- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

The Next Frontier: Oncology Biosimilars in 2025 and Beyond

The US oncology biosimilar market has rapidly evolved since its launch in 2017, driven by steep price discounts, payer adoption, and provider confidence, with an upcoming wave of biosimilars targeting blockbuster biologics promising further market growth, cost savings, and broader patient access.

The Landscape So Far

The launch of therapeutic oncology biosimilars in the US from 2017 to 2019 was a significant milestone for the pharmaceutical industry. These biosimilars not only swiftly eroded the reference product’s market share but also set a new benchmark for expectations toward net price discounts to facilitate rapid adoption by payers upon launch.

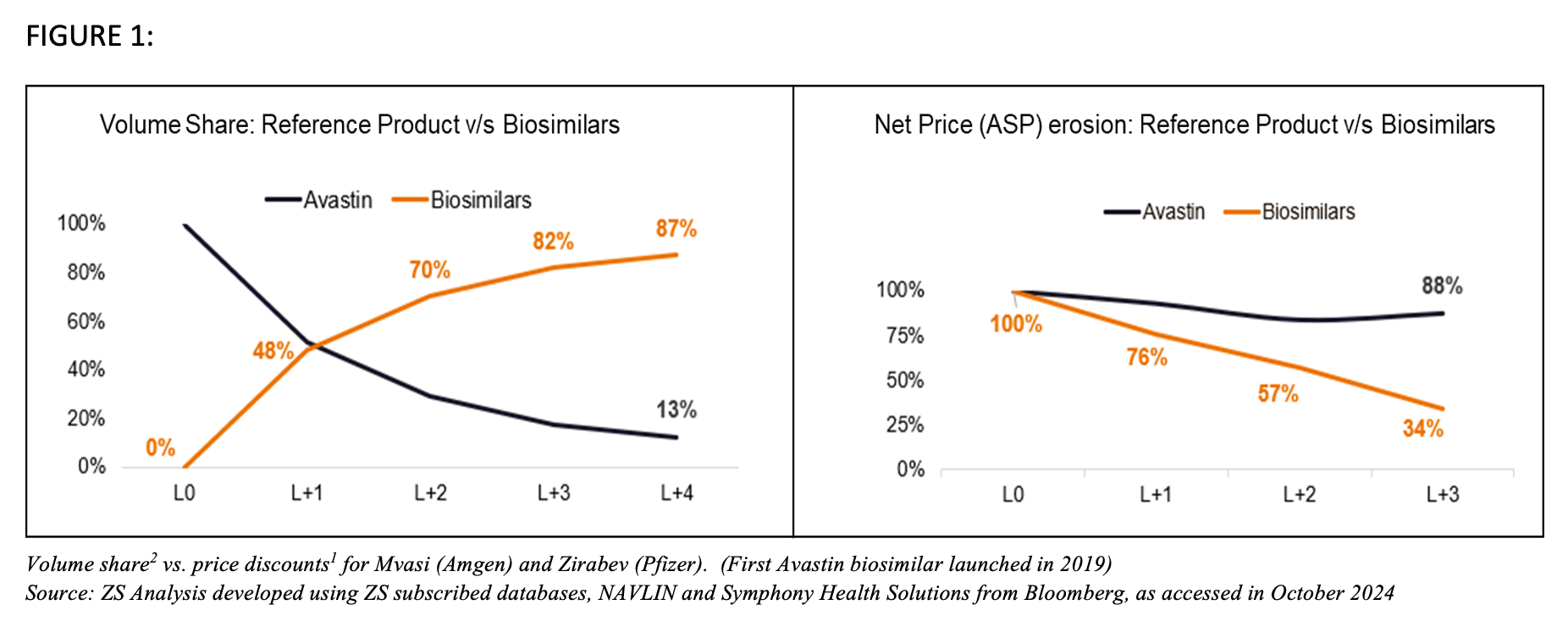

With multiple biosimilars entering the market against Roche’s trio, manufacturers were under pressure to offer steep discounts for gaining a foothold in the market. (Figure 1) Net price offers were the main driver of biosimilar adoption in the developing US biosimilars market. This contrasts with EU5 countries (France, Germany Italy, Spain, and the UK), where along with the net prices, initiatives such as hospital-based incentives (including gain sharing agreements and prescription quotas) were helpful in driving biosimilar adoption. As a result, attractive net price discounts swayed both payers and providers in the US toward biosimilars in therapeutic oncology, which allowed them to win almost half the market volume within a year of their launch.

