- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

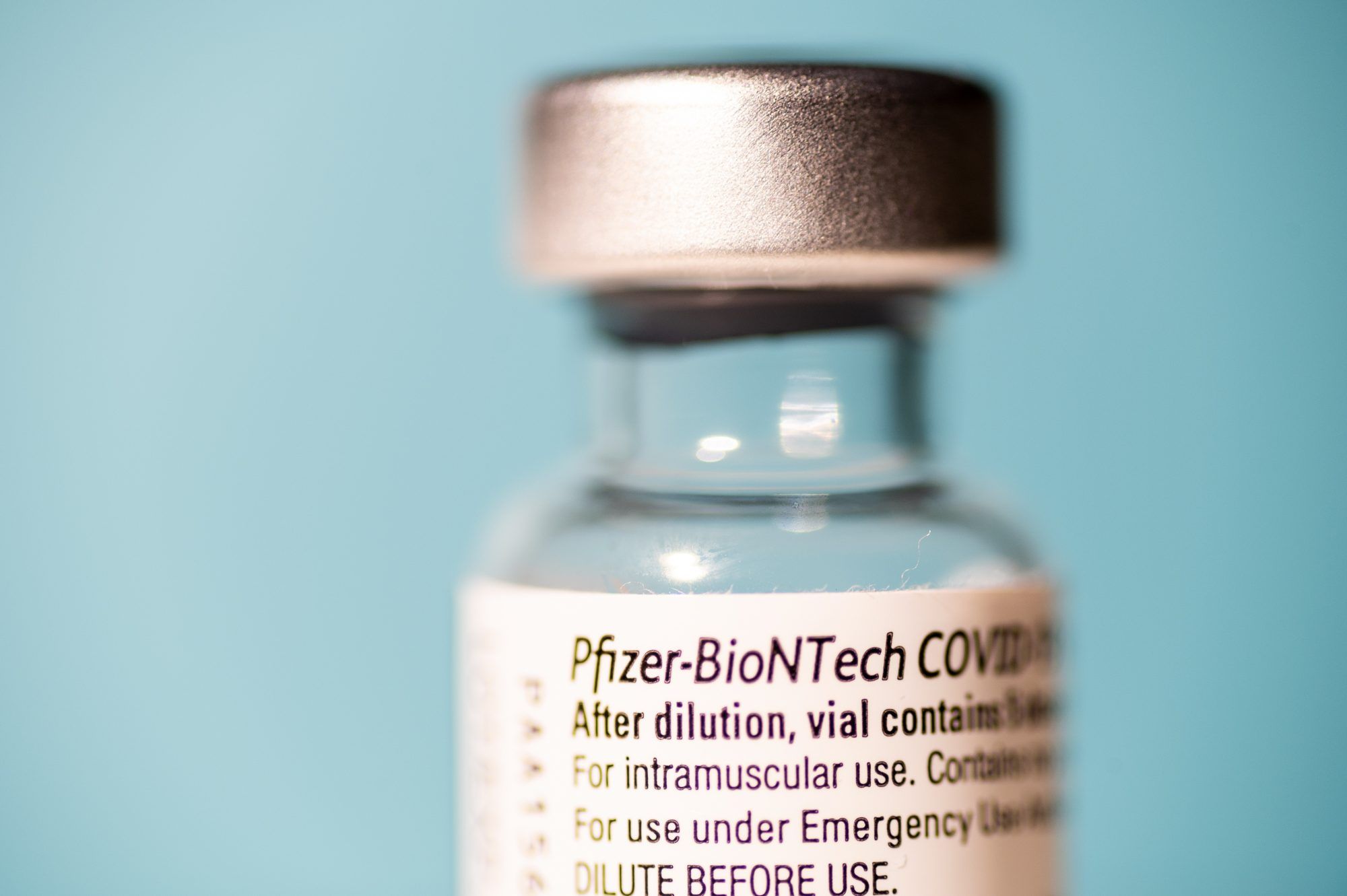

Small Step for Pfizer's Biosimilars; Leap for Its COVID-19 Vaccine

Pfizer reported strong sales for its biosimilars portfolio, but these were eclipsed by the massive success of the company's mRNA vaccine for COVID-19.

Pfizer reported second-quarter 2021 biosimilar revenues up 88% from the comparable second quarter of 2020. These were dwarfed, however, by sales of the Pfizer-BioNTech COVID-19 vaccine.

Biosimilar sales for the second quarter of 2021 were $559 million globally, primarily fueled by the launches of bevacizumab (Zirabev), rituximab (Ruxience), and trastuzumab (Trazimera) biosimilars.

The company also reported ongoing growth in sales of its epoetin alfa biosimilar (Retacrit) in the United States. Retacrit was launched in 2018 and remains the only epoetin biosimilar in the United States.

Pfizer also reported a 19% decline in global sales of its etanercept originator product (Enbrel) owing to biosimilar competition in Europe and Japan. Enbrel does not yet face biosimilar competition in the United States.

Although growth in biosimilar sales at Pfizer has been robust over the past year, the company’s core business focus is now commercialization of its mRNA COVID-19 vaccine (BNT162b2) and regulatory interaction globally to broaden access and flexibility for use of this product.

Pfizer said it anticipates 2021 revenues of $33.5 billion for BNT162b2, which reflects 2.1 billion doses that Pfizer had contracted to deliver as of mid-July 2021. The company reported overall second quarter 2021 revenues of $19 billion, up 86% from the comparable 2020 quarter.

Without the COVID-19 vaccine, Pfizer’s revenues would have climbed just 10% overall, to $11.1 billion, the company said.

For a report on the company’s first quarter 2021 revenues, click here.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.