The reality is that the PTO is an imperfect arbiter of intellectual property, and originators are able to capitalize on this, leaving biosimilar manufacturers—and consumers—to bear the burden.

- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Matrix Report Identifies Shortcomings of US Patent System

The European Union makes it far more difficult to obtain patents on biologics, reducing the likelihood of patent “thickets” that stifle competition, the Matrix Global Advisors report states.

The patent system in the United States differs markedly from that in the European Union, where biosimilar developers can challenge patents with far greater ease and less expense, according to a report from Matrix Global Advisors, a public policy consulting firm.

The report explains how US patenting laws enable originator companies to build almost impenetrable walls of patents to protect their drugs from competition.

In the United States, originator biologics companies may file unlimited numbers of patent applications on biologics, although many that are approved do not stand the test of scrutiny, which calls into question the rigorousness of the US Patent and Trademark Office’s (PTO) review process, according to the report’s authors, Alex Brill and Christy Robinson.

Brill founded Matrix and previously served as policy director and chief economist for the House Committee on Ways and Means. Robinson is a public policy analyst formerly with American Enterprise Institute.

It may be years following a patent award that a biosimilar developer or any other party may be able to bring a legal challenge or request for an inter partes review (IPR), which is a patent review trial before the US PTO.

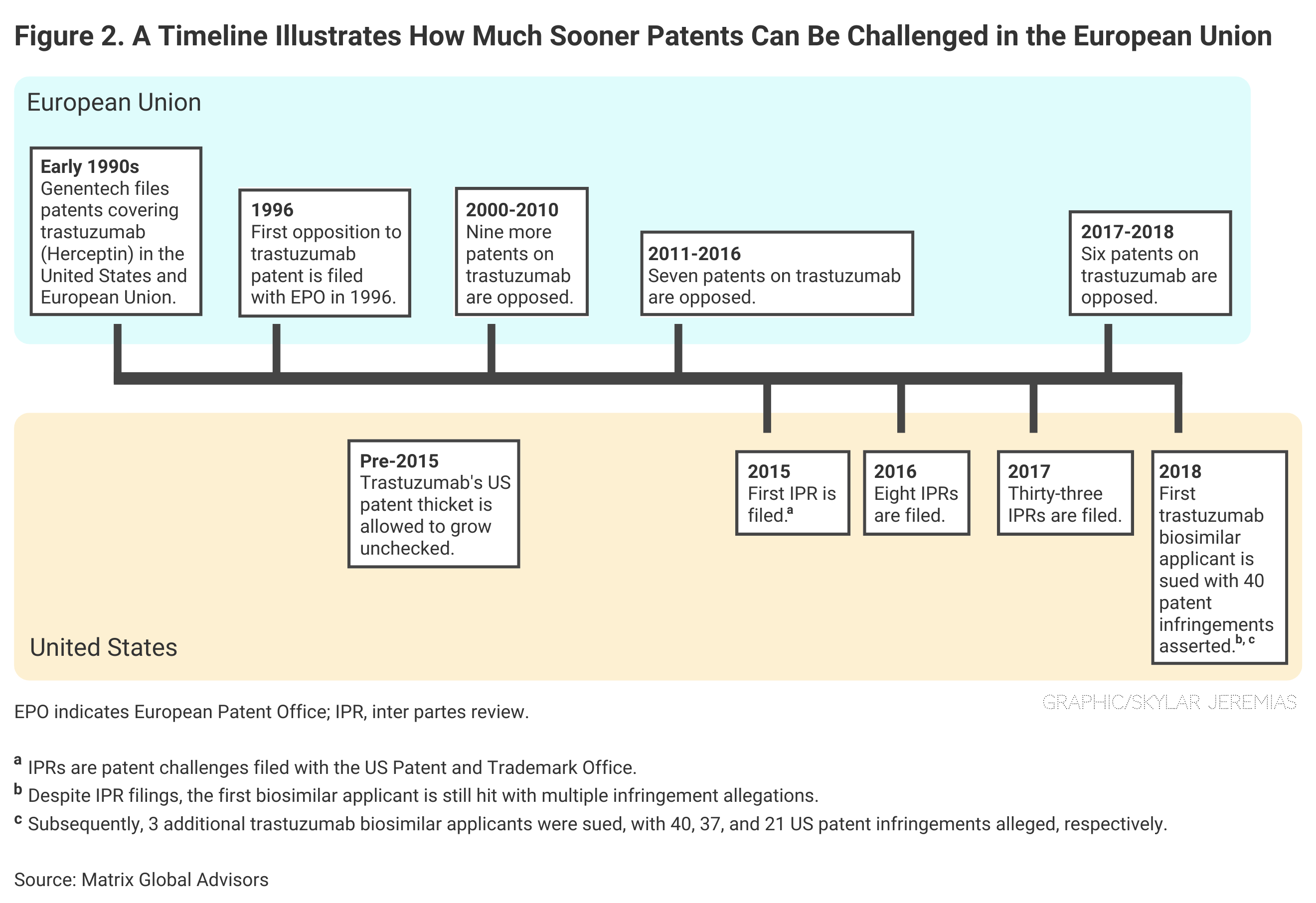

European regulators grant far fewer patents to originator companies than the United States, and they allow almost immediate challenges of patents once awarded, according to the Matrix report.

Nothing prevents an originator company from filing scores of patent applications for a single product, and in fact, they do.

For the 8 top-selling biologics in the United States, the least number of patents obtained for any individual biologic was 41 (Enbrel, etanercept), Matrix said, citing I-MAK data. The most was over 130, for AbbVie’s adalimumab product (Humira).

“Originators have a strong incentive to amass as many patents as possible on reference biologics with high asset value. They also have ample opportunity to accumulate patents,” according to Matrix.

