- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

ICER: Humira's Price Increases in 2020 Were Unsupported by Clinical Evidence

The Institute for Clinical and Economic Review (ICER) states in its latest Unsupported Price Increase report that when it comes to rising drug prices, Humira is in a class of its own.

Among 7 drugs in the United States that had the most impactful yet “unsupported” price increases in 2020, Humira (adalimumab) accounted for the lion’s share of the total increase: $1.4 billion of $1.67 billion, according to a study from the Institute for Clinical and Economic Review (ICER).

An unsupported price increase was defined as not being justified by new clinical evidence that would have suggested the drugs were significantly more important for treating patients than previously assumed.

ICER said in the case of adalimumab, which won’t face biosimilar competition until 2023, the price increases appear tied to “imminent loss of [patent] exclusivity” and the likelihood that payers will be unlikely to switch patients on adalimumab to a lower-priced product. Humira is used to treat a host of inflammatory conditions, including rheumatoid arthritis, psoriatic arthritis, juvenile idiopathic arthritis, ankylosing spondylitis, Crohn disease, and ulcerative colitis.

Another factor characteristic of products with the highest unsupported price increases was that they are in categories “in which product substitution is difficult or impossible (eg, oncology, atypical antipsychotics),” ICER said.

Substantial price hikes for branded and generic drugs in the United States have failed to incentivize state and national leaders to determine whether these price increases are justified by new clinical evidence or other factors, ICER states in the report.

Methodology

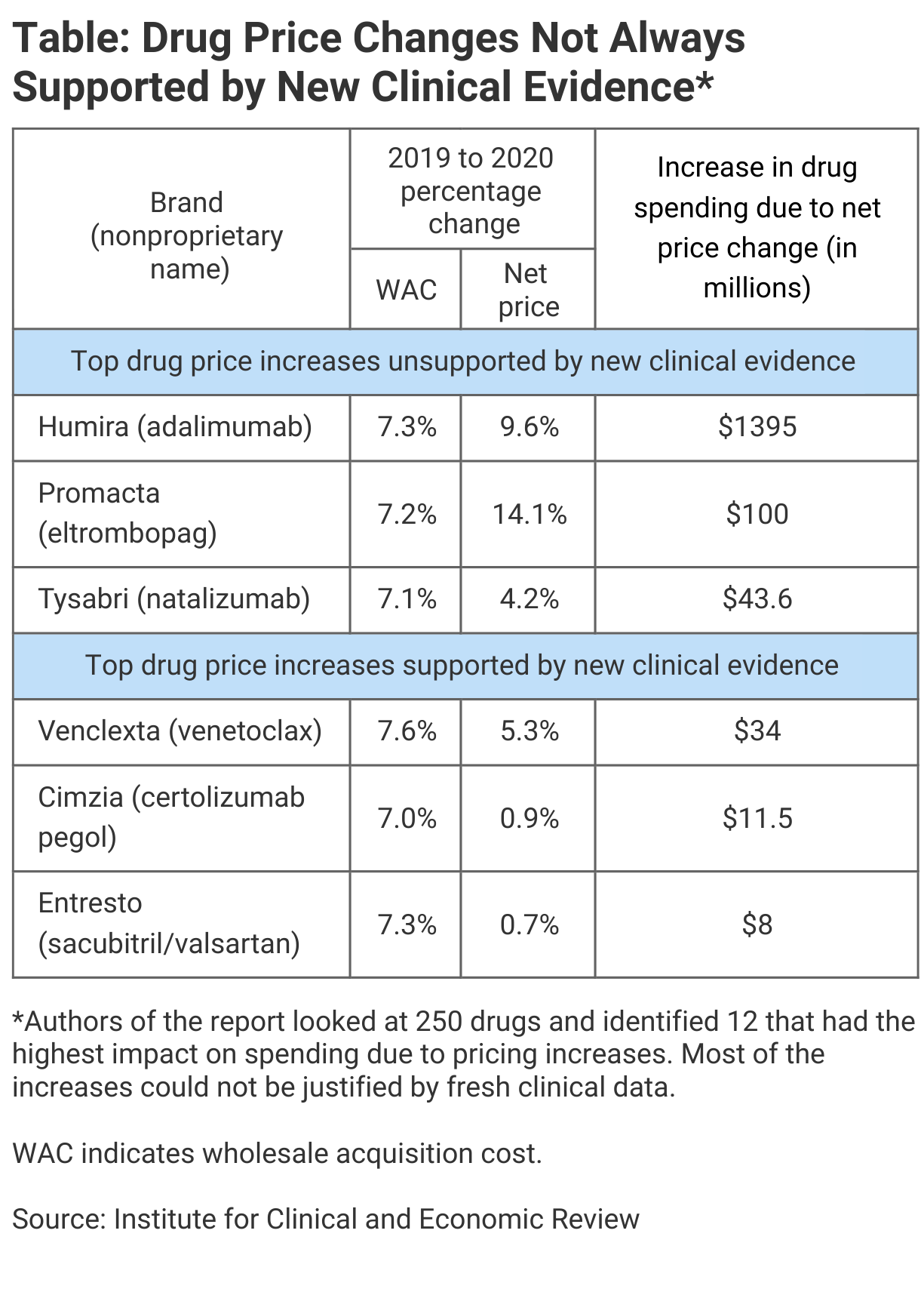

For the report, ICER studied the top 12 drugs (out of a basket of 250) in the United States whose prices had the greatest impact on national drug spending and sought to evaluate whether new clinical evidence was presented from 2019 to 2020 that might have justified the price increases seen.

“Nine were judged to have price increases unsupported by new clinical evidence and 3 were found to have price increases with new clinical evidence,” the report said. For 7 of the 9 drugs that ICER considered to have unsupported price hikes, the 1-year increase of $1.67 billion was significantly larger than observed last year when the same Unsupported Price Increase (UPI) was done: “This incremental budget impact of $1.67 billion is larger than the $1.2 billion from 7 drugs with unsupported price increases seen in last year’s UPI report.”

Despite these increases, overall net prices for drugs in the United States have decreased over the past several years, ICER said. The report states that there is potential for Congress to impose a cap on drug price spending, and “the context for assessment of drug price increases may shift.”

Among the top drugs with unsupported price increases from 2019 to 2020, Humira ranked highest, with a 7.3% increase in wholesale average cost (WAC), a 9.6% increase in list price, and an increase in drug spending due to the price increases of $1.4 billion (Table). In second place was bone marrow stimulant Promacta (eltrombopag) with 7.2% and 14.1% WAC and net price increases, respectively, and a $100 million increase in spending.

In third place was the immunosuppressive therapy Tysabri (natalizumab), with 7.1% and 4.2% increases for WAC and net price, and a $43.6 million overall spending increase. In fourth place was Xifaxan (rifaximin), used to treat inflammatory bowel disease, with 8.4% and 3.0% increases, respectively, and an overall spending increase of $43.6 million.

The ranking illustrates how dramatic the Humira price increases were in terms of impact relative to those for the rest of the pack.

ICER solicited statements from the manufacturers to justify the price increases and was told by AbbVie, the maker of Humira, that the company is “continually” investing in patient-centric enhancements to adalimumab. AbbVie said this includes a recent citrate-free formulation that reduces pain on injection for patients, thinner injection needle, and new dosing configurations.

“Continuous innovations like these require significant ongoing investment” and “such investment and innovation has continued to return value to patients, health care providers, and policymakers and yet is not considered or reflected in ICER’s methodology or report,” AbbVie stated. The response was dated October 12, 2021.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.