- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Study: Rival Drugs Drive Up Costs

"Shocked" by the threat of competition, originator manufacturers start raising prices long before rival products appear on the scene, investigators found.

The movement of potential rival products through clinical trial stages and toward new drug application (NDA) filings represents a series of “pipeline shocks” that cause originators to raise their prices, according to investigators who studied how brand prices behave as competitor products get closer to market.

Furthermore, there’s not much incentive for rival producers to enter market at significant discounts because not only do payers automatically cover approved drugs, but also fixed co-pays for tiered medicines tend to muffle the effect of price increases for patients, authors of the study wrote.

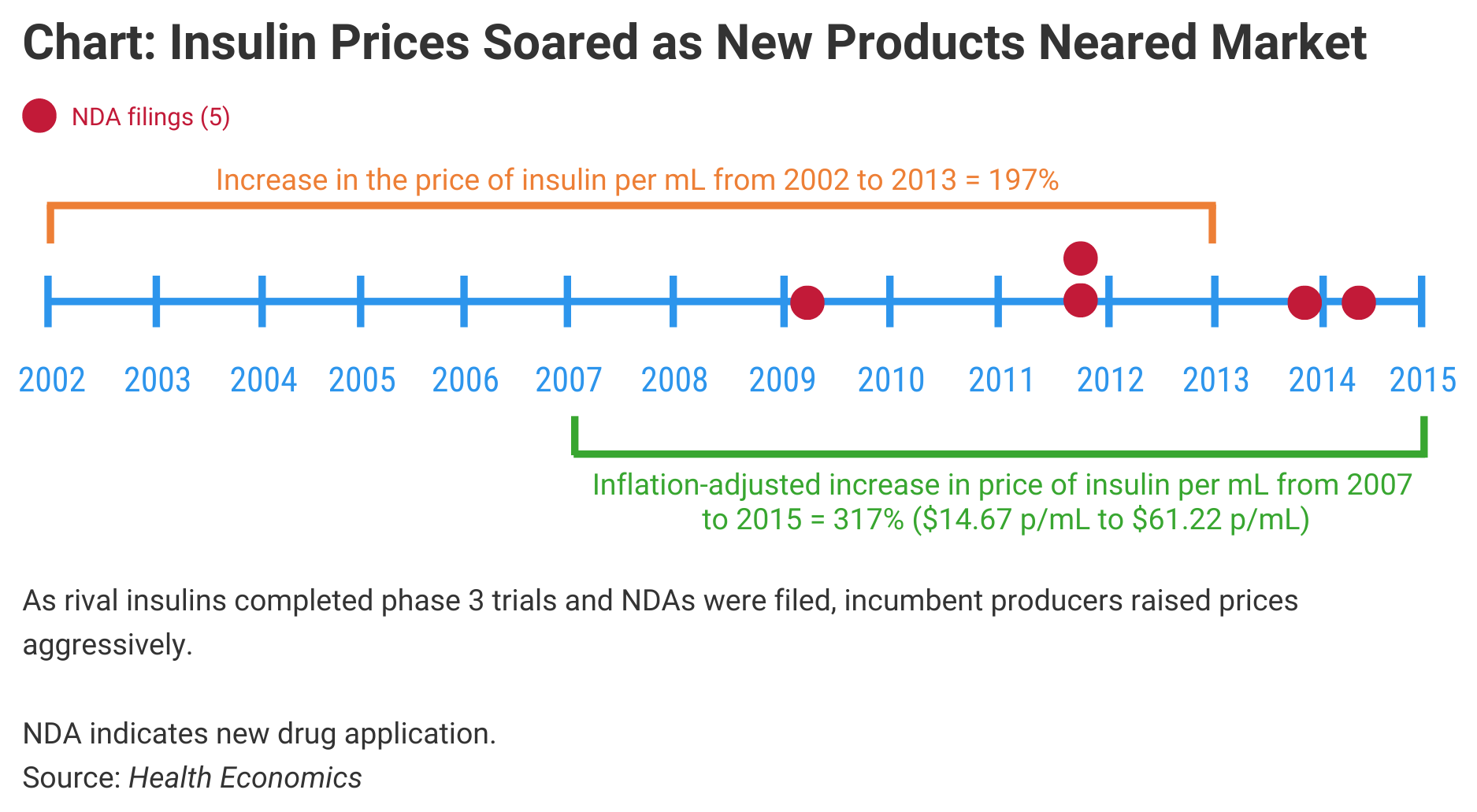

The significance is that it may take multiple competitors in a single drug category before the competitive pressure causes prices to decline. The investigators charted the pricing of insulins, primarily, and observed dramatic price increases in originator products prior to the arrival of competitors (Chart). They also noted steep price increases in products that are likely to face biosimilar competition soon, such as Enbrel (etanercept) and Humira (adalimumab).

