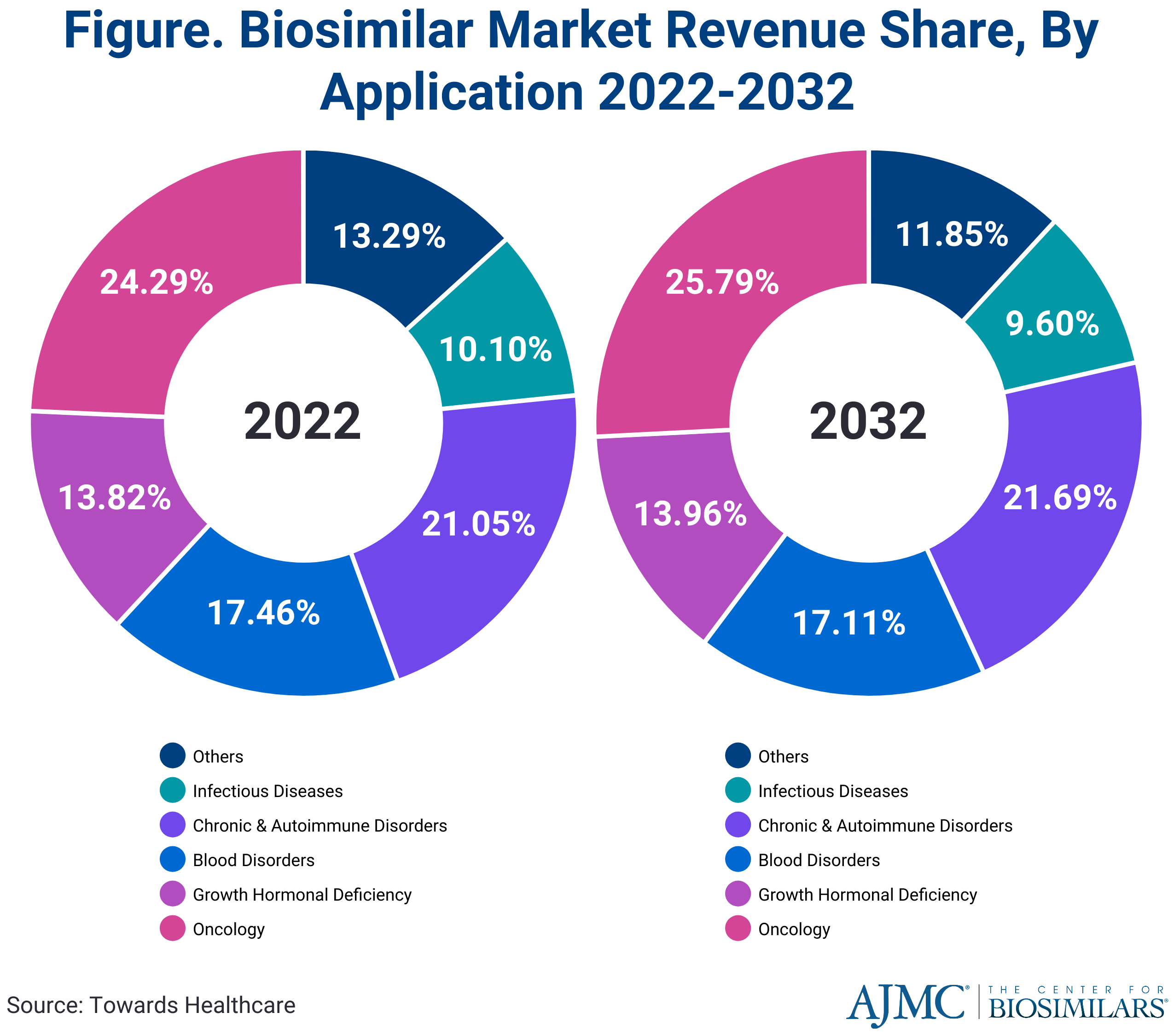

In 2022, oncology applications made up the largest market share compared with other disease states, at approximately 24.29%, and they are expected to maintain their leading position and experience rapid growth in the coming years (Figure).

In the past, biosimilar companies increasingly turned to in-house manufacturing strategies to gain a competitive edge. This approach enabled them to exert greater control over production processes, reduce costs, ensure product quality, and expedite the introduction of their products to market, all of which contributed to their competitive advantage. In 2022, the percentage of companies using in-house manufacturing was over 5 times greater than those using contract research and manufacturing services, and this trend is expected to continue in 2032.

In the coming years, the demand for biosimilar medications is expected to increase due to their favorable cost-to-benefit ratio. Historically, most biosimilars in the US offered a launch discount of less than 10% of the average sales price, followed by an annual price decrease of 10% to 15%. However, with the influx of more biosimilars into the market, particularly for chronic conditions with multiple competitive treatments, businesses must consider how this landscape may change.

For instance, the introduction of up to 10 adalimumab biosimilars in the United States could lead to significant shifts in market dynamics. Therefore, the authors stressed that companies manufacturing biosimilars need to carefully optimize distribution methods and strategies for each medication in different markets.

Developing and manufacturing biosimilars presents significant challenges in the biopharmaceutical industry due to their complexity and costs. Unlike small-molecule drugs, biosimilars are larger and more intricate molecules, requiring extensive research to demonstrate similarity to reference biologics. Challenges include ensuring precise similarity to the reference drug, managing raw material variability, expensive specialized equipment, and stringent quality control. Regulatory pathways for biosimilars differs from generics, demanding extensive clinical testing and potentially increasing development time and costs.

The report also noted an increase in start-up companies developing biosimilars, which are often smaller, nimbler, and more focused than traditional pharmaceutical companies. Additionally, start-up companies are more able to take on higher levels of risk when developing products, like branching out into more niche markets, than other pharmaceutical companies.

However, start-ups must overcome challenges, such as high cost of research and development, the complex regulatory landscape, and the need for large manufacturing capabilities. Despite these obstacles, the rise of biosimilar start-ups has spurred innovation and competition in the biosimilar market, leading to greater affordability and accessibility of treatments, ultimately benefiting patients.

The authors concluded, “Despite these challenges, biosimilar start-ups are expected to play an important role in the development and commercialization of biosimilars in the coming years, as the demand for these treatments continues to grow and more patents on reference biologics expire. With their focus on innovation, cost-effectiveness, and patient access, biosimilar start-ups have the potential to transform the biopharmaceutical industry and improve healthcare outcomes for patients around the world.”

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.