- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Specialty Biologics Report Predicts Rise in Biosimilar Access

The report from CoverMyMeds, a division of McKesson, discusses payer/pharmacy benefit manager consolidation, patient adherence, white bagging, and other issues common to specialty pharma.

An additional 1.2 million patients could benefit from biosimilars by 2025, according to a specialty pharmacy report by CoverMyMeds, a division of McKesson. “The rise of more affordable biosimilars could help more patients access biologic therapies, saving them roughly 30% off the cost of medications, with higher discounts possible,” the report states.

Biosimilars are approved by the FDA as being highly similar to their reference biologics with no clinically meaningful differences in safety or efficacy. There are 31 approved biosimilars in the United States; thus far, 21 have been launched to market.

But improved access to these agents depends on the actions of payers and pharmacy benefit managers, the report states, and these entities “have shown inconsistent favorability of biosimilars over reference biologics.”

In the marketing of biologics, much depends on the rebates and discounts offered by manufacturers, and transparency in true pricing is often lacking, so the actual cost of reference products may be lower than for biosimilars. Nevertheless, biosimilars have been making strong inroads into the markets once dominated exclusively by originator biologics.

Specialty drugs are loosely defined as complex drugs with complex administration and high costs. Among these agents, biologics, which are made from live organisms, have seen a 14.6% compound annual growth rate over the past 5 years, more than double the rate for the overall drug market, according to the CoverMyMeds report.

Per-capita spending on specialty drugs has grown from $285 to $572 from 2010 to 2020, it said.

Specialty meds are expected to increase in number, given the rise of new technologies, such as CRISPR (clustered regularly interspaced short palindromic repeats), a gene-editing technology, which is increasing hope for treatments for diseases that been impervious to attempts to cure them.

Home-Administered Agents

A trend that received impetus during the rise of COVID-19 is home-administered treatment with specialty drugs, the report states. “Many patients who received provider-administered drugs in hospitals or facilities have shifted to self-administered oral, patient-injectable, or home infusion drugs” during the pandemic, and “Many payers relaxed restrictions on home infusions to allow specialty patients improved access to their medications.”

The report estimates that 84% of health system specialty pharmacies have or are creating infrastructure or support for patient education and self-administration.”

The report describes a sharp upward trend in “white bagging,” which is when medications are delivered from pharmacies to providers’ offices for administration to patients. “In the last year, some major commercial payers have imposed policies requiring health systems and offices to go through narrow specialty pharmacy networks rather than health system pharmacies.” The report states that the practice of white bagging increased roughly 70% from 2010 to 2018 and now represents close to a 40% share of in-office provider-administered therapy.

The downside of white bagging is that it can result in “up to 20% of drugs wasted by the time drugs arrive due to variables such as a change in therapy or shifts due to palliative care,” the report said.

Brown bagging—giving the patient the drugs to take to the provider’s office—occupies a negligible share in this proportional survey, and buy-and-bill now represents close to 58% of in-office provider-administered therapy. Buy-and-bill is when the physician orders and stocks the drugs for direct administration to the patient. Claims for reimbursement are submitted to third-party payers after patient treatment.

The mergers among payers and pharmacies in the health care sector have created benefits and disadvantages, the report said. These conglomerates are as complex as they are opaque, and they exercise enormous control over pricing and patient access. “While patients under these payers may have little choice in their pharmacy or site of care, they are offered discounts on medications and treatments.”

Access problems are not limited to the rising costs of specialty drugs, the report said (Provider Figure). “Diagnosing a patient with a condition that requires specialty therapy can be quite a feat on its own,” and before prescribing and treating, providers must study patients’ medical history and navigate the often-tortuous process of obtaining prior authorization from payers. “This is a nonlinear process, with many back-and-forth communications among providers, hub services, patients, payers, and specialty pharmacies.”

