- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Samsung Bioepis Report Proves Lower Biosimilar Prices Correlate With Greater Market Share

The second edition of Samsung Bioepis’ Biosimilar Market Report shows strong correlation between biosimilar usage and decreased drug prices, proving that biosimilars are delivering on the promise of savings and price erosion.

The second installment of Samsung Bioepis’ Biosimilar Market Report highlight the success of biosimilar competition, finding a strong correlation between increased market share for biosimilars and dwindling average sales prices (ASPs).

The report sought to update stakeholders on biosimilar market trends and provide an up-to-date perspective on the US biosimilar industry. Future installments of the report consist of comprehensive pricing updates and market penetration for biosimilars in the United States. The first edition of the report was published in April 2023.

“So far in 2023, we have seen the start of biosimilars being launched within pharmacy benefits. This is the start of new beginning for biosimilars in the United States….,” said Tom Newcomer, vice president, head of market access, US, at Samsung Bioepis. "We hope Samsung Bioepis Biosimilar Market Report brings value to healthcare stakeholders involved in the decision-making process, providing an up-to-date perspective on the US biosimilar landscape."

The report commenced with an overview of the market, quantifying the number of FDA-approved biosimilars (n = 41) and launched products (n = 37). Throughout 2023, 10 biosimilars have entered the market (1 bevacizumab, 1 pegfilgrastim, and 8 adalimumab), 7 of which launched during the first week of July. One adalimumab is awaiting launch and is expected later in July 2023.

On average, biosimilars have gained 53% market share in 3 years post initial launch. Biosimilar competition has also led to a 41% decline in ASP over the first 3 years post first biosimilar launch.

