- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

News Roundup: Amneal's Bevacizumab Biosimilar, Originator Pricing Impact, and More

Amneal Pharmaceuticals develops its biosimilar pipeline with mAbxience, Xcenda estimates biosimilar effect on originator pricing, and Magellan Rx Management touts oncology biosimilars savings.

Amneal Files BLA for Alymsys

Amneal Pharmaceuticals said the FDA is reviewing its biologics license application (BLA) for a proposed bevacizumab biosimilar (Alymsys).

The product candidate references Avastin and was developed in collaboration with mAbxience of Spain. Amneal, of Bridgewater, New Jersey, said the FDA expects to complete the BLA review in the second quarter of 2022.

Amneal is also developing biosimilars for filgrastim and pegfilgrastim, referencing Neupogen and Neulasta, respectively.

Bevacizumab is a vascular endothelial growth factor inhibitor used in the treatment of metastatic colorectal cancer as well as other cancers. Amneal is seeking an indication for colorectal cancer and intends to seek approvals for other indications too, although once a biosimilar is approved for 1 indication of an originator biologic, health care practitioners are free to use it for other indications.

The company noted that bevacizumab sales in the United States were $2.8 billion for the year ended April 2021. Two existing bevacizumab biosimilars, Mvasi and Zirabev, were launched in July 2019 and December 2019, respectively.