FIGURE 1

Fortunately, due to the net prices that were offered, biosimilars picked up adoption (see Figure above). On the other hand, Roche diverted its efforts against biosimilar entry. The company didn’t focus on net prices (~10% decline year over year [YoY])1 compared to biosimilar drops (~20% decline YoY)1. This, along with its promotional efforts toward its next-generation products, contributed to a rapid volume erosion for the blockbuster triad (Herceptin/trastuzumab, Rituximab/rituximab, and Avastin/bevacizumab).

The Upcoming Competition

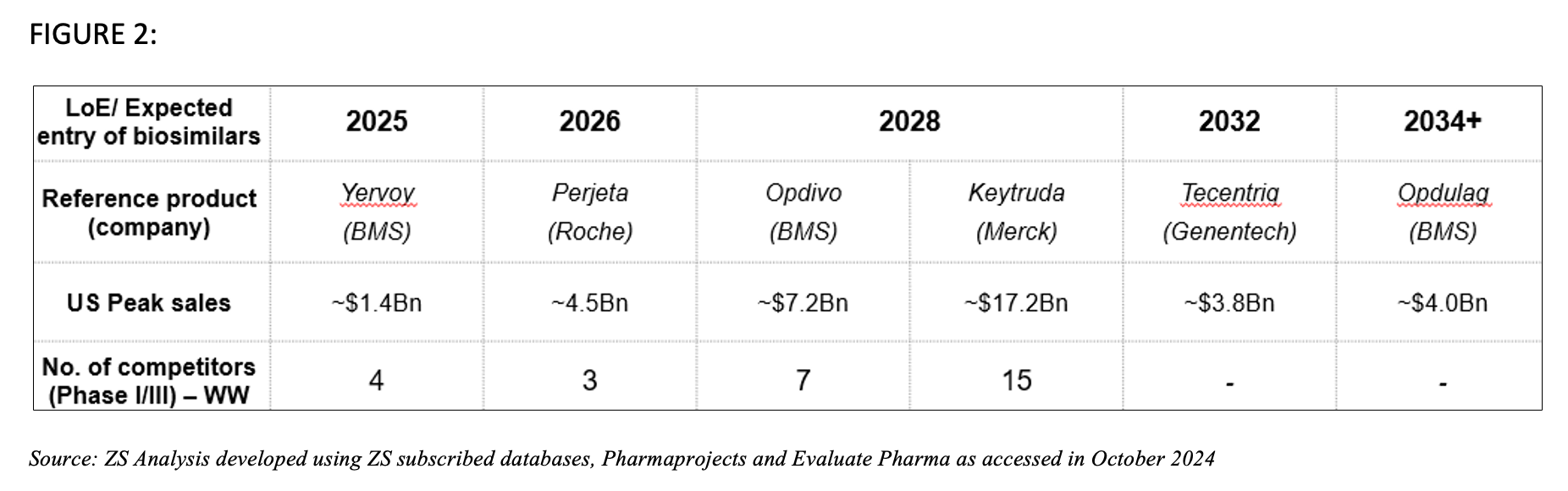

The oncology landscape is now expecting another wave of biosimilar competition, with several established biologics nearing patent expiry. The market opportunity is expected to reach about $25 billion by 2029.8,9 Frontrunners include Yervoy (ipilimumab) and Perjeta (pertuzumab), which are both crucial blockbusters in various oncology indications such as non-small cell lung cancer and metastatic breast cancer. Additionally, checkpoint inhibitors such as pembrolizumab (Keytruda) and nivolumab (Opdivo) are set to join the list with their respective biosimilars expected in 2028.3

FIGURE 2

As these pipelines develop, the biosimilar market in the US is ready to evolve. Stakeholder expectations will play a crucial role in shaping the competitive offerings in these markets. ZS Analysis categorized these expectations using the 5Ps framework of stakeholders—Players, Price, Payers, Promotion and Provider expectations.

Players

The upcoming biosimilar market will be divided into three archetypes—established, emerging and smaller players, each competing for position. Established companies like Sandoz, Samsung Bioepis and Amgen4 are expanding their portfolios with upcoming biosimilar launches that target high-value drugs like Keytruda and Opdivo. Emerging players such as Mabxience (part of Insud Pharma), Biocad, Luye Pharm and Innovent Biologics4 are also making significant strides, with several biosimilars in late-stage development targeting various oncology indications. Furthermore, smaller companies such as Prestige Biopharma and Shanghai Henlius Biotech4 are anticipated to enter the biosimilar market, focusing on segments with fewer competitors.

