- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Happy Birthday Adalimumab Biosimilars: Reflecting on the First Year of US Competition

The Center for Biosimilars® looks back at the first year of adalimumab biosimilars on the US market, including every product launch and approval as well as market trends and pricing strategies.

Since January 31, 2023, the United States has seen a boom in the adalimumab market. With 9 adalimumab biosimilars launching throughout the year, the US rheumatology, immunology, dermatology, and gastroenterology treatment spaces have a wealth of newer and cheaper alternatives to Humira (reference adalimumab).

However, more options may not indicate more adoption, as uptake for adalimumab biosimilars remains low at the 1-year mark. Despite this, biosimilar experts still have hope that patients, providers, payers, and pharmacy benefit managers (PBMs) will come around and embrace these safe and efficacious alternatives to Humira.

To mark this momentous occasion, The Center for Biosimilars® takes a walk down memory lane to reflect on how this space has developed over the last year, including all the major launches and approvals, new pricing strategies, and market trends that have come to differentiate the adalimumab biosimilar space from other markets.

What’s Launched and What’s Left?

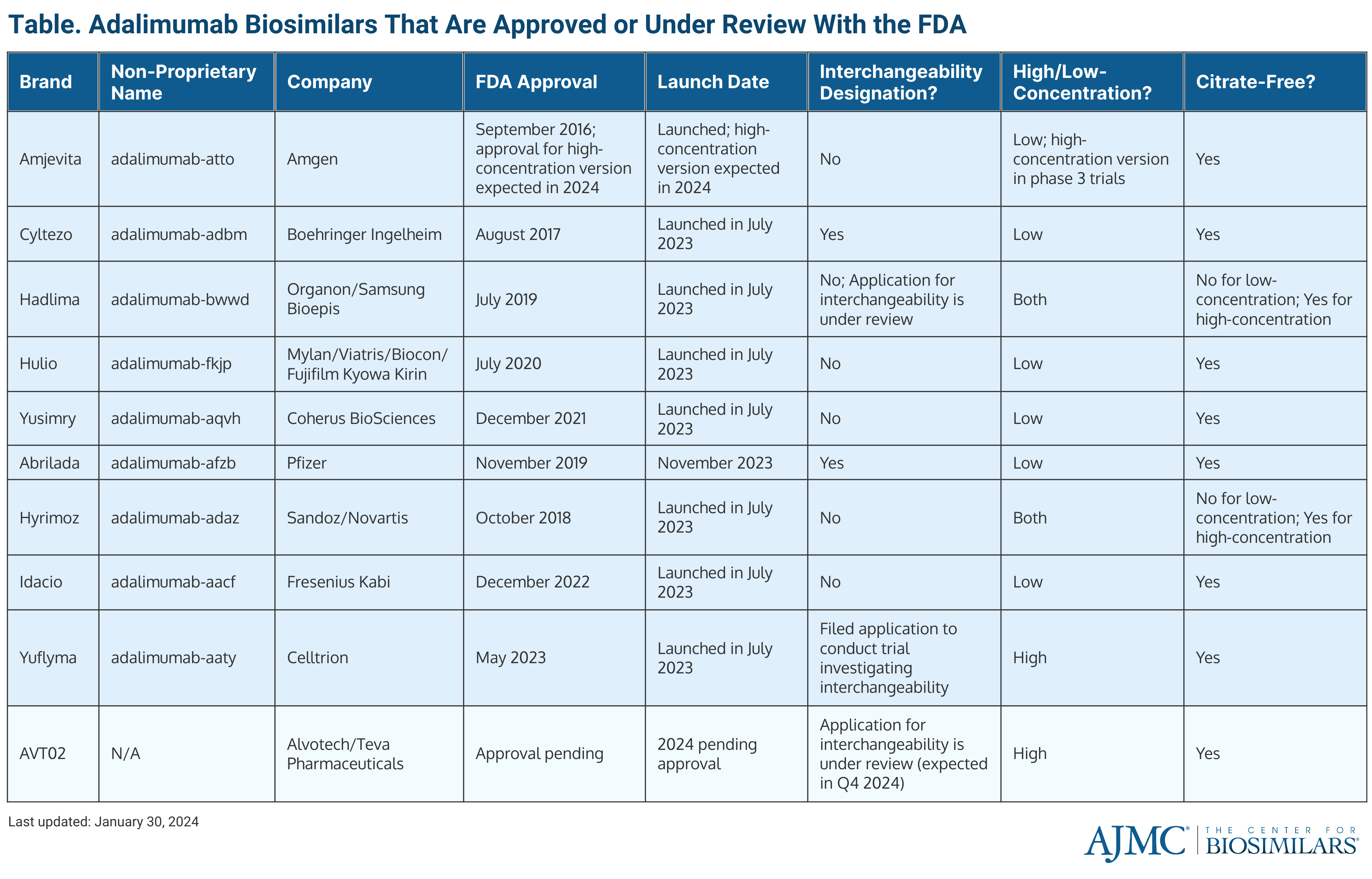

The first product to launch was Amgen’s Amgevita (adalimumab-atto) at the end of January 2023. The citrate-free product was originally approved in September 2016, and a high-concentration version is expected to be approved in 2024. (Table)

Amjevita proved that being the first to market has its perks, as the biosimilar was the only adalimumab competitor to Humira until July 2023. Additionally, it set the standard for how other companies would choose to price their adalimumab biosimilars and it was an early favorite among payers and PBMs looking to add an adalimumab biosimilar option to formularies.

