- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

NORC: Pricing Transparency Could Aid Biosimilar Uptake

This is the second of a 2-part series on a study from the independent research center NORC at University of Chicago concerning biosimilar acceptance and uptake.

Editor's note: For part 1 of this series, please click here.

How you define biosimilar savings depends on whom you ask. The payer may be very happy with a rebate deal obtained from a biologics manufacturer that cuts costs on an originator biologic by 20%, but the patient who has to pay a higher out-of-pocket for an originator vs a biosimilar (eg, $1000 vs $500) may not be very happy with that outcome.

And yet the 20% price discount may have been secured only because of the threat of a new biosimilar entering the market.

Investigators from NORC, a University of Chicago independent research center, talked to patients, providers, group purchasing organizations (GPOs), and payers about the lack of transparency and hidden deal-making that often goes into the pricing and availability of biosimilars.

Physicians included in the study said that, for them, cost is often a factor in the decisions they make about which therapies to use. But because much of price determination is hidden in the black box, it’s hard for them to make value-based decisions consistently.

“These things are not exactly transparent, so you don’t really know if you’re saving money or not. It’s kind of a guessing game,” said a gastroenterologist who was interviewed anonymously. “I imagine that if we can get some real data and we really know what’s going on, we would make our decisions maybe a little bit more rationally.”

Study authors said that manufacturers of originator brands may negotiate deep discounts and rebates with payers and GPOs when biosimilars come to market and these may undercut the discounts offered by the biosimilar makers. Further, preestablished contracts between health plans and manufacturers may shut out biosimilar makers entirely.

“If there’s a biosimilar, we absolutely can try to…get the biosimilar on contract; and then it just depends on how the previous contract was written to inhibit us from actually being able to put [the biosimilar] on contract right away….We may have to wait until that contract expires in order to do that,” said a GPO representative who spoke to study authors.

There are signs that this lack of transparency in biologics pricing may be ebbing away. At the close of the Trump administration, CMS announced a series of moves to force health care plans and payers to tell patients what their treatments are costing them. Starting on January 1, 2024, health plans must disclose costs of drugs, durable medical equipment, and other services; and it’s very likely that consumer advocates will exploit this information to develop industrywide comparisons, in a further snip at the veil of secrecy.

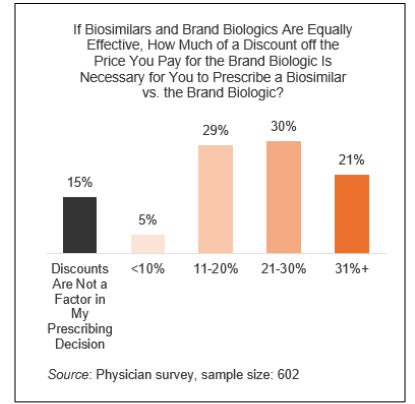

A percentage of surveyed physicians said price discounts would cause them to prescribe biosimilars over originator brands, but they said they often don’t know the real costs and they need to know that. The NORC authors said 5% of physicians would increase their biosimilar prescribing if there were a discount of under 10% and they knew about it. Higher percentages would be encouraged to do so if the discounts were greater (Figure).

Even if a biosimilar is an also-ran in the race to get on formulary, it still has a positive influence on overall pricing, the NORC study suggested. “Having the ability to buy a biosimilar does change the contracting and the negotiation strategy,” said a GPO representative whose thoughts were included in the study writeup. “I feel it puts pressure on the branded company to adjust their price points a little bit.”

However, physicians said that if contracts are still going to be awarded to the originator companies, it ought to be the case that the discounts, if there are any, should be passed along to the patients, so that they are not zapped by health plan cost-sharing requirements.

Among their recommendations for improvement, the NORC study authors suggested the following:

- Stop incentivizing high list prices and, instead, encourage contracts that benefit patients and the health care system overall.

- Make actual prices of drugs far more transparent for physicians and patients.

Reference

Wilde S, Schapiro L, Fletcher M, Pearson C. Understanding stakeholder perception of biosimilars. NORC. April 2021. Accessed April 13, 2021. https://www.norc.org/PDFs/Biosimilars/20210405_AV%20-%20NORC%20Biosimilars%20Final%20Report.pdf

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.