In response to the upcoming competition, reference product manufacturers will need to take several key factors into account, including identifying upcoming biosimilar competition, prepping for their next-generation launches, monitoring the patent landscape for biosimilar entry considerations and articulating their value proposition.

Price and Payers

Established biosimilar manufacturers with more commercial capabilities can calibrate payer and provider contracting through innovative models such as payer-manufacturer partnerships. Driven by attractive net level discounts and large portfolios, these models enable manufacturers to negotiate at their terms. Manufacturers are likely to prioritize payers that have demonstrated medical benefit control5 and have high exposure to key provider accounts that noncontracting strategies are unable to protect. With more competitors offering similar support and value, these biosimilar companies will need to ensure their economic model remains competitive.

On the other hand, less established manufacturers (emerging and smaller players), are likely to provide moderate payer and provider concessions to prioritize average sales price maintenance and avoid price war with fast gross-to-net erosion. The success of these strategies, however, will be influenced by factors such as order of entry, company’s reputation, awareness and comfort of stakeholders with their differentiation, if any.

Wide payer coverage would remain arguably the most important life cycle management strategy for any reference product manufacturer and here’s why: payer-tender driven restrictive coverage for reference product manufacturers can limit both market access and utilization for the reference product that’s facing biosimilar competition. The eminent financial toxicity in this therapy area also makes it difficult for patients to pay for these drugs without payer assistance. As health care budgets tighten and costs soar, payers in oncology will likely be moving away from traditional volume-based models, where manufacturers are paid solely for the drug’s volume sold. Instead, value-based contracts tie payment to the actual health outcomes achieved by patients using the drug. This shift will incentivize reference product manufacturers to focus on developing innovative therapies that demonstrate not only efficacy but also long-term value, including improved survival rates, reduced hospitalizations and improved quality of life for patients.

The oncology biosimilar landscape is evolving rapidly, impacting biosimilar manufacturers, pharmacy benefit managers, and the broader contracting environment. While not a perfect analogy, the Humira (adalimumab) biosimilar experience provides insights into potential stakeholder reactions to a wave of biosimilars. Initial surveys indicated payer reluctance to prioritize biosimilars over established reference products unless offered significant discounts10. In 2023, 1 month before the launch of adalimumab biosimilars, Oliver Wyman Health7 estimated a minimum net price reduction of around 10% might be necessary for biosimilar parity. Smaller discounts might not justify administrative burdens. For larger discounts (around 20%), payers could consider preferential access pathways, such as formulary tiering and utilization management. In cases of substantial price differences (approaching 50%), complete exclusion of the reference brand might occur.

These predictions were validated in practice, as payers began to remove Humira from their coverage lists in exchange for substantial net price reductions offered by biosimilar manufacturers. It’s reasonable to anticipate a comparable trend unfolding with the imminent wave of competitive oncology biosimilars.

Promotion

As biosimilar and reference product prices become comparable, manufacturer-related factors such as supply reliability and brand reputation become essential for hospital committees to make informed decisions. Manufacturers should continue to analyze data from actual clinical practice to highlight the effectiveness and safety of their drug in real-world settings, complementing clinical trial data.

Beyond contracting strategies, reference product manufacturers in oncology have a whole arsenal of tactics at their disposal to preserve their market share as a part of their life cycle management. Promoting the potential of blockbusters such as Keytruda and Opdivo in combination with other therapies, including novel drugs or different treatment modalities, can demonstrate superior efficacy or broader applicability compared to biosimilars. However, emerging research indicates strong similarity between reference products and their biosimilars, supporting their interchangeability in combination therapies.

Winning approval for new indications and a new route of administration expands the reference product’s access to new populations while simultaneously protecting the drug’s exclusivity for a few years. This strategy has been tried and tested in the past by reference product manufacturers such as Roche for Avastin and AbbVie for Humira.12,13 New indications were excluded from extrapolation on biosimilar labels that limit biosimilar access to all types of patient populations upon approval (except off-label usage). These “excluded” indications were later added in the biosimilar label post the expiry of specific regulatory exclusivity.

Provider Expectations

A robust level of provider confidence in biosimilars, coupled with the significant financial burden imposed by traditional anti-cancer agents, is expected to exert a strong positive influence on biosimilar switching rates. Providers look for biosimilars to be included in clinical practice guidelines, which can help standardize their use and increase confidence in prescribing them. They also expect continuous education campaigns and resources to better understand biosimilar extrapolation, their switching data packages and health care provider support services for driving adoption in oncology.

