Delayed adalimumab biosimilar availability resulted in important forgone savings to Medicare that could have been allocated to other health services, highlighting the need for patent reform and legal changes to facilitate biosimilar availability in the United States

- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Study: Medicare's Lost Savings Due to Delayed Adalimumab Biosimilar Entry

Medicare lost out on over $2 billion in savings as adalimumab biosimilars were sidelined by patent restrictions, said investigators who recommended patent reforms.

Medicare would have saved $2.19 billion on adalimumab spending between 2016 and 2019 had biosimilars become available in the years they were approved, according to investigators who identified patent obstacles as the cause.

They made comparisons with the European Union system for biosimilar introduction and suggested various legislative reforms that would improve access to biosimilars in the United States.

“Delayed adalimumab biosimilar availability resulted in important forgone savings to Medicare that could have been allocated to other health services, highlighting the need for patent reform and legal changes to facilitate biosimilar availability in the United States,” authors of the study wrote.

During the study period, 5 adalimumab biosimilars were approved by the FDA. None will be marketed before 2023 owing to patent settlements with AbbVie, the adalimumab (Humira) originator company. “Although the main active ingredient patent in the United States expired in December 2016, AbbVie obtained over 100 additional US patents on the drug, ranging from manufacturing processes to new formulations,” the authors wrote.

In calculating the savings to Medicare, the authors assumed that the first biosimilar (Amjevita) would launch with a 25% price discount relative to Humira, with an additional 3.4% price discount per year. They assumed that each successive adalimumab biosimilar would result in a further 1.7% price discount upon market entry. They based those assumptions on a study of biosimilar launch prices in the European Union.

They assumed that by 2019 the 5 approved adalimumab biosimilars (through 2019) would have achieved a 42.9% price discount relative to Humira. They also assumed that the presence of the biosimilars in the marketplace would cause the Humira price to drop 3.5% each year, resulting in a 21.3% lower Humira price by December 2019.

Actual Medicare payments for Humira products from 2016 to 2019 increased from $1.75 billion in 2016 to $2.47 billion in 2019. This was owing to price increases by AbbVie as well as an increase in the units of product sold, according to the authors. During the 4-year period, net prices per unit, which included syringe and pen formulations of adalimumab, increased from $1571 to $1752.

“Had adalimumab biosimilar products launched immediately upon approval, estimated Medicare nonrebate spending on them would have been $18.3 million in 2016, $225.7 million in 2017, $436.2 million in 2018, and $727.7 million in 2019,” they wrote.

During that same time, Medicare nonrebate Humira spending would have declined from $2.33 billion to $1.42 billion annually, they said.

Under their scenario of earlier biosimilar introduction, cumulative Medicare spending on adalimumab from 2016 to 2019 would have been $8.98 billion instead of $12.11 billion.

“Conservative Estimates”

“Our estimates were likely conservative,” the authors wrote. They expected US adalimumab biosimilars to capture 46% of the US market by 3 years after first launch. But in the United Kingdom, adalimumab biosimilars captured over 63% of the market within 6 months after first launch and over 50% of the German market 1 year after first launch.

They also estimated that US biosimilar competition would drive down Humira prices 21.3% by December 2019, but in some EU countries, adalimumab biosimilars have driven down Humira costs by 80% of prebiosimilar pricing. “These observations suggest that even greater savings than calculated in our study may have been possible from timely adalimumab biosimilar entry in the United States.”

