- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

IRA Reimbursement Impact on Biosimilars Minimal Despite Rising Market Share

The Inflation Reduction Act (IRA) has modestly boosted oncology biosimilar uptake through Medicare reimbursement, but its impact has been limited due to preexisting competitive market conditions.

Oncology and supportive care biosimilars have secured significant market share and saved the US health care system millions, with the Inflation Reduction Act (IRA) providing a modest boost through Medicare reimbursement, although its impact has been limited by existing market competition, according to a new white paper from Centara.1

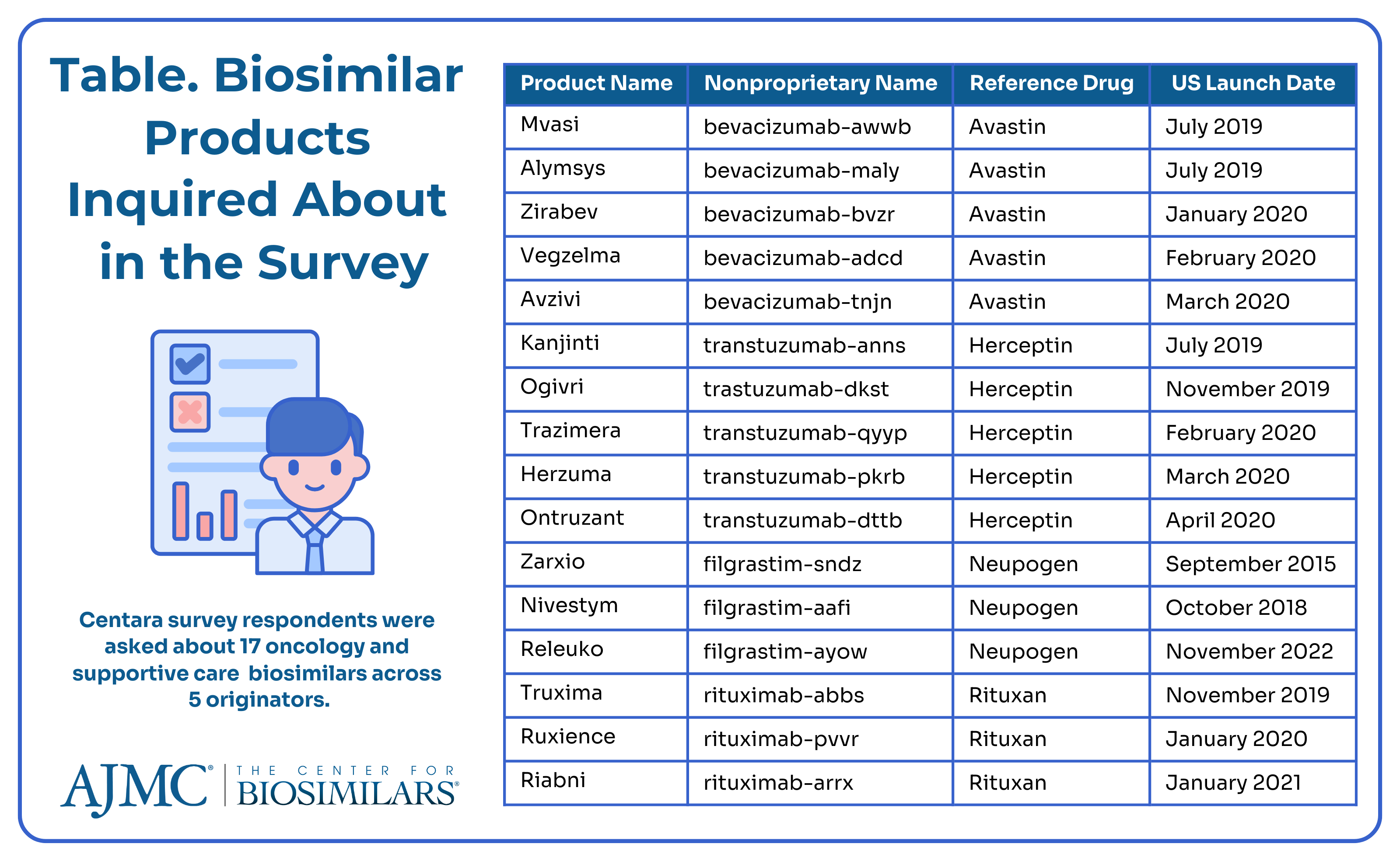

Centara is a drug development software company that enables companies using its Model Informed Drug Development software to make better risk assessments when choosing which products to develop and which markets to pursue. The company surveyed 79 facilities administering 17 intravenous oncology therapies to quantify respondents’ awareness of IRA policies and perception of its impact on biosimilar utilization at their organization (Table).

The online survey was conducted from January to February 2024 and included a mix of hospitals and community infusion sites that have reimbursement responsibilities. The respondents were nonphysicians and were from all geographic regions of the US.

Background on the IRA

The Act was signed into law in 2022 and has attracted just as much criticism as praise. The IRA has 4 pillars that relate to biosimilars2:

- Increasing Medicare rebates for biosimilars from 6% of the average sales price (ASP) of the reference drug in addition to the cost of the biosimilar to 8% through 2027

- Putting a $35 patient out-of-pocket cap on insulin products, including biosimilar and follow-on insulin products

- A redesign of Medicare Part D benefits

- Lowering prices through Medicare negotiations with originator manufacturers

Going into effect in October 2022, the reimbursement increases were intended to help incentivize providers to prescribe biosimilars over originator agents.3 Alas, there are several caveats. Only biosimilars with an ASP lower than the reference drug qualify for enhanced reimbursement, meaning that in markets with aggressive discounting, a biosimilar may lose and regain eligibility from 1 quarter to the next. Additionally, the 5-year reimbursement period starts when the ASP is established, so biologics entering the market in 2027 won't be eligible for enhanced reimbursement until 2032.