What Does the Future Hold?

The upcoming wave of oncology biosimilars offers a potential benefit for payers, health care providers and patients. This wave will include biosimilars to Yervoy and Perjeta, followed by those to Opdivo and Keytruda in 2028 and beyond. Multiple biosimilar companies have expressed interest in entering this market.

Successful biosimilar adoption could lead to broader patient access, cost reductions and the reallocation of health care resources toward advanced treatments like cell and gene therapies. To sustain a biosimilar business, companies may need to diversify into other therapy areas beyond oncology and optimize their development processes. This could involve combining phase 1 and 3 trials, cost-effective manufacturing and adaptable commercial models.

Such strategic shifts in the biosimilar industry could have a positive impact on public health, particularly in the management of rare diseases. By improving access to affordable treatments, the health care system can better address the needs of patients with rare conditions. ZS Analysis is actively monitoring these developments through comprehensive research initiatives, leveraging both primary and secondary data sources. This ongoing research by experts in the field ensures that ZS remains at the forefront of understanding and navigating the evolving landscape of oncology biosimilars.

Author Bios

Christina Corridon, MPH, MBA, is a principal in ZS’s Boston office and leads the firm’s Biosimilars Centre of Excellence (CoE). During her experience of over 18 years she has worked on US as well as globally focused projects including launch strategy and planning, go-to market or customer engagement strategy, competitive scenario planning, and marketing strategy.

Prateek Yadav, MPTh, MBA, a manager at ZS India Office, co-leads the Biosimilars Center of Excellence, driving ZS's thought leadership in this area. With 9 years of dedicated experience in biosimilars within his decade-long healthcare career, he has supported clients in the US, European Union, and the Asia–Pacific region on a wide range of projects, including competitive intelligence, market opportunity assessments, strategic planning, go-to-market, and mergers and acquisitions.

Mayuri Mathuria, MBA, is a consultant in ZS's India Office. Her more than 5 years of experience in the biosimilars space has been shaped through her work in marketing, launch planning, portfolio, and brand planning along with a background in knowledge management & research.

References

- ZS database Navlin. ZS. Accessed October 2024.

- ZS subscribed database Symphony Health Solutions from Bloomberg. ZS. Accessed October 2024.

- Vivek Subbiah. The next generation of evidence-based medicine. Nat Med. 2023;29:49-58. doi:10.1038/s41591-022-02160-z

- Keytruda, Opdivo may be only part b drugs chosen for Medicare negotiation in first applicable year. Pink Sheet by Citeline. March 31, 2023. Accessed January 13, 2025. https://insights.citeline.com/PS147826/Keytruda-Opdivo-May-Be-Only-Part-B-Drugs-Chosen-For-Medicare-Negotiation-In-First-Applicable-Year/

- ZS subscribed database AdisInsight. ZS. Accessed October 2024.

- Shah Z, Pandey S, Patel K, Dugar R. Payer management is coming for oncology drugs: what you should know. ZS. February 28, 2022. Accessed January 13, 2025. https://www.zs.com/insights/payer-management-is-coming-for-oncology-drugs

- Tomassi M, Chou A, Shi C, Welliver S. Humira biosimilars could reshape the market. Accessed January 13, 2025. https://www.oliverwyman.com/our-expertise/perspectives/health/2023/jan/humira-biosimilars-could-reshape-the-market.html

- ZS subscribed database Evaluate Pharma. ZS. Accessed October 2024.

- Biosimilars market growth at a CAGR of 23% by 2030. BioSpace. August 30, 2022. Accessed January 13, 2024. https://www.biospace.com/biosimilars-market-growth-at-a-cagr-of-23-percent-by-2030

- IQVIA, Adalimumab biosimilar tracking. IQVIA. April 2, 2024. Accessed January 13, 2024. https://biosimilarscouncil.org/wp-content/uploads/2024/04/04022024_IQVIA-Humira-Tracking-Executive-Summary.pdf

- Humira FDA approval history. Drugs.com. Updated August 25, 2022. Accessed January 13, 2025. https://www.drugs.com/history/humira.html

- Avastin FDA approval history. Drugs.com. Updated May 5, 2021. Accessed January 13, 2025. https://www.drugs.com/history/avastin.html

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.