- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Part 2: For Patients and Employers, 2023 Means a Changed Landscape

The second part of this 4-part series looks at what patients and employers can expect when adalimumab biosimilars hit the market.

Readers can also check out part 1, part 3, part 4, podcast 1, and podcast 2 now.

Starting in 2023, patients receiving therapy with Humira (adalimumab) will have several lower-cost options available. As the year unfolds, between 7 and 12 adalimumab biosimilars will launch on the US market, and all are slated to be priced at a significant discount to the originator.

However, there are many aspects of this competition that are still flying under the radar. Will these lower prices be offered to patients? Will patients be forced to switch therapies? Is switching from a reference product to a biosimilar safe? How will interchangeability influence prescribing habits? What role can employers play in ensuring patient satisfaction and substantial savings?

This month, The Center for Biosimilars® is looking at all aspects of what the launch of adalimumab biosimilars in the US market will mean for stakeholders, from lessons learned in other markets to the need to hear from providers who must decide whether to prescribe new products. This second installment in a 4-part series examines how the introduction of adalimumab biosimilars will impact patients and employers and the steps each group can take now to prepare.

Will Patients See Savings, and How Much Is Expected?

Projections show that adalimumab biosimilars could generate $19.3 billion in savings by 2025, a 50% share of the total amount of saving expected from biosimilars between 2021 and 2025. However, whether those savings will impact patients directly depends on a few things:

- Price discounts of biosimilars and reference products

- Co-payments and co-insurance

- Insurance coverage

As biosimilars enter the market, companies developing these competitors will have to set launch prices, which will likely be considerably lower than Humira. Additionally, AbbVie, the maker of Humira, will also have to determine whether to lower its price for Humira to compete against the biosimilars.

Overall, list price discounts for biosimilars average about 30% to 40% lower than the reference products. However, biosimilars in the US immunology space, such as those referencing Remicade (infliximab) tend to launch at a 19% to 25% discount from the reference product.

In Europe, where 10 adalimumab biosimilars compete against Humira, there’s more hope for biosimilar discounts. One analysis published by The Journal of Pharmaceutical Sciences showed that after the first quarter of 2020, when compared with the Humira’s list price 1 year before biosimilar market entry, adalimumab biosimilars averaged net price reductions from the reference product ranging from 15% to 29% in France to over 50% in Denmark, Germany, Hungary, Italy, Poland, and Sweden.1

Even more impressive, the threat of biosimilar competition has been enough to get AbbVie to lower its price for Humira up to 80% in some international markets.

However, for the first 6 months of biosimilar competition, Humira will only face 1 competitor, making it difficult to tell exactly how much of a price reduction biosimilars will cause in the long run. In July 2023, between 5 and 9 biosimilars are expected to launch. Many biosimilar companies will have less time to gauge the market to determine a launch price.

Additionally, AbbVie has been gradually raising the US price of Humira over the past few years, increasing its wholesale acquisition cost by 7.3% and its net price by 9.6% between 2019 and 2020.

Co-payments and coinsurance can be a tricky field to navigate because they are determined by health insurers, also known as payers. Co-payments, or co-pays, are fixed dollar amounts that patients pay for many prescription drugs and health services such as office visits, and often do not count toward a deductible. Coinsurance costs, which act as a cost sharing measure between patients and payers, are calculated as a percentage of the cost of some medicines and health services that patients must pay after they meet their deductible.

For Medicare beneficiaries, cost sharing gets even more complicated. For most, adalimumab would be covered under Part D, but some beneficiaries may be covered under Part C if they are enrolled in Medicare Advantage or even Part B if they receive treatment in a doctor’s office. Historically, cost sharing varies over the year as out-of-pocket spending hits certain benchmarks.

Assuming prices of adalimumab biosimilars and Humira are lower than the current prices of Humira, patients with plans using coinsurance will likely see lower out-of-pocket costs. Additionally, a report from the ERISA Industry Committee (ERIC), found that US patients who took a covered biosimilar over the reference product paid an average of 12% to 45% ($300 to $600) less out-of-pocket annually than those who took the reference product.