Xcenda Releases Report on Originator Pricing

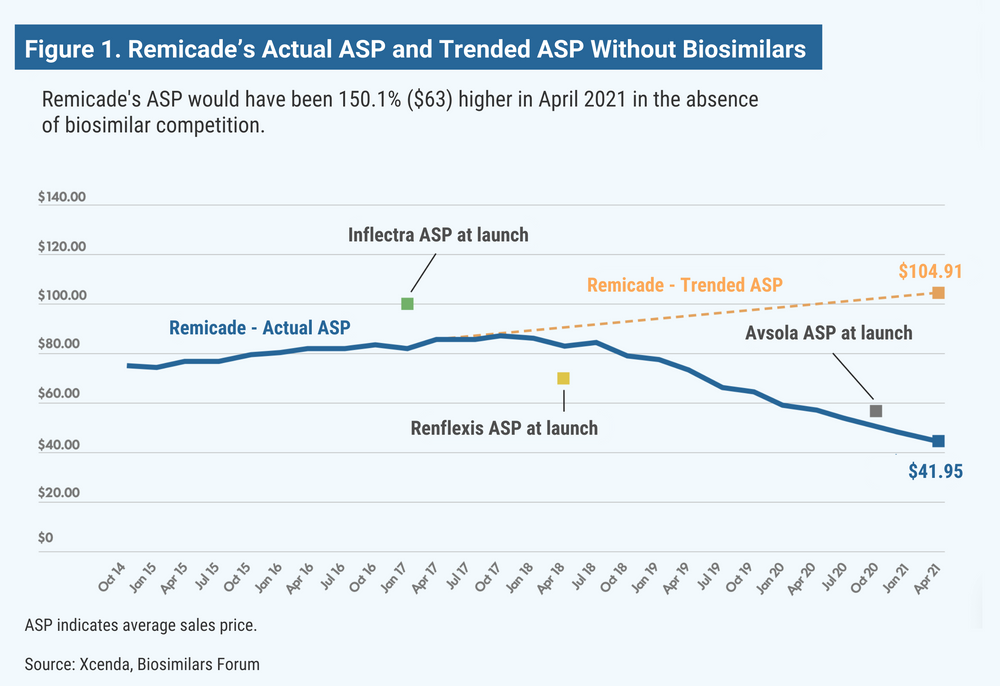

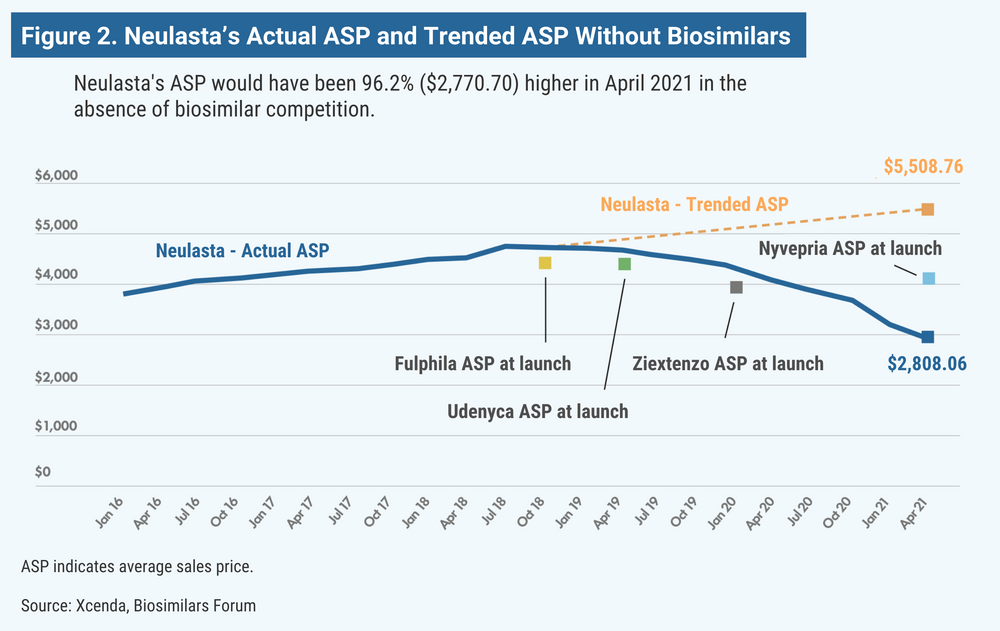

The first biosimilar in the United States was approved 6 years ago, and since that time, biosimilar competition has succeeded, on average, in averting 56% price increases on originator drugs for which biosimilars are available, according to the Biosimilars Forum and Xcenda, a division of Amerisource Bergen.

The findings were based on the 2-year average sales price (ASP) trends for the originator biologic products over the 2 years prior to the introduction of the respective biosimilars. Xcenda said that without the presence of biosimilar competition, prices for the originator drugs would have climbed 56% on average.

The price increase estimates are not based on actual price increases by the reference product companies, nor is it certain that the companies would have increased their prices at all or to the extent that Xcenda projected. There are currently 20 biosimilars on the market referencing 7 originator drugs.

Despite the downward pricing pressure on reference drugs, making biologics more affordable for patients, “uptake still remains slow,” the report said of biosimilar use. “The US market needs bipartisan policy solutions to break down barriers to continued access.”

According to the report, the ASP for Remicade (infliximab) would have been 150% higher (Figure 1); Neulasta (pegfilgrastim), 100% higher (Figure 2); epogen and Procrit (epoetin alfa), 60% higher; and Avastin (bevacizumab), Herceptin (trastuzumab), and Neupogen (filgrastim), 13% to 26% higher.

Although the price increase estimates are based only on the assumption that reference companies would have raised their prices, there is evidence that reference product companies are fairly consistent about raising prices of their biologics year by year.

Members of the House Committee on Oversight and Reform in a recent report and hearing noted the steep and frequent price increases for adalimumab (Humira) and etanercept (Enbrel) over 19 years by AbbVie and Amgen, respectively.

Amgen used to be a member of the Biosimilars Forum but had a falling out with the group in which both sides accused each other of failure to properly support biosimilars in the marketplace.

Similar concerns about pricing were raised this month by the attorney general of Mississippi, who filed suit against the big 3 insulin makers, Eli Lilly, Novo Nordisk, and Sanofi, contending that their pricing increases are needless, excessive, and depriving hundreds of thousands of patients of affordable medicine.

For a column on the price projections by representatives of the Biosimilars Forum and Xcenda, click here.

