- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Mabpharm Raises the Stakes in Infliximab Market With a "Biobetter" Approval

China has approved a product for rheumatoid arthritis and Crohn disease that Mabpharm and Sorrento Therapteutics say is an improvement on infliximab.

Has a Chinese company come up with an improvement on infliximab, the immunosuppressive drug used to treat rheumatoid arthritis, Crohn disease, and ulcerative colitis, among other conditions?

Mabpharm, of Taizhou, and its commercialization partner Sorrento Therapeutics, of California, said China’s National Medical Products Administration has granted Mabpharm approval to market a “biobetter” (CMAB008) for infliximab in China.

Biobetters are drugs that have similar structure and properties to an innovator product but are enhanced or modified to produce better outcomes. In a statement, Sorrento said the antibody biobetter was developed with Chinese hamster ovary cells, vs mouse cells for infliximab, and “has demonstrated a better safety profile…while maintaining [infliximab’s] efficacy profile.”

Sorrento has been granted rights to commercialize the product outside China and said it would now approach regulators in the United States and Europe for guidance on filing for marketing approval.

In the United States and the European Union, in addition to the originator product, Remicade (Janssen), there are several infliximab biosimilars on the market, including Renflexis (Merck, Samsung Bioepis), Avsola (Amgen), and Inflectra (Celltrion, Pfizer).

Market Dynamics

The arrival of a biobetter could shake up demand for the originator product and its biosimilars, and this highlights one of the challenges for biosimilar makers.

By the time biosimilars come on the market, an originator company has enjoyed a long run of profits, presumably more than compensating for research and development expense, but this may not be the case for biosimilar companies.

Biosimilar developers may invest as much as $200 million in development of a biosimilar and could immediately face competition from other biosimilars, costly litigation from originator companies, and heavy pressure to reduce prices.

Avsola, for example, launched in the United States just a year ago, in July 2020. Inflectra and Renflexis launched in the United States in 2016 and 2017, respectively, and their makers have enjoyed a longer run of sales revenue.

However, in the United States infliximab biosimilars have been among the slowest of biosimilars to take off. They commanded just 23% of the market for infliximab by the close of the first quarter of 2021, according to Amgen.

Competition and pricing pressures have also battered the returns on these products for drug makers. Infliximab biosimilar average sales prices (ASPs) have declined roughly 45% since these biosimilars were first introduced in the United States, whereas the ASP for Remicade has experienced a drop of greater than 40%, according to Amgen data.

Remicade notched revenues of $3.7 billion in 2020, down from $4.4 billion the previous year, according to a Johnson & Johnson earnings statement. Sorrento estimated that total 2020 infliximab sales, including biosimilars, were $4.2 billion.

In the rapidly changing field of oncology, where the pace of treatment advances is high, the business risks are more acute. For this reason, pharmaceutical companies may adopt a cautious stance toward developing biosimilars for use in oncology.

Treatment of Last Resort

Infliximab is an anti–tumor necrosis factor (TNF) antibody that targets inflammation characteristic of arthritic and gastrointestinal disorders. “It is usually prescribed when other medicines or treatments have failed,” which makes it an important treatment of last resort, Sorrento noted in its statement.

Sorrento said the Mabpharm biobetter has not only an improved safety profile but also lower immunogenicity compared with infliximab. “The Chinese approval covers 6 different indications, including adult ulcerative colitis, ankylosing spondylitis, rheumatoid arthritis, adult and childhood Crohn disease, fistula Crohn disease, and psoriasis,” the company said.

Sorrento was described as a clinical stage, antibody-centric biopharmaceutical company geared toward developing therapies for cancer and COVID-19.

Mabpharm describes itself as a biopharmaceutical company with a focus on development and production of new drugs and biosimilars for cancer and autoimmune diseases.

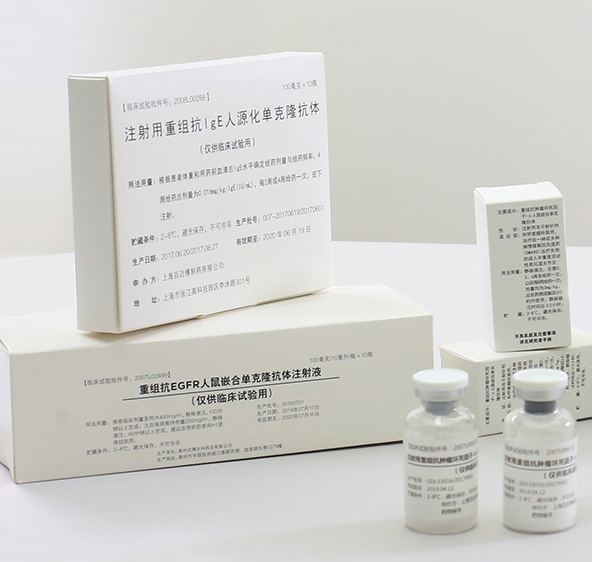

Mabpharm has multiple monoclonal antibody drugs (both biobetter and biosimilar candidates) in development, including versions of omalizumab (asthma), cetuximab (colorectal cancer), trastuzumab (breast, metastatic gastric cancer), and nivolumab (non–small cell lung and hepatocellular cancers).

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.