Regarding price negotiation, the first price changes will go into effect in early 2025 and the initial list of drugs to be negotiated include 2 originators that will face biosimilar competition in the next few years: Enbrel (etanercept) and Stelara (ustekinumab). The list for the first 10 negotiated drugs was released in August 2023, and the new prices were announced in August 2024.2,4

Additionally, Centara’s white paper comes as Avalere Health publishes a report finding that payments to community oncology practices could be reduced by $12 billion through 2032 due to the IRA failing to separate add-on payments for administering complex cancer drugs from drug price negotiations.5

The cap on insulin products was designed to offset the financial burden of patients with diabetes who may be pressured to skip doses or ration their insulin due to high prices. A 2023 report6 by the HHS Office of the Assistant Secretary for Planning and Evaluation investigating the impact of the IRA insulin gap found that beneficiaries enrolled in Medicare Part D and Part B plans could have saved $734 million and $27 million, respectively, on insulin products had the policy been implemented in 2020. Researchers estimated that, on average, beneficiaries missed out on $500 in annual insulin savings per person.

However, Centara’s report tells a different story, showcasing the minimal impact the IRA has had on the US biosimilar industry through 2023.1

How the IRA Has Impacted Biosimilars So Far

The survey results demonstrate moderate awareness of the IRA biosimilar add-on payments, with less than 20% of staff being completely unaware and 95% of facility leadership being at least partially informed. Awareness was higher in larger facilities that administered more oncology infusions. Biosimilars of oncology and supportive care drugs were widely accepted, with 91% of facilities using at least 1 biosimilar. Utilization was consistent across most biosimilar categories, with trastuzumab biosimilars having the highest adoption (79%), reflecting the market's maturity since the FDA approved Ogivri (trastuzumab-dkst) in 2017.

The company surveyed 79 facilities administering intravenous oncology therapies to quantify respondents’ awareness of IRA policies and perception of its impact on biosimilar utilization at their organization. | Image credit: wladimir1804 - stock.adobe.com

Reimbursement policies from managed care organizations (MCOs) played a key role in whether an organization chose to use biosimilars, with some plans encouraging biosimilar use through medical policy preferences or financial incentives. Additionally, over 30% of respondents mentioned that reimbursement incentives from CMS, such as those under the IRA, are driving biosimilar adoption for Medicare patients.