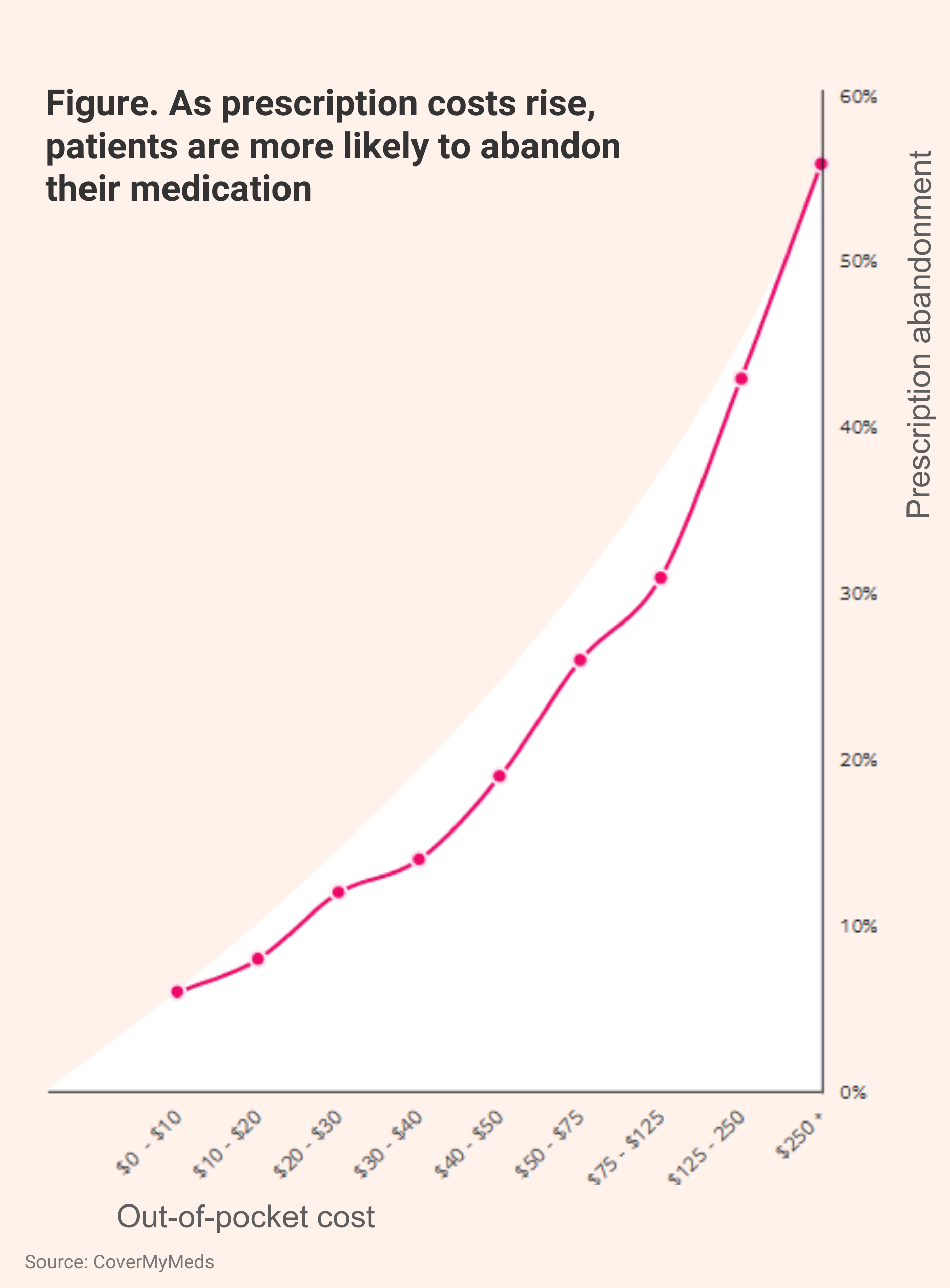

Ultimately, patients may abandon specialty therapies if the price is too high for them. The report stated that out-of-pocket costs that exceed $50 translate to 31.2% and 27.6% rates of commercial- and Medicare Part D–covered patients abandoning treatment, respectively (Abandonment Figure).

When the out-of-pocket cost is $250 or higher, the abandonment rate climbs to 56%, the report said.

A recently-created interactive tool from Biosimilars Forum predicted that the United States could save $14 billion annually if biosimilars achieve a 75% share of the market for the drugs they reference. The tool enables users to estimate savings by state.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.