Magellan Rx Management Touts Biosimilar Savings It Achieved

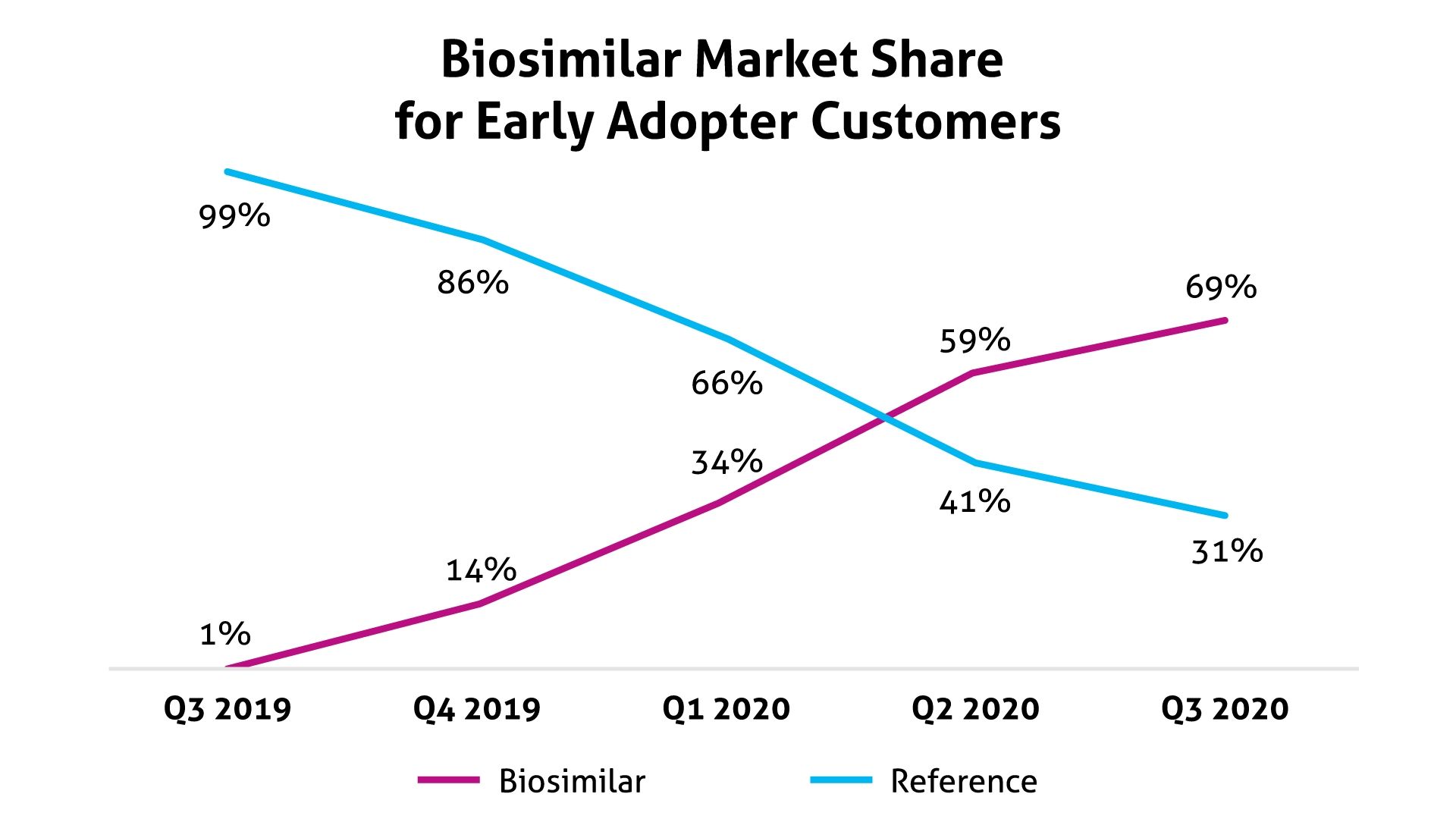

The pharmacy benefit manager (PBM) Magellan Rx Management said that over a 2-year period it achieved $40 million in biosimilar savings for 5 health plans that were early adopters of biosimilars in oncology.

“We have been tracking the emergence of biosimilars and started to deliver biosimilar-first solutions as early as 2016,” said Steve Cutts, PharmD, senior vice president and general manager of specialty drugs.

The program encouraged the use of 3 biosimilars in oncology. From the third quarter of 2019 through the third quarter of 2020, use of these biosimilars grew to 69% vs 31% for the originator products, which initially represented 99% of usage (Figure). According to Magellan Rx, these biosimilars may offer savings of up to 40% from reference products.

Source: Magellan Rx Management

Magellan Rx did not identify the oncology biosimilars used in this program. In a statement issued prior to the start of the program, the PBM said it anticipated projected savings to be $5 million to $8 million per 1 million covered lives.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.