One finding indicating the IRA’s success in increasing biosimilar uptake is the positive correlation between knowledge of the IRA’s reimbursement enhancements and the number of unique biosimilar products used by facilities. Facilities with leadership highly aware of the IRA's add-on payments tended to use more biosimilars, suggesting that strong awareness of enhanced reimbursement encourages strategic adoption of biosimilars.

Most respondents noted a slight increase in biosimilar utilization due to the IRA. However, facilities that did not increase their biosimilar use cited reasons such as lack of awareness among providers or leadership, institutional inertia, and existing contracts with originator products.

Nearly 90% of respondents believe that biosimilar utilization will increase over the next 5 years, and 74% believe that IRA add-on payments will be a significant factor in this anticipated increase.

The white paper noted that much of the increase update for oncology biosimilars occurred prior to the passage of the IRA. The number of biosimilar competitors can also impact market dynamics significantly, especially in markets that have multiple competitors (like bevacizumab, filgrastim, and rituximab) showing more substantial changes compared with those with fewer competitors. Additionally, cost recovery differences between hospitals/clinics and physician offices affect the impact of reimbursement policies.

About two-thirds of respondents expect an increase in their facility’s use of biosimilars for Avastin (bevacizumab), Neupogen (filgrastim), Remicade (infliximab), and Rituxan (rituximab), while about half anticipate more use of Herceptin (trastuzumab) follow-on biologics, possibly due to the market maturity of trastuzumab biosimilars. Limited market data suggest that the IRA enhancement may have slightly increased biosimilar uptake, although the impact is minimal, with less than a 1% increase. Despite the modest results so far, the report expressed optimism that the biosimilar boost could have a greater effect over the remaining 3 years of the provision, particularly in the bone health and ophthalmology sectors.

References

1. Verrilli C, Vargas M, Junghahn M. Boost or bust? Evaluating the impact of the IRA’s enhanced reimbursement on uptake of biosimilars. Centara. August 2024. Accessed September 18, 2024. https://www.certara.com/white-paper/biosimilars-inflation-reduction-act/?submissionGuid=97970a15-dfe5-4464-96c3-995c97692192

2. Jeremias S. Stelara and Enbrel chosen for IRA price negotiation. The Center for Biosimilars®. August 29, 2023. Accessed September 18, 2024. https://www.centerforbiosimilars.com/view/stelara-and-enbrel-chosen-for-ira-price-negotiation

3. Inserro A. Biosimilar Medicare Part B payment boost begins. The Center for Biosimilars. October 3, 2022. Accessed September 18, 2024. https://www.centerforbiosimilars.com/view/biosimilar-medicare-part-b-payment-boost-begins

4. Jeremias S. CMS announces new drug prices under the IRA, including for Stelara and Enbrel. The Center for Biosimilars. August 19, 2024. Accessed September 18, 2024. https://www.centerforbiosimilars.com/view/cms-announces-new-drug-prices-under-the-ira-including-for-stelara-and-enbrel

5. Caffrey M. Part B losses to oncologists due to IRA could total $12B through 2032 across Medicare, commercial plans. The American Journal of Managed Care®. September 17, 2024. Accessed September 19, 2024. https://www.ajmc.com/view/part-b-losses-to-oncologists-due-to-ira-could-total-12b-through-2032-across-medicare-commercial-plans

6. Jeremias S. IRA insulin cap could have saved Medicare beneficiaries millions in 2020. The Center for Biosimilars. January 24, 2023. Accessed September 18, 2024. https://www.centerforbiosimilars.com/view/ira-insulin-cap-could-have-saved-medicare-beneficiaries-millions-in-2020

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.

259 Prospect Plains Rd, Bldg H,

Cranbury, NJ 08512

All rights reserved.