In July, 7 others entered the market, including Boehringer Ingelheim’s Cyltezo (adalimumab-adbm), Coherus Biosciences’ Yusimry (adalimumab-aqvh), Organon and Samsung Bioepis' Hadlima (adalimumab-bwwd), and Sandoz' Hyrimoz (adalimumab-adaz), Celltrion USA’s Yuflyma (adalimumab-aaty), Fresenius Kabi’s Idacio (adalimumab-aacf), and Biocon Biologics’ Hulio (adalimumab-fkjp).

Cyltezo, approved in August 2017, was the first adalimumab biosimilar to be deemed interchangeable, meaning it can be substituted at the pharmacy-level without physician permission. It features a low-concentration, citrate-free formulation.

Yusimry was approved in December 2021 and also is only available as a low-concentration, citrate-free formulation. Hadlima received approval in July 2019 and comes in a high- and low-concentration; however, only the high-concentration version is citrate-free. An interchangeability application is also under review.

The citrate-containing, low-concentration formulation of Hyrimoz was approved in October 2018, and the citrate-free, high-concentration formulation was approved in March 2023. Yuflyma, approved in May 2023, is the only adalimumab currently on the market that is solely available as a citrate-free, high-concentration formulation. An application for interchangeability is under review.

Idacio (approved in December 2022) and Hulio (approved in July 2020) are both available as citrate-free, low-concentration formulations.

In early November 2023, Pfizer’s Abrilada (adalimumab-afzb) launched. The citrate-free, low-concentration formulation was originally approved in November 2019, and received a second approval for interchangeability in October 2023.

Alvotech’s AVT02 was expected to receive approval and launch in 2023. However, FDA complete response letters (CRLs) regarding the company’s Iceland-based manufacturing facility have delayed progress. The CRLs have not cited any issues with Alvotech’s data package nor the quality or safety of the biosimilar itself. Alvotech is expecting an official approval from the FDA February 24, 2024.