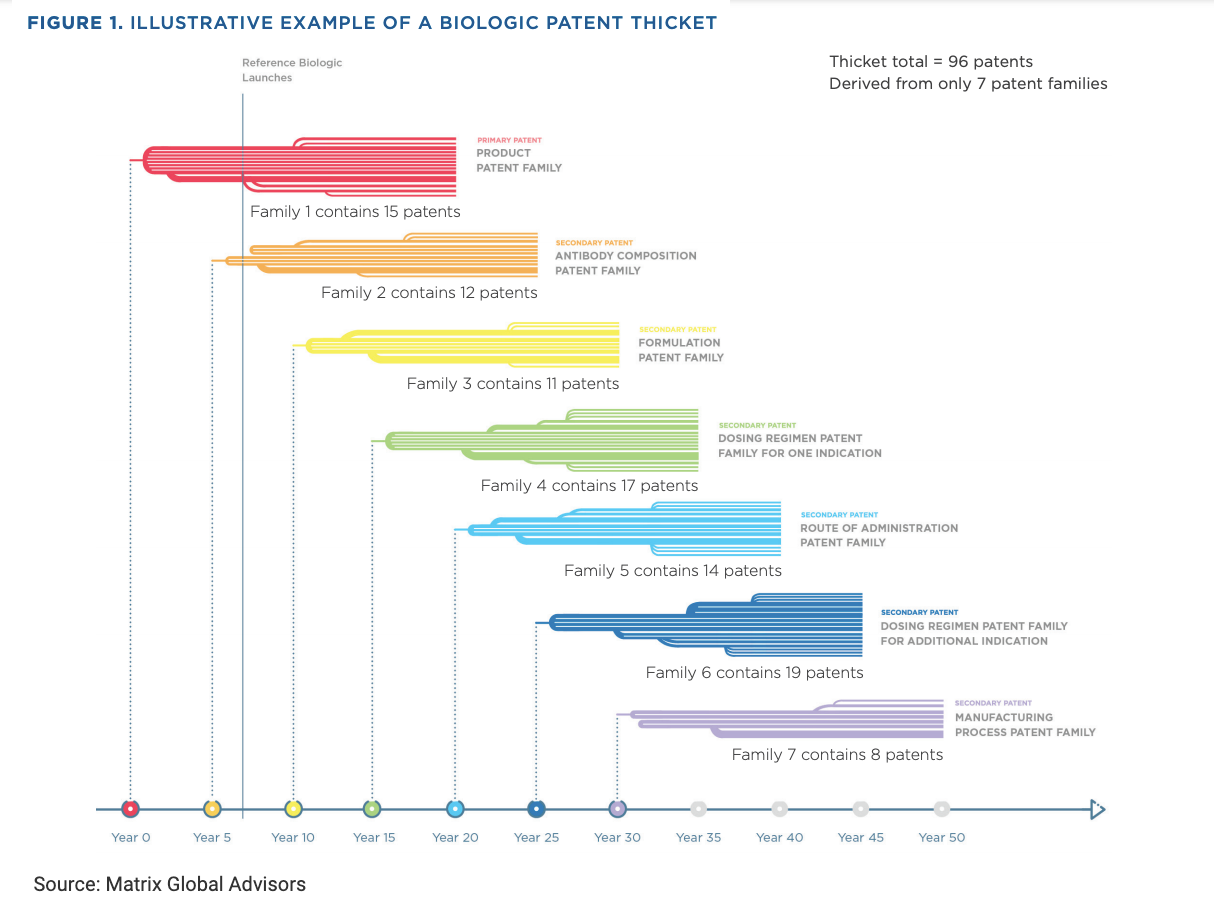

Originator companies in the United States may obtain multiple “families” of patents for a single product, effectively extending product exclusivity for years beyond the original protection granted by the FDA (Figure 1).

In the United States, the cost of a biologics IPR can reach $1 million, according to Matrix. Conversely, it may cost an originator company as little as $25,000 to apply for and maintain a single patent. Such lopsidedness makes it far more advantageous for originator companies to apply for multiple patents than for biosimilar developers to attempt to fight them.

In the United States, a biosimilar developer may have to wait years before it can demonstrate the “legal standing” necessary to challenge a patent. In the European Union, even a third party can bring a patent challenge, and much sooner (Figure 2).

Click to enlarge.

“No Statutory Prohibition”

There is “no statutory prohibition” on creating a patent thicket to obstruct biosimilar competition in the United States, the Matrix report notes. Years after the primary patent family is created, the manufacturer may still be busy creating patent families for antibody composition, product formulations, dosing regimens, routes of administration, and manufacturing processes.

Bristol Myers Squibb already has 38 patent families (or groups of patents) for nivolumab (Opdivo; FDA approval 2014), and patent applications for 30 of these families “were filed after Opdivo entered the US market.”

