- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Magellan Rx Reports Step Therapy Is Workhorse in Biosimilar Utilization

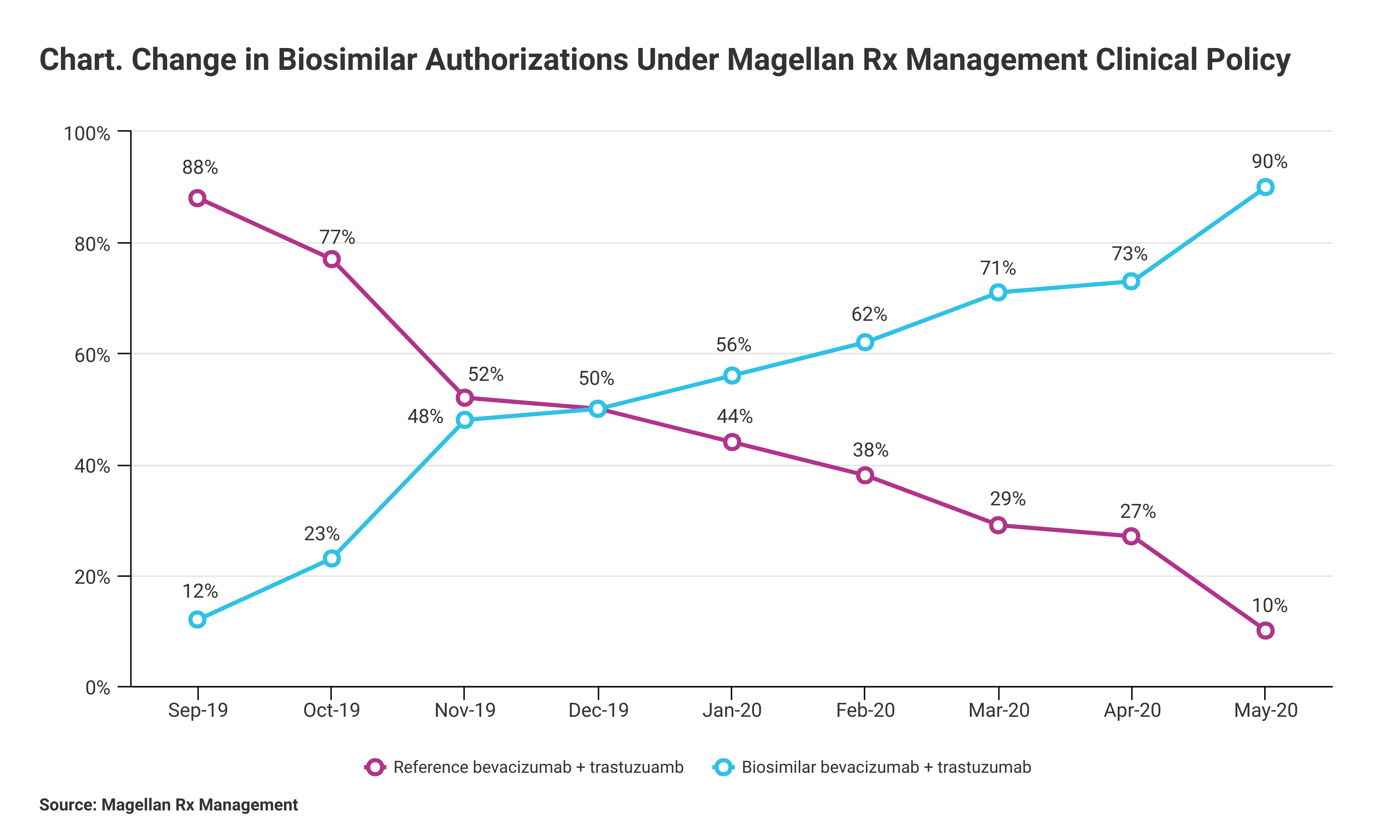

The pharmacy benefit manager reported 90% biosimilar uptake among its health plans that adopted clinical management policies that included step therapy or parity usage.

Using a combination of step therapy and parity reimbursement, pharmacy benefit manager (PBM) Magellan Rx Management has achieved a 90% success rate in biosimilar authorizations for the period from July 2019 to May 2020. Magellan Rx, a division of Magellan Health, manages specialty drug benefits for health plans, employers, and trade unions.

Oncology biosimilars emerged on the US market in July 2019 with the launch of Kanjinti (trastuzumab; Amgen) and Mvasi (bevacizumab; Avastin). Now, there are 10 oncology biosimilars available in the United States.

Magellan defined the 90% utilization rate as the number of authorizations for biosimilars compared with authorizations for reference products (Chart). “Due to the cost differential between oncology biosimilars and their reference brands, savings are expected to be at least 15%,” Magellan said in a statement.

Click to enlarge

Oncology therapeutic biosimilars have been approved for not only bevacizumab (Avastin) and trastuzumab (Herceptin) but also rituximab (Rituxan). There also are multiple approved oncology support biosimilars. Bevacizumab, rituximab, and trastuzumab “were the highest-spend drugs in the United States from 2011 to 2016,” according to Rebecca Borgert, PharmD, BCOP, senior director of Oncology Clinical Strategies and Innovation for Magellan. During that period, average annual expenditures on the reference products for bevacizumab, rituximab, and trastuzumab were $8.6 billion in the United States.

“Oncology and oncology support drugs continue to be the largest driver of specialty pharmacy spend on the medical benefit—43% of total medical drug spend for both the commercial and Medicaid populations and 55% in Medicare—and given the billions of dollars that are spent on these treatments, significant additional savings are anticipated with full results expected in early 2021,” Magellan said.

The first bevacizumab and trastuzumab biosimilars launched at a 15% wholesale average cost discount to the reference products, and the first rituximab biosimilar launched at a 10% discount to the reference product, according to a study led by Borgert.

Prior to the launch of the first oncology therapeutic biosimilars, Magellan worked to prepare its client network to incorporate these agents into therapeutic plans. The PBM developed a provider education program and targeted key oncology providers. Drug utilization management policies were drawn up and reviewed with clients prior to biosimilar launches. Health plans were given the option to use step therapy for patients who had not previously received the reference product, or they could manage oncology biosimilars at parity with the reference products.

From September 1, 2019 to January 31, 2020, patients received biosimilars (Mvasi, Kanjinti) 15.3% of the time under the parity strategy and 49% of the time under step therapy. “Payers equipped with proactive utilization management strategies for oncology biosimilars were able to capitalize on early utilization shifts to the less expensive biosimilar products,” investigators concluded. They said some providers switched patients to oncology biosimilars “even without” step therapy requirements.

In earlier statement, Magellan reported similar success among its payer clients in increasing use of infliximab biosimilars vs the reference product. Beginning in the third quarter of 2017 and ending in the third quarter of 2018, infliximab biosimilar use rose from 0% to 86% vs 100% to 14% for the reference product after Magellan established a policy of transitioning all patients to a biosimilar agent.

These figures apply to Magellan health plan customers (physician offices and hospitals) that accepted a management approach to utilization that involved working closely with Magellan pharmacists to follow the clinical policy. “Even when utilizing a softer approach that mandates only new patients use the biosimilar version, health plans have experienced an uptake in biosimilar utilization as high as 75%,” the company said.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.