Pricing Strategies and Coverage Trends

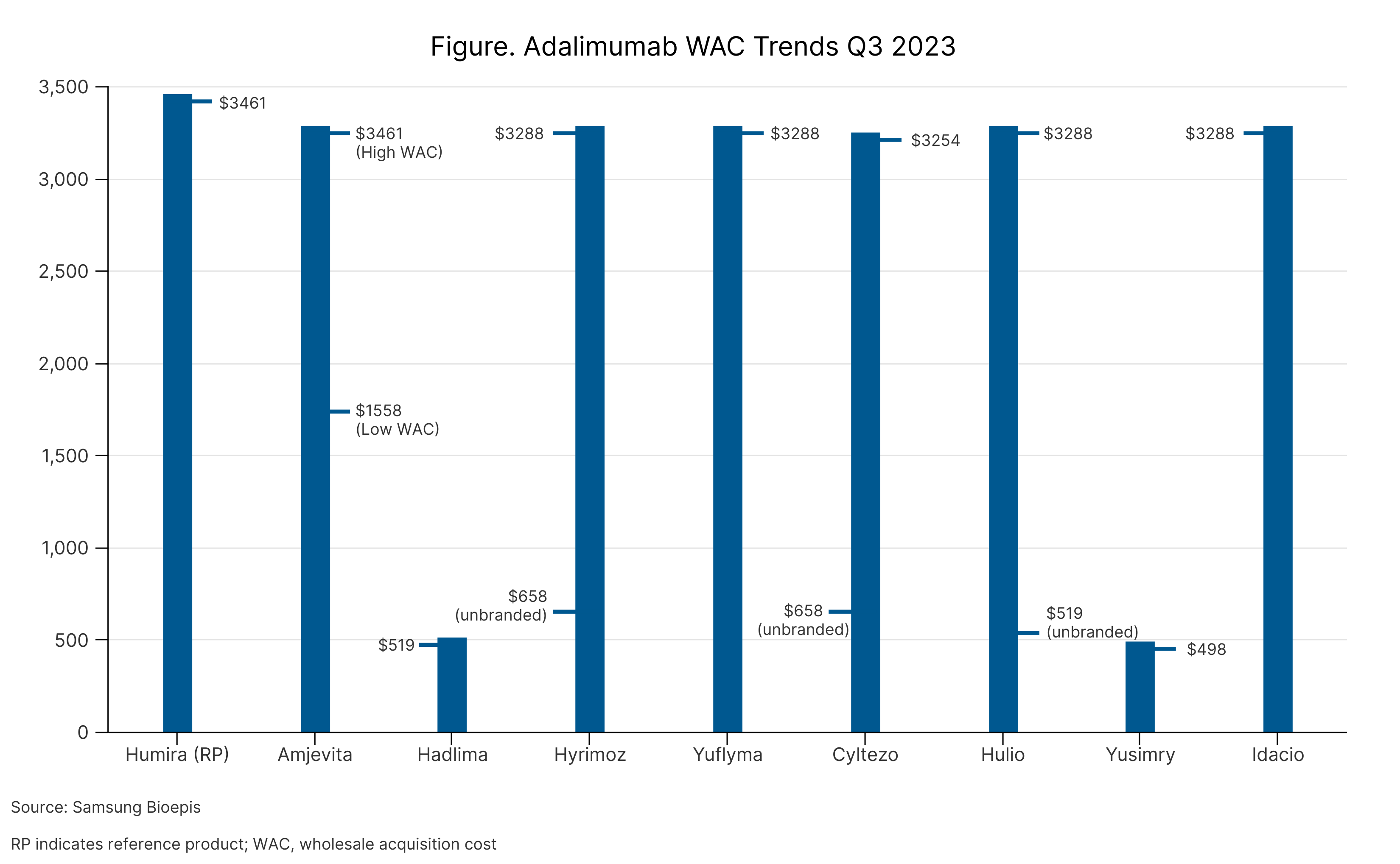

Many companies have chosen a dual-pricing strategy for their adalimumab biosimilars, either launching their product at 2 wholesale acquisition costs (WACs) or launching branded and unbranded versions at 2 different price points. (Figure)

According to Julie Reed, MS, executive director of the Biosimilars Forum, this is to ensure that companies can convince pharmacy benefit managers to put their products on formulary (high WAC) and to ensure that uninsured patients can have access to the product at a decent price (low WAC).

However, in July 2023, JAMA Network Open published a study that found that despite many adalimumab biosimilars having steep discounts from the current price of Humira, they are priced higher than Humira’s original price, showcasing just how extreme price hikes have been for the originator over the last decade.

Although it remains to be seen whether this strategy is effective at improving uptake, payers have started to embrace adalimumab biosimilars more, with Amjevita and Cyltezo being the most popular choices. CVS Caremark deviated from the pack a bit by removing some adalimumab products—including Amjevita and Humira—from some formulary lists in favor of branded and unbranded Hyrimoz.

Another deviation was CarePartners Specialty Pharmacy Cost Savings Programs, which chose to add Yuflyma to its formulary list.

Interestingly, in June 2023, Mark Cuban’s online pharmacy (Mark Cuban Cost Plus Drug Company) partnered with Coherus Biosciences to add Yusimry as the company’s first biosimilar option for its patients. Smith Rx, the PBM that is partnered with the Mark Cuban Cost Plus Drug Company, became the first PBM to add Yusimry to its formulary list.

