- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Report: Specialty Drug Cost Increase Eased a Little in 2020

A report from Artemetrx details 2020 changes in demand for biosimilars and other specialty drugs, according to health plan spending. Dynamics that could affect future spending are also explained.

Specialty drug spending grew at a slower pace from 2019 to 2020, marking the first time in 5 years that the trend of rising specialty drug costs moderated, according to a report from Artemetrx.

The report said the slower increase in specialty drug spending was likely due to delayed or deferred diagnostic care during the COVID-19 pandemic, increased biosimilar use, and the availability of more generic products.

“On a per-member-per-year basis [PMPY], specialty drugs across both the medical and pharmacy benefits spectrum averaged $959 [in 2020, up 11.8%], an average increase of $101 compared with an increase of $111 in the prior year,” according to the report.

However, the report’s authors said specialty spending varied widely by plan sponsor, ranging from $587 to $1065 PMPY.

Between 2019 and 2020, there was no increase in the percentage of plan members using specialty drugs. This rate, representing the percentage of members taking at least 1 specialty drug, stayed level at 4% for both years. In 2018, the rate stood at 3.7%.

Authors of the report noted that specialty drug costs can quickly escalate if the percentage of specialty drug users increases. An increase of 0.1% can result in a $2.4 million overall spending increase, based on a population of 100,000 plan members.

Although there was no increase in the percentage of specialty drug users, there was an increase in the number of specialty drug claims per user: 5.2 claims in 2020 vs 4.8 claims in 2019. This represented an 8.3% increase.

“Increases in the number of specialty drug utilizers and the average number of specialty claims per utilizer could result in an exponential trend in the coming years,” authors of the report said.

As the pandemic raged in 2020, the number of claims for home infusion treatment spiked, they said. The increase was 8.8% for the year, but there was unevenness during 2020, and the highwater mark was an 18.3% spike in home infusion claims in the second quarter of 2020. The low was in the first quarter, when home infusion claims rose just 3.1%.

The report noted significantly higher average costs per claim for specialty drugs administered in the outpatient hospital setting vs home infusion or the physician’s office, with the physician office being the most economical venue.

The outpatient hospital annual cost for infliximab (Remicade) was $94,525 and for pegfilgrastim (Neulasta), $109,825. The comparable costs for the home infusion vs physician office settings were $54,222 and $72,317 vs $48,844 and $61,103, respectively. Remicade and Neulasta are originator products and are generally considered more costly than biosimilar forms of infliximab and pegfilgrastim.

“The average plan could save between $77,811 and $94,403 by shifting these 2 medications from outpatient hospitals to home infusion or physician office sites of care,” the authors said.

The report anticipated a continuing increase in specialty drug spending PMPY over the next 2 years of about $100 or slightly above each year. The authors anticipated “low double-digit” year-over-year increases, which they said would likely be prompted by increased drug use and offset by cost management efforts, more use of biosimilars, and a trend toward greater use of the pharmacy drug channel. New products expected to reach market will also contribute to this effect, the authors predicted.

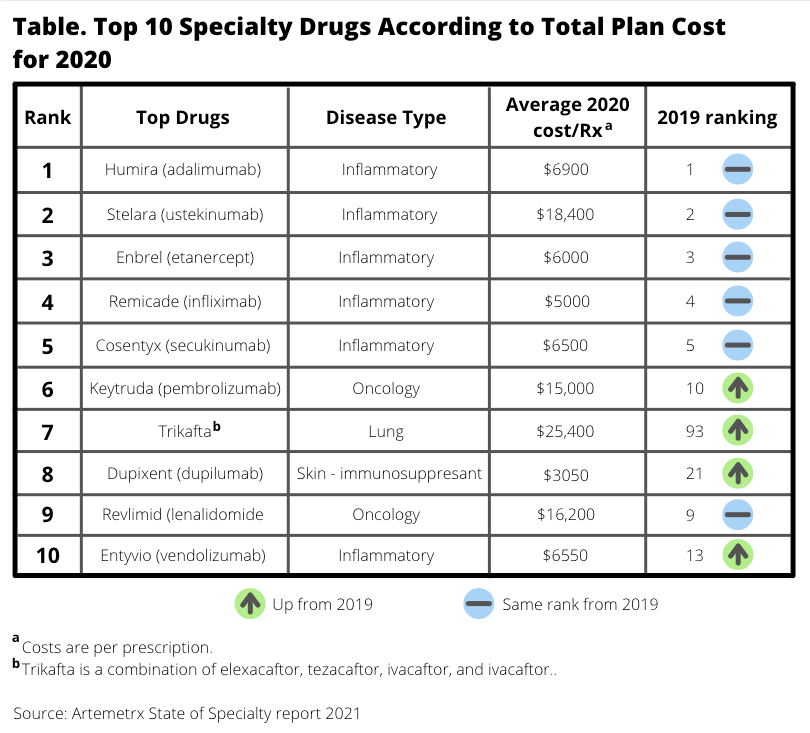

In terms of 2020 specialty drug spending, the following categories of drugs were at the top of the list (Table):

- Inflammatory disorders, 35%

- Oncology, 24%

- Multiple sclerosis, 8%

For every plan member who shifts to a biosimilar for inflammatory disorders, the potential annual savings is $9973, the report said.

Biosimilar Market Share Gains

Biosimilars are taking a lot of market share from originator drugs, the authors said. For example, claims for the originator product Neulasta dropped roughly 35% from 2018 to 2020. Claims for Herceptin, the originator trastuzumab product, have dropped 40%, the study said.

Steep, but less impressive, biosimilar gains were seen in the bevacizumab, rituximab, and infliximab markets.

Infliximab biosimilars represented just 18% of infliximab claims in 2020, “but the downward effect on average sales price [ASP] is apparent. Since January 2019, the ASP per unit for Remicade has declined from nearly $75 per unit to $45 per unit at the close of 2020.”

Per-unit costs of Neulasta, an originator product, declined from $4500 in January 2019 to under $3500 in December 2020, a reflection of an increasing number of biosimilar options in this market.

The authors of the report modeled the potential savings in inflammatory disorders and oncology for patients receiving biosimilars, and they found the reduced cost would be significant.

“For a plan with 100 members taking infliximab, shifting 20% of members to a biosimilar would save nearly $200,000 per year, and shifting 50% of members would save nearly $500,000 dollars,” they said. The comparable savings for shifting 20% of 100 patients to pegfilgrastim biosimilar would be $87,780 and $219,450, respectively.

In some cases, manufacturer rebates for reference product use are highly competitive with rebates offered for biosimilars. The report said Remicade rebates averaged $9, which is within the rebate range for Inflectra, Renflexis, and Avsola ($10, $9, and $6, respectively).

Rebates for the originator pegfilgrastim Neulasta were $431, vastly higher than available for Udenyca, Fulphila, and Ziextenzo ($19, $70, and $45, respectively).

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.