Although efforts have been made to cap co-pay costs for insulin, so far, they only apply to patients enrolled in Medicare Part D plans. The Inflation Reduction Act, signed August 16, 2022, creates a $2000 annual cap on out-of-pocket spending in Part D starting in 2025, although this provision awaits a rulemaking process. Again, this cap does not extend to commercial plans.

Some pharmaceutical companies may offer co-pay assistance programs that can help patients afford medicines and encourage them to maintain loyalty to their drug. However, patients should check with their insurance providers, as some may exclude co-pays paid through patient assistance programs or drug company-issued coupons from counting towards their deductible.2

Additionally, some insurance companies, such as Cigna, have implemented shared savings programs. Cigna, for example, offered patients a $500 debit card to switch to biosimilars. The program was designed to encourage patients to ask for biosimilar versions of expensive originators, saving both the patients and the plans money.

How Will Coverage Work? And Will There Be Changes?

Patients should be aware that their pharmaceutical coverage may change, meaning that patients currently on a therapeutic regimen with Humira may suddenly be given a biosimilar.

Coverage options are dictated by a pharmacy benefit manager (PBMs), a third-party entity that makes decisions on which drugs will be included on formulary lists and which preference tiers they fall on, which correspond with their level of coverage. As a result, every insurance plan may have a different list of adalimumab products that may be covered.

According to Vizient’s Pharmacy Market Outlook Report, plans will cover adalimumab products in 1 of 3 ways: preference for biosimilars, preference for the reference product, or coverage for the reference product and biosimilars at parity (no preference). Patients will not have much of a say in which strategies their plans will implement. Additionally, different plans may have different policies on whether to alert patients or their providers on coverage changes.

However, if patients see that their Humira prescription has changed to another adalimumab product, they should try not to worry. The FDA has some of the strictest guidelines in the world for approving a biosimilar, and every FDA-approved biosimilar has met the agency’s standards.

Multiple studies and reviews have demonstrated the safety of switching from a reference product to a biosimilar. Early studies have also shown that switching from a biosimilar to another biosimilar does not impact clinical outcomes. In many cases, if a patient does experience negative clinical outcomes from the result of a switch, they can talk to their doctor about switching back to the original product.

Employers and patients can also look at international experiences to see how switching from reference products to biosimilars has not disrupted clinical outcomes. Many European countries and Canadian provinces have experience with biosimilar switching, and clinical outcomes have not been compromised as a result.

If a patient wants to save money by using a biosimilar, they should talk with their physician to understand their options.

The Trouble With Interchangeability

As discussed in the first article in this series, interchangeability is a US regulatory designation that allows for reference products to be substituted at the pharmacy level without requiring permission from a physician prior to dispensing. The FDA awards this designation when companies submit data from switching studies, in which patients are switched back and forth between the biosimilar and the reference product several times to establish that switching is safe and doesn’t impact clinical outcomes.

Interchangeable biosimilars allow patients to have easier and accelerated access to lower-cost biologic drugs by alleviating prior authorization requirements; the designation prevents patients from waiting long periods for their biosimilar prescription to be approved.

An interchangeable biosimilar is not better or safer than a biosimilar without the designation. The clinical safety and effectiveness are the same. Interchangeability only impacts the requirements for pharmacists before dispensing a biosimilar to a patient.

Currently, 3 biosimilars have an interchangeability designation. Two have not entered the market yet, 1 of which is an adalimumab product. However, at least 5 more companies are seeking an interchangeable designation for their respective adalimumab biosimilars, signaling that more are expected to reach the market.