This partnership spurred threats of litigation from AbbVie, the maker of Humira, which alleged that the agreement infringed on a previous agreement between Coherus and AbbVie granting the former a nonexclusive license to commercialize Yusimry in the United States. The dispute resulted in Coherus filing a restraining order against AbbVie to keep it from terminating the licensing deal. In turn, AbbVie filed a preliminary injunction against Coherus, but eventually agreed to leave the licensing deal in place.

Market Trends and Slow Uptake

Overall, uptake has been low for adalimumab biosimilars. However, this is to be expected during the first year of biosimilar competition.

A report from Samsung Bioepis found that on average, biosimilars obtain 53% market share in the first 3 years after initial launch. The entry of adalimumab biosimilars in 2023, comprising 8 FDA-approved products, has captured 2% of the market. Despite the potential for substantial discounts, the impact of interchangeability and acceptance by providers and patients remains uncertain. The slow adoption suggested a need for strategies promoting biosimilar use over the originator product to accelerate adoption rates, as prescribers and specialty pharmacies grapple with payer biosimilar preferences.

Additionally, the IQVIA Institute for Human Data Science’s Global Use of Medicines Report, published in January 2024, predicted that the immunology space will experience slow growth over the next 5 years, a 2% to 5% increase in part due to adalimumab biosimilar competition.

On the provider acceptance side, Spherix Global Insights found that although rheumatologists, dermatologists, and gastroenterologists rated their awareness of adalimumab biosimilars as high, a significant proportion of each group reported that they were not confident prescribing a biosimilar over the originator. However, this data was taken after the launch of Amjevita but prior to the launches of the other 8 biosimilars.

Alas, some hope remains: as US sales for Amgen dropped significantly year-over-year, global sales for Amjevita, which is marketed in the European Union as Amgevita, grew 29% year-over-year, thanks to the US market introduction.

Predictions—and Recommendations—for the Future

Many experts watching the space have seen the complexities of the market coming from a mile away. While many have praised the launches of these products as hope that the drug pricing hikes will trend downward, other have offered words of caution and recommendations for stakeholders to take action to ensure long-term market stability.

Cardinal Heath’s 2023 Biosimilar Market Report from February 2023 found that over 60% of providers, including rheumatologists, gastroenterologists, and dermatologists, reported that they would only feel comfortable prescribing adalimumab biosimilars that have interchangeability designations.

However, a report from CVS Health in March 2023 predicted that interchangeability will not be a primary factor in driving adalimumab biosimilar adoptions, particularly for payers, saying that competition’s impact on drug pricing as well as formulation, delivery mechanism, adequate supply, and member experience will be bigger drivers.

In a review article, researchers from Brigham and Women’s Hospital and Harvard University speculated on whether the availability of adalimumab biosimilars in the United States, which began in January 2023, will lead to cost savings for patients. Although it is too early to know, they said, “there are already some concerning signs.”

Recommended several policy advancements to ensure that the adalimumab market is able to thrive, including FDA clarification on interchangeability, collaboration with manufacturers, and permitting pharmacists to substitute biosimilars. The authors also suggest restricting confidential rebates for biologics to foster transparent pricing. Improved education by the FDA and professional societies is proposed to enlighten prescribers and patients about the safety and effectiveness of biosimilars.

The National Alliance of Healthcare Purchaser Coalitions also had recommendations for employers, which were published in the organization’s playbook designed to help plan sponsors adopt biosimilars into their pharmacy benefit plans.

The playbook provided strategies across various domains, advising on plan design with a focus on cost-limiting measures for patients, suggesting custom formulary designs, cautioning against exclusionary practices, proposing a phased approach to rebates, and recommending transparent contracting. Additionally, it emphasized the importance of including all biosimilars on the formulary, offering incentives for their use, and considering advancements in drug delivery for incorporation into plan designs.

Although the adalimumab biosimilar market has hit the 1-year mark, it’s still very young, and the possibilities of how it will continue to develop are endless. Most of the products have only been on the market for a little over 6 months—in the case of Abrilada, even less. This space will continue to be a sticking point for market experts to watch and the US overall will have to wait to see the true impact on pricing and adoption. But there’s no doubt that adalimumab biosimilars have had one heck of an exciting first year.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.