- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Opinion: Is the Ophthalmology Market Ready to Embrace Biosimilars?

Samsung Bioepis has filed for FDA approval for a ranibizumab biosimilar candidate (SB11), and more ophthalmology biosimilars are in the pipeline.

The evolution of biosimilars so far in the United States has revealed one thing for certain: Generalizations cannot be made about biosimilar market dynamics across different therapeutic areas. Although therapeutic oncology biosimilars gained significant market share in the year after they became available, adoption of infliximab biosimilars in rheumatology over the past few years has been sluggish at best. As products in other therapeutic areas make their way through the development pipeline, questions remain about how quickly uptake will occur. One therapeutic area to watch in the coming year is ophthalmology.

Ophthalmology biosimilars, specifically anti–vascular endothelial growth factor (VEGF) agents, are poised to compete with some of the most commonly used therapies for neovascular (eg, wet) age-related macular degeneration (AMD). With Samsung/Biogen’s FDA filing for SB11 (a ranibizumab biosimilar) in November 2020, and with several more candidates in the pipeline, biosimilars are about to make an impact on the ophthalmology market.

AMD is the leading cause of irreversible visual impairment in people aged 60 and older and is projected to affect over 288 million people globally by 2040 as the population ages. It is an eye disease that affects the macula (the central area of the retina), resulting in the loss of sharp central vision. Without central vision, people are unable to carry out critical daily activities such as reading, driving, and recognizing faces, which can lead to an overall decline in quality of life. In addition to lowering quality of life, AMD is associated with significant economic and treatment burdens for patients, as current management strategies include frequent monitoring and recurrent intravitreal injections with anti-VEGF agents. It is estimated that the US annual economic burden from direct health care costs due to AMD is $4.6 billion.1,2

Three of the most common treatment options for AMD include anti-VEGF agents: ranibizumab (Lucentis), aflibercept (Eylea), and bevacizumab (Avastin, off-label).2 Bevacizumab has been used off-label for several years by being repackaged by compounding facilities for intravitreal administration.2 Both Lucentis and Eylea have multiple biosimilar candidates in development by various manufacturers, but there are no approved biosimilars for these agents. In the case of Avastin, biosimilars are already approved and available on the market, but the role of bevacizumab biosimilars in ophthalmology is unclear. Known utilization has been for on-label oncology indications.

To gain early insight into levels of awareness and perspectives on the role of biosimilars in ophthalmology, Cardinal Health conducted research via a series of survey questions with community-based retina specialists (N = 37) from across the country. Interim results of the survey revealed significant opportunities to help prepare the market for the entrance of ophthalmology biosimilars. When asked about their familiarity with biosimilars, 31% of physician respondents (29 total responses) said they are not very familiar with biosimilars, and more than half (55%) said they have read research about them but are not familiar with the specifics, such as manufacturing, approval processes, and clinical trial design. However, the majority of respondents (83%) perceive biosimilars as fitting into the treatment armamentarium to help keep drug costs down (29 total responses), and more than half of respondents said they would consider using a ranibizumab biosimilar or aflibercept biosimilar once they become available.3

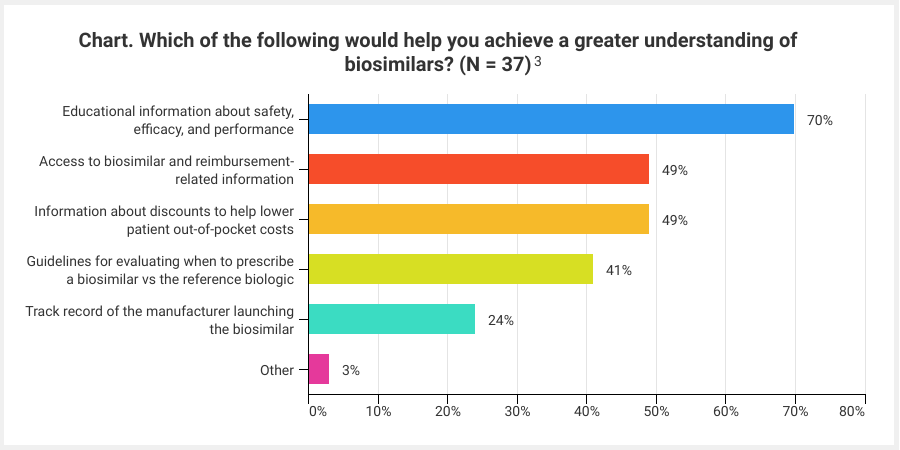

When asked what their primary concern with prescribing ophthalmologic biosimilars would be, 43% responded they would be uncomfortable from a clinical standpoint and 35% responded with payer coverage concerns. These responses serve as critical reminders that, when it comes to driving biosimilar adoption, it is important to provide proactive education to all key stakeholders, including providers, practice administrators, payers, and patients. For example, payers, and strategies such as step-therapy, will play a significant role in the ability to adopt ophthalmology biosimilars. Therefore, early payer engagement and education are critical to support clinically and financially sound formulary decisions that are best for patients and practices. Topics including the regulatory approval pathway and clinical trials structure and terms, such as extrapolation and interchangeability, are important in developing stakeholder familiarity and confidence in biosimilars. In fact, the vast majority of provider survey respondents said they would like to receive more educational information about the safety, efficacy, and performance of biosimilars (Chart).

Click to enlarge

Although the trajectory for ophthalmology biosimilars in the United States is still unknown, there are key lessons that can be applied from current and past experiences to better prepare the market for the launch of the first ophthalmology biosimilar. Education should be at the forefront of this drive. As the country prepares for the market entrance of the first ophthalmology biosimilar, the time to focus on educational efforts is now. Biosimilars are poised to bring significant cost savings to help mitigate the financial burden associated with the management of AMD, and in order to realize the full benefits of these agents, providers, payers, and patients must be well equipped to evaluate and adopt them as soon as they hit the market.

References

- Pennington KL, DeAngelis MM. Epidemiology of age-related macular degeneration (AMD): associations with cardiovascular disease phenotypes and lipid factors. Eye Vis (Lond). 2016;3:34. doi:10.1186/s40662-016-0063-5

- Holekamp NM. Review of neovascular age-related macular degeneration treatment options. Am J Manag Care. 2019;25(1suppl 10):S172-S181. www.ajmc.com/view/review-of-neovascular-agerelated-macular-degeneration-treatment-options

- Cardinal Health. 2020. Cardinal Health survey of US retinal specialists. Internal report. Unpublished.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.