“This is not to say that patent examiners [in the United States] are individually to blame for the rise of patent thickets, but the reality is that the PTO is an imperfect arbiter of intellectual property, and originators are able to capitalize on this, leaving biosimilar manufacturers—and consumers—to bear the burden,” the report states.

The report recommends expanding the resources of the PTO and creating higher standards for patent issuance.

“Broadly, what will help ease the problem of patent thickets will be reforms at the PTO that promote better patents and IPRs, antigaming policies that deter anticompetitive patent practices by originators, and reasonable limits on the number of patents that can be asserted against biosimilar competitors,” the report states.

Effect on Manufacturing

There’s another deleterious effect of US patent laws, the report’s authors said. “Drug manufacturers are at legal risk if they manufacture or stockpile biosimilars for commercial launch in the United States before patents expire or patent litigation is resolved.”

Biosimilar manufacturers may find it more advantageous to manufacture outside the United States, costing the United States manufacturing jobs and revenue.

The European Union in 2019 allowed the production and stockpiling of biosimilar and generic medicines before “supplementary” patent expiration. “Establishing an exception policy in the United States like the one the European Union recently instituted would reduce some [but not all] of the barriers to manufacturing biosimilars in the United States,” the report said.

For more in The Center for Biosimilars® series on patents and biosimilars, read this column from Axinn about the limitations of the Purple Book patent listings.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.