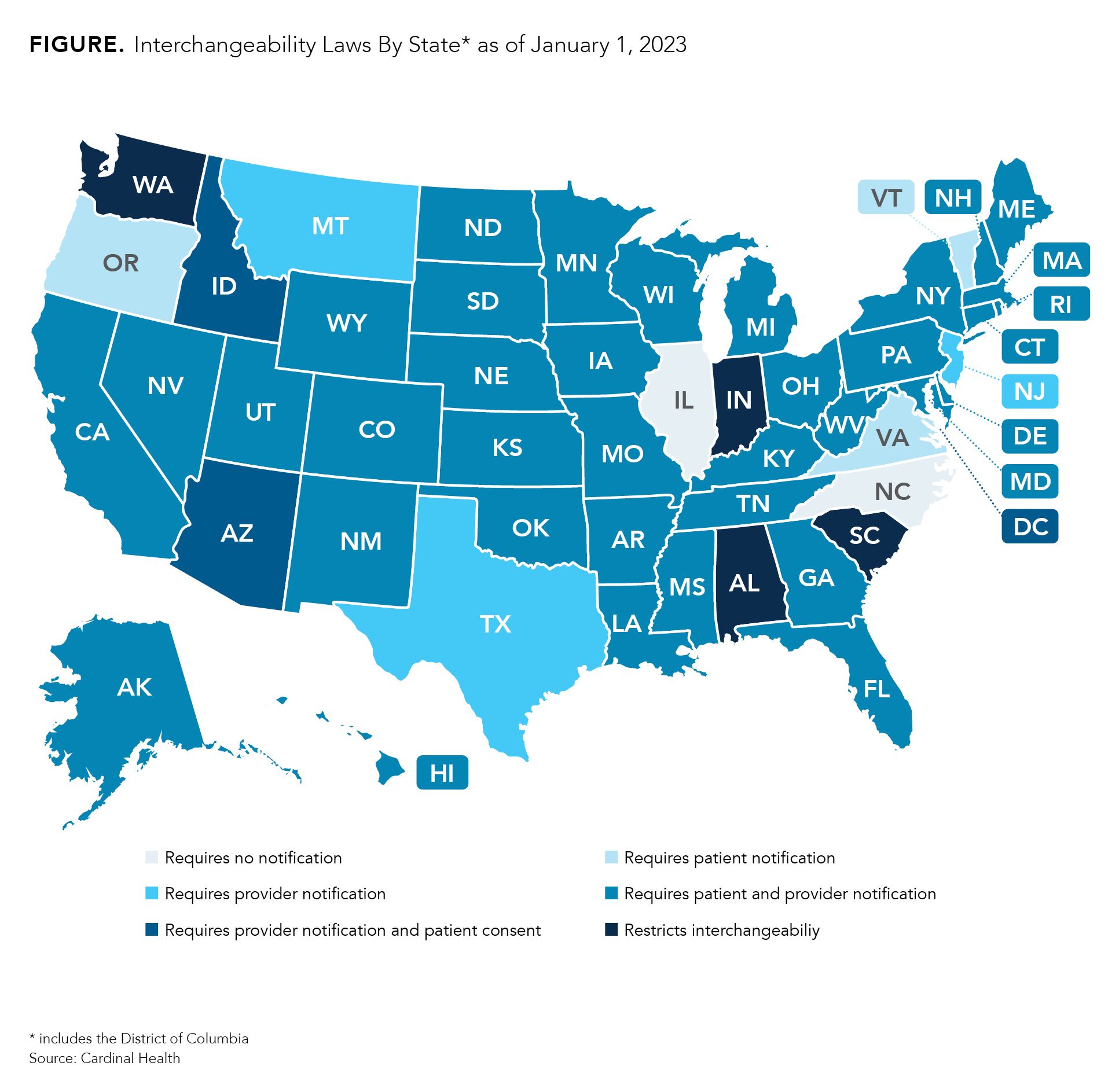

Although the United States doesn’t have much experience with interchangeable biosimilars, every state and the District of Columbia has implemented laws on interchangeability. Most states have passed legislation that requires pharmacists to notify providers and/or patients that an interchangeable biosimilar is substituting for the reference product listed on the prescription (Figure). Every state gives physicians the power to deny substitutions. Many allow for providers to write “dispense as written” or “brand medically necessary” on the prescription.

