- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Green Shield Canada: Preferential Status Is Vital to Biosimilar Uptake

To overcome provider and patient preferences for brand originators, there has to be more of an incentive to use biosimilars, explains Nedzad Pojskic, PhD, MSc, Green Shield Canada.

Based on the success of a biosimilar switching program, Nedzad Pojskic, PhD, MSc, vice president of Pharmacy Benefits Management for Green Shield Canada, detailed why payers should become bigger advocates for biosimilar uptake, at the Festival of Biologics USA meeting.

Canada ranks third in the world in per capita spending on drugs ($1012 vs $1324 in Switzerland and $1457 in the United States), he said, explaining the need for biosimilar savings.

“I think it's really important to recognize that as payers in this country, we have to be explicit around being leaders in educating various stakeholders, whether they be physicians, other sorts of players in the system, patients, or those in leadership roles, to support a viable biosimilar market and to move forward,” said Pojskic.

Although Canadian provinces such as British Columbia and Alberta have begun executing biosimilars switching initiatives, Pojskic noted that Green Shield Canada was the first payer to have a policy that preferred biosimilars to originators.

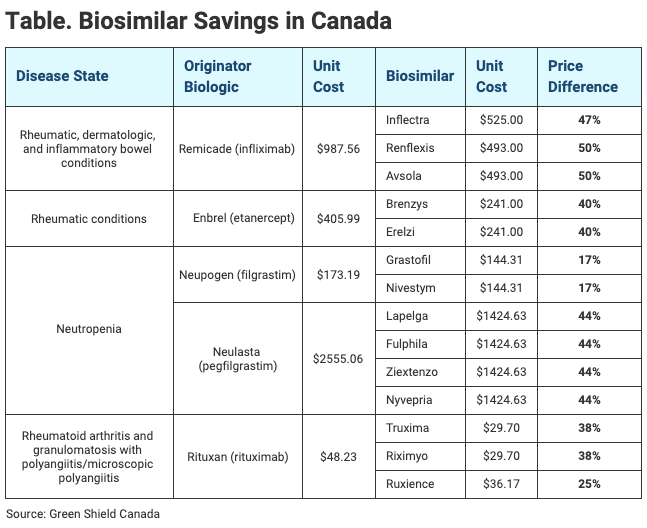

Under the program, patients with a number of rheumatic conditions are either started on or switched to biosimilar versions of infliximab, etanercept, and rituximab, whose respective originator brands are Remicade, Enbrel, and Rituxan. Other biosimilar switches are expected with future program expansions.

How Payers Have Influence

Pojskic said that, for him, one of the most important lessons to come out of implementing a biosimilar transition program such as this was that payers are the real “gatekeepers” to biosimilar uptake.

“Evidence has shown us time and again that when payers allow open access to an originator and a biosimilar with no preferential policies for biosimilars, the uptake naturally flows to the originators….However, with more aggressive policies that target a sustainable biosimilar market and the uptake of biosimilars in preferential fashion, we start to see payers being a really important part of this equation,” he said.

When biosimilars and originators are treated equally on the formulary, patients and providers flock to originator products because they have historical comfort with using the dominant brands. As a result, biosimilar uptake occurs very slowly, Pojskic said.

So far, Green Shield Canada’s program is a success, generating an average of $8500 in savings per member annually. Of the patients involved in the program, 55% transitioned to a biosimilar and 14% stayed on the originator but were billed for the price of the biosimilar, which resulted in reduced costs, Pojskic noted.

Pojskic also said that Green Shield Canada made it a priority to work with patients to ensure comfort with biosimilar switching, and this was successful. He reported that patients understood and were receptive to the change, had talked with their physicians about transitioning, and appreciated the support and aid given by nurses.

Current State of Canadian Biologics

The Canadian health care system primarily functions as a Medicare-like structure that covers most aspects of hospital and physician care. However, pharmaceuticals are different in that they are funded both privately and publicly. Canada spent $39.8 billion on drugs in 2018, and of that, $12.30 billion and $14.33 billion was privately and publicly funded, respectively, and out-of-pocket costs for pharmaceuticals were $13.10 billion, Pojskic said.

The share of total pharmaceutical costs generated by biologics spending has grown year-over-year, from 20% in 2015 to 24.7% in 2019. Pojskic said that he expects this number to grow as more biologics enter the market.

As biosimilars have entered the market, discounts from originator costs have ranged from 17% for filgrastim biosimilars to 50% for some infliximab biosimilars, he said (Table).

Click to enlarge.

Canada is one of the largest purchasers of originator infliximab, but at the end of 2018, uptake of infliximab biosimilars was only at 8% of total use, slightly above the United States (7%) but significantly trailing Norway (98%), Poland (96%), the United Kingdom (92%), Austria (89%), and Italy (79%), according to Pojskic’s presentation.

Pojskic said several factors pose barriers to biosimilar uptake in Canada:

- There are no interchangeability policies (pharmacists cannot simply substitute biosimilars without physician approval)

- Payer policies offer reimbursement for biosimilars without making them preferred products

- Switching to biosimilars was not encouraged until recently

- Originator manufacturers interfere with biosimilar uptake

Transition Program Challenges

Pojskic said a major hurdle that had to be overcome when implementing the biosimilar transition program was addressing the common concern that there is not enough evidence to support the safety of biosimilar switching.

To combat this, Green Shield Canada produced a systematic review of studies showing that switching between originators and biosimilars was safe and effective. The review encompassed 178 studies, of which 140 were based on real world evidence, and included data on 21,000 patients and 10 biologic agents.

“There's plenty of evidence to support biosimilar transitioning and it all points in exactly the same direction. We knew that this evidence was more than enough to safely engage in biosimilar transitioning and to create a program,” said Pojskic.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.