- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Part 1: Oncology Biosimilars Offer Comparable Benefits to Originators at Lower Prices

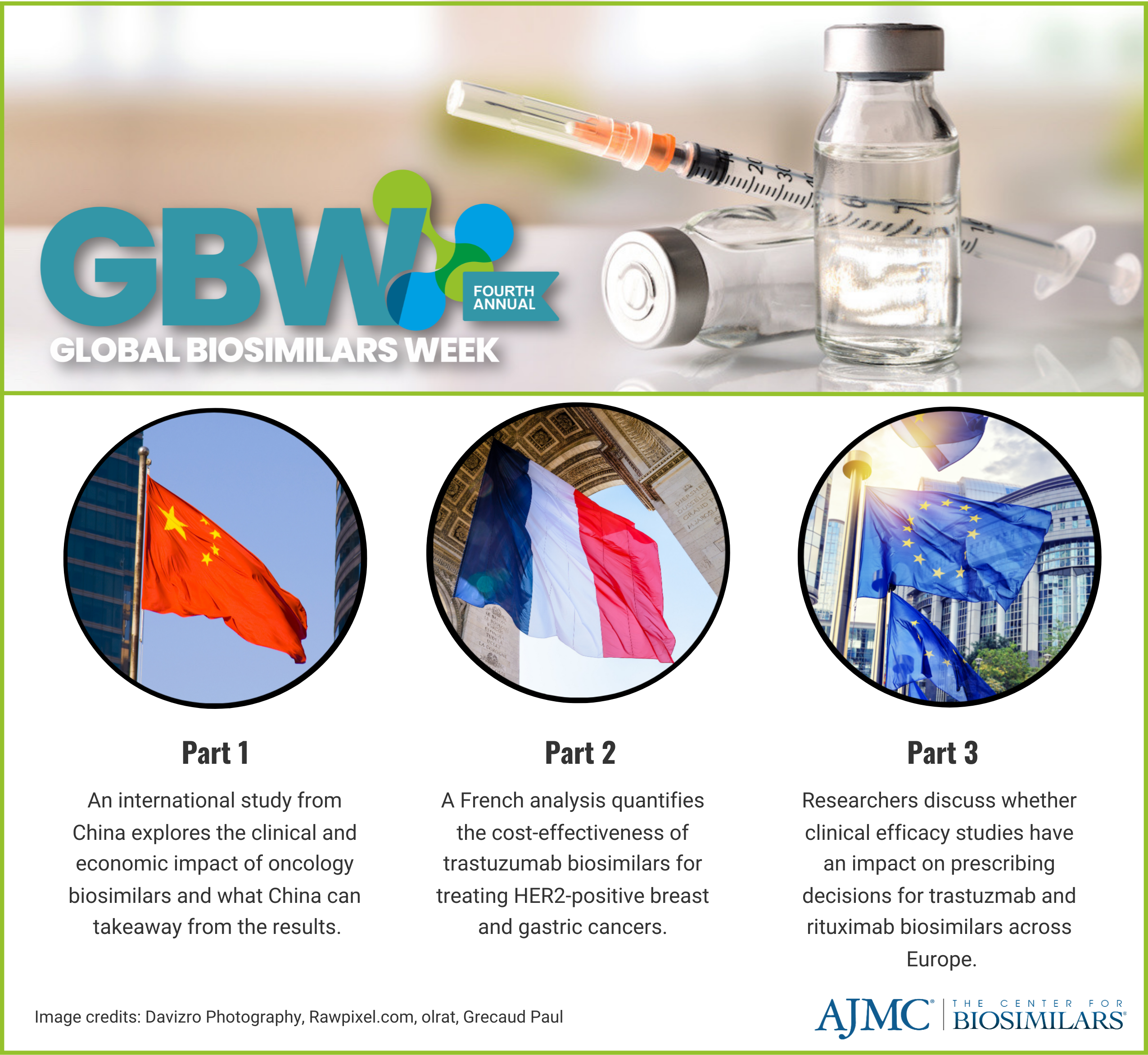

In part 1 of a 3-part series for Global Biosimilars Week, The Center for Biosimilars® looks at a retrospective study comparing the clinical benefits, price changes, and uptake associated with oncology biosimilars in China.