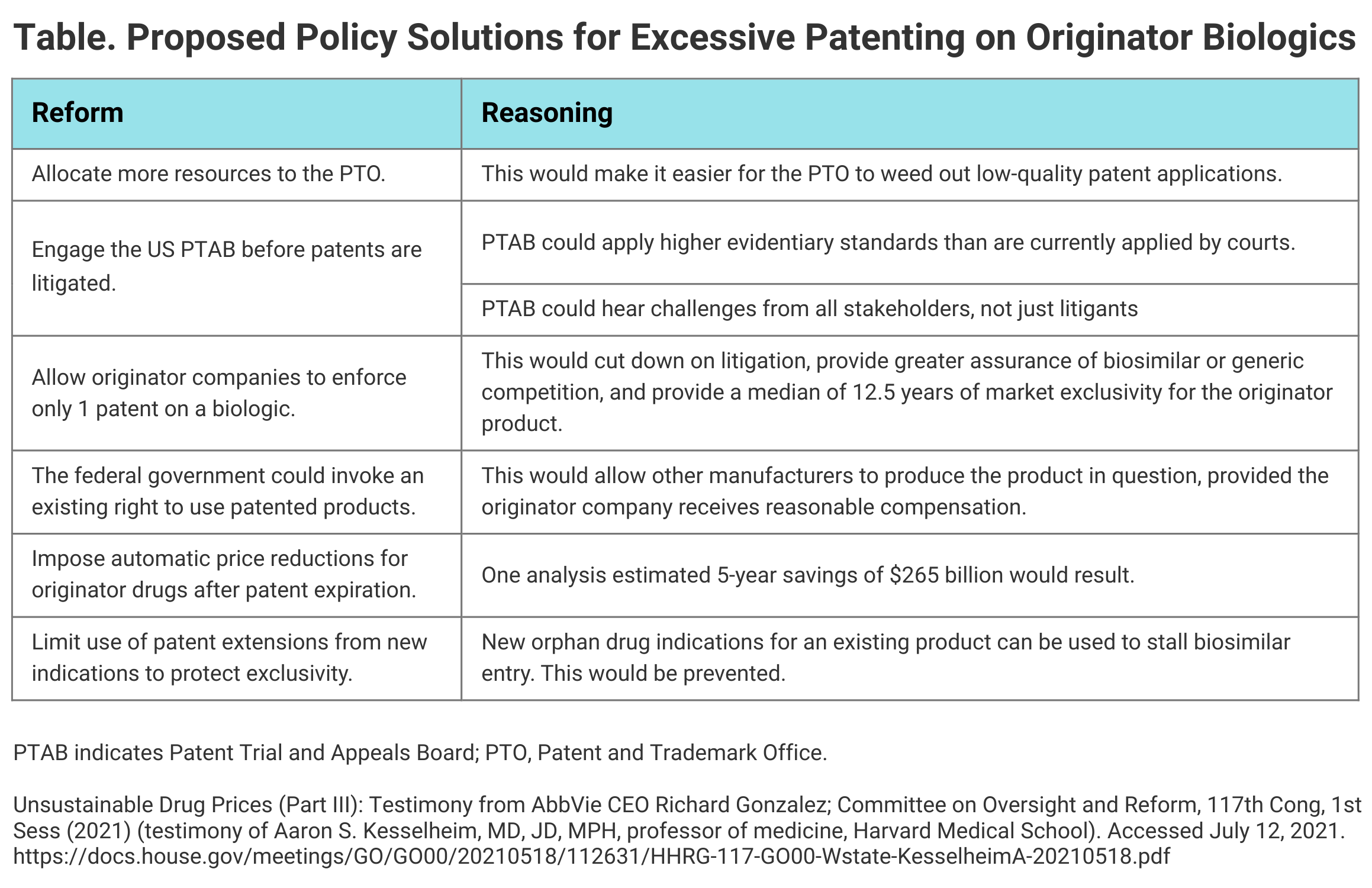

The authors offered support for various reforms that would remove patent obstacles, such as a proposal for allowing originator products exclusivity protection for just 1 key patent filed before FDA approval (Table). “Alternatively, manufacturers could be free to secure any number of patents on their product but to claim infringement on only a few,” they wrote.

Click to enlarge.

They also recommended strengthening of antitrust laws, noting that California has tightened up allowances for settlements between originator companies and biosimilar developers. This law has a stronger presumption of anticompetitiveness where transfers of value between originator companies and generic or biosimilar companies are involved.

The authors concluded that the loss of the potential $2.19 billion in savings from 2016 to 2019 from adalimumab biosimilars was costly in that those savings might have expanded access to “commonly underfunded services, such as preventive, behavioral, and hospice care.”

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.