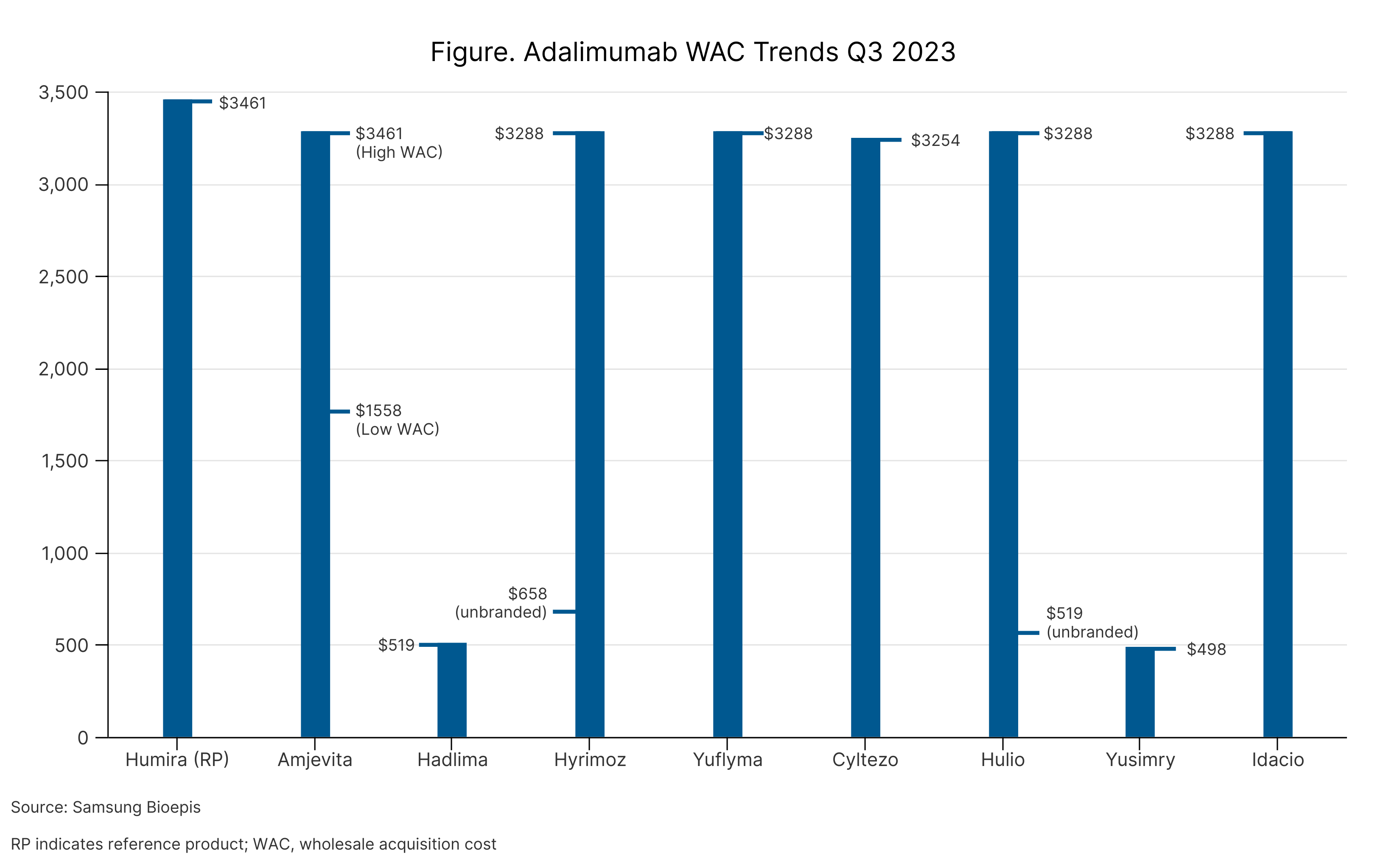

The wholesale acquisition costs (WAC) for the oncology, supportive care, and immunology and ophthalmology categories have seen modest discounts for the third quarter of 2023, ranging from 10% to 25%, 18% to 59%, and 19% to 59%, respectively.

Discounts in the immunology and endocrinology space were harder to calculate, as several products in this space have multiple WAC prices.

The insulin glargine and adalimumab markets took into account products that are deemed unbranded biologics. These products are either drugs that are marketed using the nonproprietary name (unbranded Hulio, unbranded Hyrimoz, unbranded Semglee, unbranded Lantus) or drugs that by definition are biosimilars, but since they were approved prior to the creation of the biosimilars approval pathway, they cannot legally be classified as biosimilars (Basaglar, Toujeo, Granix).

Unbranded biologics can offer companies an avenue to expand access to their products by allowing the branded version to be priced closer to the originator, making it more enticing for pharmacy benefit managers to add the product to formulary lists, and for unbranded versions to have steep discounts, making it more accessible for patients who do not have insurance.

Among the adalimumab biosimilars on the market, 3 have a dual WAC price strategy, whereby one version is priced 5% below the originator (Humira) and the other is priced 55% to 86% lower (Table). Unbranded Lantus (reference insulin glargine) is priced 61% lower than branded Lantus; and branded and unbranded Semglee (insulin glargine biosimilar) are priced 8% and 66% lower than branded Lantus, respectively.

Adalimumab WAC Trends Q3 2023

By treatment space, the oncology sector (trastuzumab, bevacizumab, rituximab) has the steepest correlation between increased market share and ASP discounts, followed by supportive care (filgrastim, pegfilgrastim, epoetin alfa) and immunology (infliximab).

The average ASP of all products and how much prices have eroded since the initial introduction of biosimilars to the market (%) are listed below:

- Trastuzumab: $1471 (–65%)

- Bevacizumab: $1819 (–41%)

- Rituxan: $2125 (–52%)

- Filgrastim: $211 (–53%)

- Pegfilgrastim: $1226 (–77%)

- Remicade: $266 (–66%)

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.

259 Prospect Plains Rd, Bldg H,

Cranbury, NJ 08512

All rights reserved.