- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Swift Uptake for Mvasi Suggests Provider Comfort With Use

Investigators looked at the first 9 months of use following the launch of the bevacizumab biosimilar Mvasi to gauge physician comfort with this agent across tumor types.

Investigators have demonstrated that initial uptake of the first bevacizumab biosimilar (Mvasi, Amgen) in the United States was strongest for patients receiving treatment for metastatic colorectal cancer (mCRC).

In the retrospective study presented at the ASCO Gastrointestinal Cancers Symposium 2021, investigators sought to evaluate uptake of Mvasi, which was approved by the FDA for all indications of the reference product (Avastin): mCRC, cervical cancer (CC), non–small cell lung cancer (NSCLC), glioblastoma (GBM), and metastatic renal cell carcinoma (mRCC).

They also concluded that, based on the findings, providers were comfortable initiating or transitioning patients to the bevacizumab biosimilar, and they saw little difference in patient characteristics or demographics between those who previously received the reference product and those who initiated treatment with the bevacizumab biosimilar.

The investigators drew patient data from a Flatiron Health electronic health records database, Oncology Services Comprehensive Electronic Records, which included cancer treatment information for 2.2 million patients from over 280 cancer clinics. The study included patients who received a bevacizumab biosimilar infusion between July 2019, when Mvasi was first approved, and April 2020 (9 months).

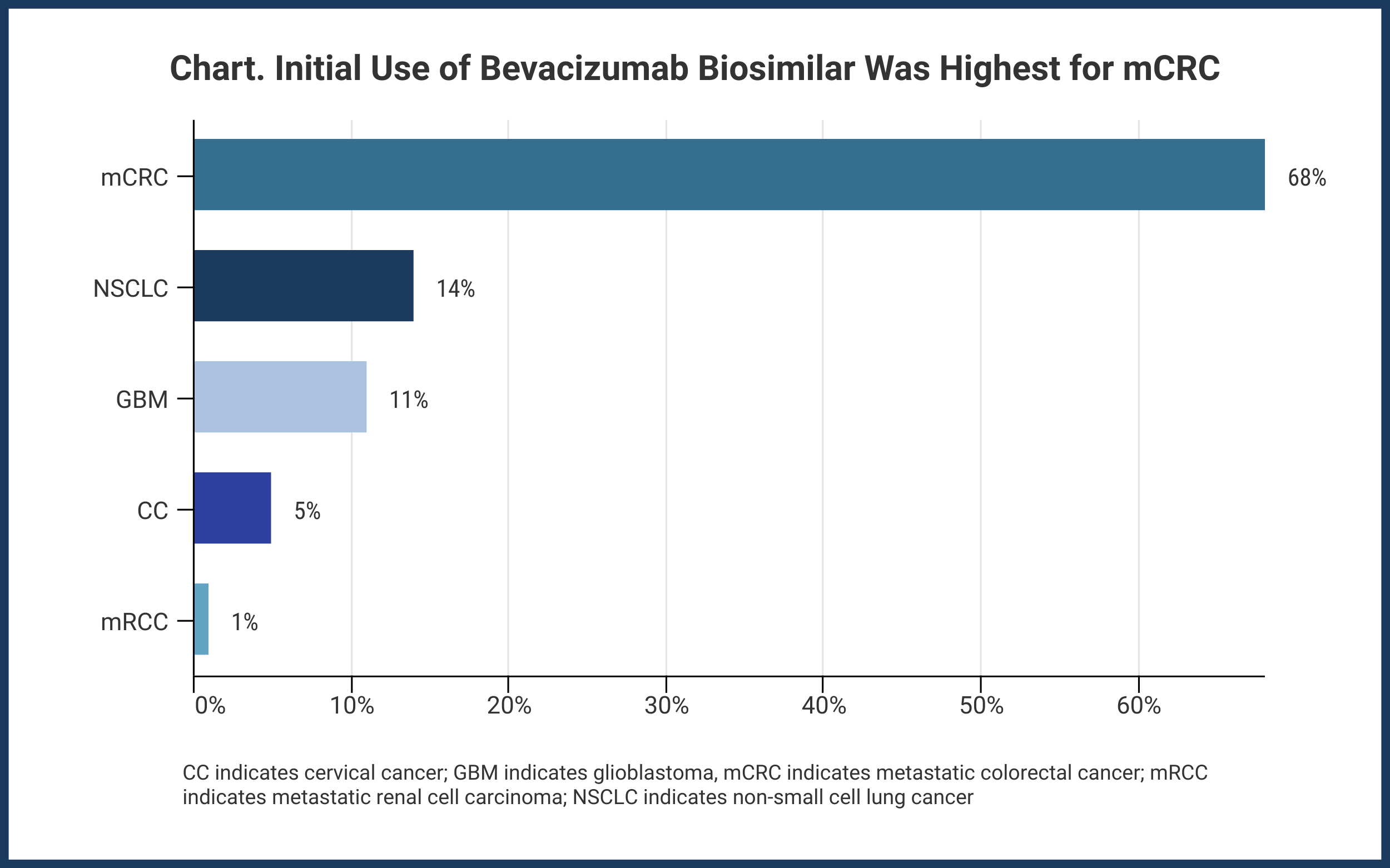

The bevacizumab biosimilar was first used in a patient with mCRC, and this occurred within 10 days of product launch. Ultimately, during the study period, 68% of patients with mCRC received an infusion of Mvasi. The other indications accounted for lower biosimilar use: NSCLC, 14%; GBM, 11%; CC, 5%; and mRCC, 1% (Chart).

Patients eligible for inclusion numbered 1657, among whom 685 had no prior reference drug treatment vs 972 who did. The investigators said 49% of patients (810) were younger than 65 years, and 60% were White; 11%, Black; and 2%, Asian. The race distribution between those with no prior reference drug and prior reference drug was equivalent, 84% of patients had Eastern Cooperative Oncology Group (ECOG) scores of 0/1, and median body weight was 78 kg. ECOG is a measure of a patient’s ability to function independently, with 0 representing the highest functioning patients and 5 indicating deceased.

The investigators said 59% of patients with mCRC received the reference product prior to receiving the biosimilar. Among other tumor types, the respective percentages ranged from 42% to 50%.

For 67% of patients with mCRC, the average length of time that elapsed between the last reference drug infusion and biosimilar initiation was ≤ 28 days.

A second bevacizumab biosimilar (Zirabev, Pfizer) was launched in the United States in January 2020. Mvasi was launched at a 15% discount to the reference drug wholesale acquisition cost (WAC; $677 vs $797, respectively) and a 12% average sales price discount (ASP; $677 vs $767). Zirabev was launched at 23% and 19% WAC and ASP discounts, respectively ($613 vs $797 and $613 vs $761, respectively). These sales data, provided in a 2020 report from Amgen, reflect the early 2020 launch of Zirabev and the changes in ASP and WAC that occurred since Mvasi was launched in the third quarter of 2019.

As of the second quarter of 2020, Mvasi had attained a 38% market share in the United States vs 2% for Zirabev.

Reference

Jin R, Accortt NA, Sandschafer D, Lawrence T, Loaiza-Bonilla A. Initial experience of patients treated in a real-world clinical setting with bevacizumab-awwb: the first FDA-approved biosimilar to bevacizumab. Presented at: ASCO GI Cancers Symposium; January 15-17, 2021. Accessed January 15, 2021. https://meetinglibrary.asco.org/record/194163/poster

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.