However, 4 states (South Carolina, Indiana, Alabama, and Washington) have laws that restrict interchangeability, meaning that every prescription must be approved by a physician prior to dispensing regardless of whether the FDA has deemed the product to be interchangeable. Providers may indicate on prescriptions that substitutions are permitted.

Additionally, the laws in Mississippi and Idaho for alerting patients and providers are expected to expire July 1, 2026, and July 1, 2025, respectively. So far, there is no sign that a law will be passed as a replacement.

Those who wish to know more about the specific language in the laws from their state can visit Cardinal Health’s Interchangeability Laws By State report.3

How Much Can Employers Save and What Can They Do?

Self-insured companies could have saved $407 million in 2018 had they completely ceased use of Remicade (reference infliximab) and Neupogen (reference filgrastim) in favor of biosimilars. Ford Motor has already saved $5 million by switching patients to 5 biosimilars.

Despite how much power PBMs and other health care entities have over coverage options, employers have more power than they realize.

“If we look at the way the health insurance markets are today, they're driven by the employers…. As large employers switch, you have that double effect of one; they're moving a large population toward more-affordable drugs—that is a beneficial impact—but [you also have] the secondary impacts of news stories that come from it and the awareness that those drive other large, as well as smaller, payers towards embracing biosimilars,” said Wayne Winegarden, PhD, senior fellow in business and economics at the Pacific Research Institute (PRI), director of PRI’s Center for Medical Economics and Innovation, and a member of The Center for Biosimilars®’s Advisory Board, in an interview.

Already, large employers and benefit funds, such as CalPERS, Costco, and Disney, have analyzed how much they were paying for biologic drugs, negotiated with their payers, and have worked hard to drive more patient use of biosimilars and generate savings.

Employers can advocate for policy changes that promote biosimilar use by contacting federal and state legislators to encourage them to support biosimilars legislation, such as the Biosimilars User Fee Amendments of 2022 among others.

In February 2022, the National Alliance of Healthcare Purchaser Coalitions outlined several steps that employers can take to get biosimilars on formulary and improve employee satisfaction. They include:

- Creating an additional tier or preferred reimbursement for biosimilars and reference products or adding biosimilars to the branded tier without having to change cost-sharing or co-pay models

- Ending relationships with PBMs and payers that have spread misconceptions about biosimilars being more expensive and less safe than reference products and search for those that are more transparent

- Include all biosimilars on formulary and offer incentives for their use over reference products

- Explore a precision-medicine model to help patients receive the right treatment on the first try

Employers may need to be persistent during negotiations, as many biosimilars may be on the medical benefit; this may require more preparatory work to ensure that cost share is lower or nonexistent.

Overall, employers spend around 40% to 50% of their health care costs on specialty medications, including adalimumab. Employers can also work with employer support organizations, such as Employers Health, which helps employers oversee pharmacy plan performance and secure health benefits that can help patients and save them money.

References

- Coghlan J, He H, Schwendeman AS. Overview of Humira® biosimilars: current European landscape and future implications. J Pharm Sci. 2021;110(4):1572-1582. doi:10.1016/j.xphs.2021.02.003

- Parekh KD, Wong WB, Zullig LL. Impact of Co-pay Assistance on Patient, Clinical, and Economic Outcomes. Am J Manag Care. 2022;28(5):e189-e197. doi:10.37765/ajmc.2022.89151

- Biosimilar interchangeability laws by state. Cardinal Health. Updated July 2021. Accessed August 5, 2021. https://www.cardinalhealth.com/content/dam/corp/web/documents/publication/Cardinal-Health-Biosimilar-Interchangeability-Laws-by-State.pdf

FOR MORE:

Part 1: Biosimilars to Bring a Bumper Crop of Adalimumab Options

Podcast 1: What Will Year 1 Look Like for Adalimumab Biosimilars?

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.