When the Onpro fails, the patient may not have received any or all of the necessary prophylaxis, and therefore may be at higher risk of chemotherapy-induced FN and its many consequences, including hospitalization or death.

- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

How Risky Was Amgen's Onpro Advertising?

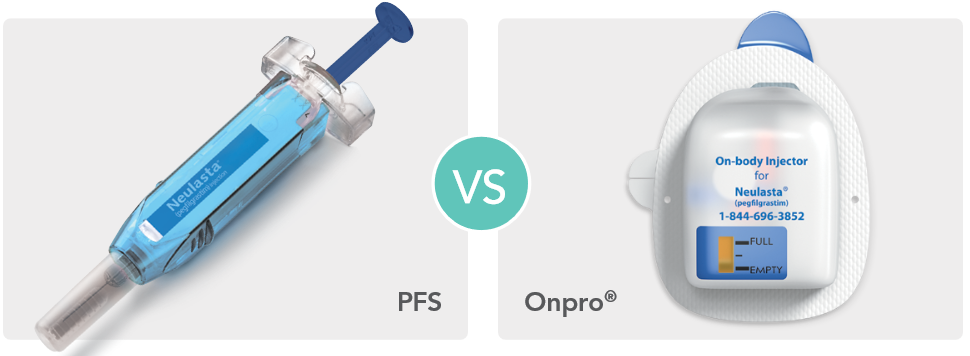

Amgen's advertising appeared to push doctors and patients away from the prefilled syringe version of its pegfilgrastim (Neulasta) product, which may have a better sales future than the Onpro.

Was a cannibalization scheme at work in Amgen’s troubled advertising for the Onpro wearable pegfilgrastim injector? In a cannibalization ploy, the manufacturer will draw sales away from an existing product to support growth of revenues for a follow-on product.

In this case, Amgen’s advertising claims made the Onpro pegfilgrastim injector seem superior in efficacy to its longstanding Neulasta prefilled syringe (PFS). In a warning to Amgen recently, the FDA said the evidence supporting this claim was weak, and the agency raised concerns that the advertising would weaken public faith in pegfilgrastim biosimilars, all of which are in a PFS.

“If Amgen believes that the way to go is to cannibalize its Neulasta PFS for the Neulasta Onpro device with an analysis subjected to many potential biases, I don’t think that they’ll get much of a hearing from the pharmacy and therapeutics [P&T] committees,” said Ivo Abraham, PhD, a professor in the Department of Pharmacy Practice at the University of Arizona, who has conducted multiple studies into the value of pegfilgrastim in the cancer care supportive setting. P&T committees are the clinical groups that make decisions about which drugs to use in medical institutions.

Pegfilgrastim is a long-acting granulocyte colony stimulating factor (GCSF) used to spur the growth of neutrophils and ward off the development of febrile neutropenia (FN) in patients receiving chemotherapy.

Onpro Advertising Claims

In advertising for the Onpro, Amgen relied upon data that described a 31% higher incidence of FN among patients using PFS vs Onpro forms of pegfilgrastim application. As the FDA pointed out, that was actually the difference between 2 very low proportions of patients who experienced FN and the finding was not statistically significant, meaning no reliable medical inference could be made from it.

Separately, a Sandoz study evaluated for possible reduction in FN incidence between the Onpro and PFS pegfilgrastim, which also found no statistical significance. The incidence of FN in the initial cycle of chemotherapy was 1.01% for Onpro vs 1.48% for PFS (P = .336). In all chemotherapy cycles, FN incidence was 0.91% for Onpro vs 1.22% for PFS (P = .214).

The FDA found other problems with the Amgen study, saying there was strong potential for bias in selection of patients and a failure to define the sensitivity of the data sources.

A Pandemic Superstar

The Onpro proved its worth to Amgen during the pandemic as it allowed patients undergoing chemotherapy to receive their follow-up pegfilgrastim injections at home. PFS biosimilars currently hold a 35% market share of the pegfilgrastim market, but the Onpro still retained a 54% share of the total market at the end of the first quarter of 2021. Overall sales of Neulasta, meanwhile, had declined 21% for the year ended March 31, 2021, according to Amgen.

However, the dynamics of the pegfilgrastim market are changing and it may become difficult for Onpro to maintain its dominance. Pegfilgrastim is a long-acting agent that is administered once per chemotherapy cycle at a cost of around $6200 per injection. There is evidence that payers are sometimes preferring to use filgrastim, another GCSF that is administered daily at a lower cost of around $360 per injection. Further, the number of filgrastim injections in a recent study averaged around 5, which means that comparatively speaking, filgrastim can be administered for far less than pegfilgrastim.

Another trend has to do with the administration of PFS. It is beginning to appear that pegfilgrastim can be safely administered on the same day as chemotherapy, obviating the need for home-based or follow-up injections, Abraham noted.

In a recent study of patients with lymphoma receiving CHOP chemotherapy (cyclophosphamide/hydroxydaunorubicin/vincristine [Oncovin], prednisone), investigators concluded pegfilgrastim (Udenyca) can be safely administered on the same day as the CHOP chemotherapy.

“This study from the University of Arizona Cancer Center showed that administration of pegfilgrastim on the same day as chemotherapy is a safe, effective method of preventing FN in patients who receive standard-of-care chemotherapy to treat lymphoma,” investigators concluded.

“While the pegfilgrastim label implies that this growth factor should not be injected before the 24-hour to 72-hour time window, there is growing evidence, some from controlled trials—including a set sponsored by Amgen—and more from noncontrolled studies, that same-day administration may be a safe and effective alternative during treatment with chemotherapy. In addition, there is initial evidence that eflapegastrim, a novel GCSF, administered the same day as chemotherapy may be safe and effective,” Abraham said.

And lastly, whether there is a lower incidence of FN with the Onpro vs PFS pegfilgrastim, studies have shown failure rates with the Onpro ranging from 1.7% to 6.9%, meaning that these proportions of patients enrolled in trials failed to receive appropriate dosing of pegfilgrastim from the Onpro.

“When the device fails, the patient may not have received any or all of the necessary prophylaxis, and therefore may be at higher risk of chemotherapy-induced FN and its many consequences, including hospitalization or death,” Abraham said.

Time to Move On?

In Abraham's opinion, Amgen has transformed supportive oncology care through the development of Neupogen (filgrastim) and Neulasta, but it’s time for Amgen to develop new and more effective products, using its significant pharmaceutical resource base, and allow competition and market dynamics to take over the pegfilgrastim market and make this agent more affordable and more widely available.

“Amgen’s growth factor innovation has given clinicians effective means of combating the effects of myelosuppressive chemotherapy, enabling better and more sustained chemotherapy. Just as much, it has decreased patient suffering and has improved clinical outcomes and quality of life.

“But there is also the much-needed patent system: It helped Amgen develop and market growth factors with the protection afforded by the patent system. That protection has ended and biosimilar competition for market share is now a global reality,” he said.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.