Click to enlarge.

The authors called this increasing price phenomenon a “new” paradox of pharmaceutical pricing. Previously, the pharmaceutical industry has been known for the “prescription drug paradox,” which holds that when generics enter market, originator brands lose market share and raise prices of their brands to compensate for the lost income. Although brands might lose additional market share by raising prices, many consumers stay loyal to brands and eschew generics.

In their study of originator pricing, the authors found that as potential rival products moved through early stage trials, the connection between price increases and product development was negligible, most likely because in earlier stages of development, it’s still unclear that drug products will eventually receive FDA approval and incumbent drug producers aren’t as worried about competition. But for those potential rival drug candidates completing phase 3 trials and with NDAs in the offing, the pricing effect is quite strong.

“The competition risk facing an incumbent depends on successful completion of trials by potential entrants, not the initiation of trials,” the authors wrote.

Competition Risk

Competition risk varies depending on whether the potential rival is likely to be a new brand with a different formulation or a copy of the incumbent brand. For new product rivals, the chances of successfully completing trials are considerably worse, the authors wrote. The likelihood of moving from a phase 2 trial to phase 3 is just 35.5%, whereas the chance of succeeding with phase 3 trials ranges from 55% to 64%. “Thus, the credibility of the threat of entry increases considerably once a drug successfully clears phase 3,” the authors wrote.

A succession of 2 late-stage pipeline shocks added roughly $58 to the monthly insulin cost for a patient taking about 12.48 mL of insulin, the authors said.

One problem with the current pricing system is that insurers pay so much of the price of biologics and generics that they undermine price competition, they said. This removes the incentive for new market entrants to offer significant discounts from the originator product. At the same time, incumbent manufacturers anticipate this pricing behavior from new rivals and are incentivized to raise their prices to offset revenue loss from the arrival of a competitor drug, the authors said. Even if payers downgrade the preferred tier status for the originator drug, patients may see only small changes to their out-of-pocket payment requirements, which softens the incentive for them to change drugs.

Insulin biosimilars are now approved under the Biologics Price Competition and Innovation Act, although none have been approved since this regulatory pathway was instituted for them early in 2020. The authors studied pipeline shocks from insulin product advances before this pathway was established and observed that insulin prices per mL increased despite the development, approval, and launch of competitors to dominant brands. Similarly, patient out-of-pocket costs for insulin increased 56% from 2007 to 2015, although patient costs as a share of total insulin costs declined, meaning payers picked up the bulk of the price increases.

The 5 potential insulin product entrants studied were Afrezza, Tresiba, Ryzodeg, Basaglar, and Toujeo. NDAs were filed for each of these products during the study period. The incumbent insulins included in the study were Lantus, Novolog, Humalog, Humulin, Levemir, Novolin, and Apidra.

“Many hope that biosimilar competition will [counteract] the ongoing rise in biologic branded drug prices, but so far, there is considerable debate over whether these reductions in price will materialize,” the authors said. “A contribution of our insulin analysis is that it provides real world evidence for the impact of potential biosimilar pipeline shocks.”

In their study of pricing for Enbrel and Humira, the authors found that the biosimilar pipeline shocks resulted in much greater price increases than for insulins. “The biosimilar shocks for each drug increase price for both Humira and Enbrel by over $700 (74.9% for Humira, 63.2% for Enbrel) for a 30-day supply,” they wrote. The amount of litigation over these products also increased as the incumbent manufacturers fought off the potential competition.

Litigation Adds to Drug Prices

In their conclusions, the authors stated they believe that the litigation surrounding biosimilars will boost costs of doing business for incumbent manufacturers and add to the pressure they feel to raise their prices prior to the arrival of rival products. Biosimilar companies also will have to charge higher prices to recoup their legal expenses.

They said the structure of the payer system in the United States contributes to price increases and argued that the muffling effect of fixed co-pays would limit the incentives for physicians and patients to switch to biosimilars as they become available. “This lack of demand response from price increases incentivizes entering biosimilars to reference/shadow price incumbent products in the market,” they wrote.

Another factor that influences end prices of drugs, they said, is that, due to expense and time involved, manufacturers, payers, and pharmacy benefit managers likely do not automatically engage in renegotiation of drug prices, rebates, and tier positions as rival product candidates get closer to FDA approval and launch. These interactions may occur quarterly or less frequently, and therefore, “The market power held by a manufacturer likely persists until after entry occurs, a considerable time frame given FDA review lag between NDA submission and approval.”

The authors concluded “there is considerable work to be done to assess the role of manufacturer-insurer bargaining power.”

Reference

Ellyson AM, Basu A. Do pharmaceutical prices rise anticipating branded competition? Health Economics. January 30, 2021. doi:10.1002/hec.4248

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.