Click to enlarge.

In part 1 of a 3-part series for the fourth annual Global Biosimilars Week, The Center for Biosimilars® looks at a retrospective study comparing the clinical benefits, price changes, and uptake associated with oncology biosimilars in China.

Global Biosimilars Week is an awareness campaign created by the International Generic and Biosimilar Medicines Association. The event runs from November 13-17, 2023, and serves as a way to expand awareness of biosimilars, their clinical effects compared with originators, the economic impacts of using them, and the growing industry worldwide. To read part 2, click here. To read part 3, click here.

In the present international study, the authors conducted a systematic review and meta-analysis of randomized clinical trials and cohort studies to compare the clinical benefit, price changes, and uptake rates between cancer biosimilars and their respective reference drugs.

China has high morbidity and mortality rates for cancer, which have resulted in substantial economic burden. To the authors’ knowledge, there are 37 oncology biosimilars in development, and the National Medical Products Administration (NMPA), China’s FDA-equivalent agency responsible for drug approvals, has approved several bevacizumab, rituximab, and trastuzumab biosimilars. However, as the number of cancer biosimilar approvals increases, their clinical benefit, price, and uptake of these products are rarely reported in China.

Approvals for oncology biosimilars and their respective phase 3 comparative efficacy studies through February 1, 2023, were assessed using publicly available listing databases of the NMPA, FDA, European Medicines Agency, and Japan’s Pharmaceuticals and Medical Devices Agency. Prices and uptake figures were collected from a centralized procurement platform and the Pharnexcloud database module. Weighted average price and uptake rate were assessed from 2015 to 2022.

In total, 39 randomized controlled trials (RCT; n = 18,791 patients) and 10 cohort studies (n = 1998 patients) were analyzed. The studies came from Russia, the United Kingdom, the Republic of Korea, China, Ukraine, Iran, the United States, Poland, Japan, Mexico, Germany, India, France, Canada, and Spain. Nineteen studies assessed bevacizumab, 15 concerned rituximab, and 13 regarded trastuzumab.

Bevacizumab, rituximab, and trastuzumab biosimilars met equivalence margins with their reference products (Avastin, Rituxan, and Herceptin, respectively). The risk ratios—which were based on RCTs—for bevacizumab, rituximab, and trastuzumab products were 0.97 (95% CI, 0.93-1.01; P = .17), 1.03 (95% CI, 0.98-1.08; P = .70), and 1.04 (95% CI, 0.97-1.12; P = .29), respectively. Results from cohort studies were consistent with those from RCTs.

From 2015 to 2022, the prices of cancer biosimilars compared with reference drugs significantly decreased, with the estimated median wholesale acquisition price in 2022 being 74% for bevacizumab biosimilars, 69% for rituximab biosimilars, and 90% for trastuzumab biosimilars.

The uptake rates of these biosimilars increased over time, with bevacizumab having the highest uptake rates in the first and second years after launch of the first biosimilar (26% and 68%), followed by trastuzumab (20% and 47%) and rituximab (6% and 44%). In 2022, the uptake rates for these biosimilars were 83%, 74%, and 54%, respectively.

Some of the study limitations included reliance on abstracts for some trials, a lack of research on patient and physician preferences for biosimilars, limited access to data on biosimilars with quality issues, and a focus on primary efficacy endpoints without analyzing secondary endpoints like response duration.

“These biosimilars were considerably less expensive, which could have substantial implications for expanding access to treatment for patients with cancer. Our findings suggest that China should speed up its efforts to promote the use of biosimilars to benefit more patients with cancer,” the authors concluded.

Reference

Luo X, Du X, Li Z, et al. Clinical benefit, price, and uptake for cancer biosimilars vs reference drugs in China: A systematic review and meta-analysis. JAMA Netw Open. Published online October 12, 2023. doi:10.1001/jamanetworkopen.2023.37348

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.