- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

US Welcomes First Adalimumab Biosimilar, Amjevita

Amgen’s Amjevita (adalimumab-atto) has officially entered the US market, making it the first of potentially 10 biosimilars referencing Humira to launch in 2023.

Amgen has launched Amjevita (adalimumab-atto) on the US market, making it the first biosimilar referencing blockbuster drug Humira to become commercially available for American patients.

Amgen logo

"With today's announcement, Amjevita is the first U.S. biosimilar to Humira®, a medicine used by more than a million patients living with certain serious inflammatory diseases,"said Murdo Gordon, executive vice president of global commercial operations at Amgen, in a statement.

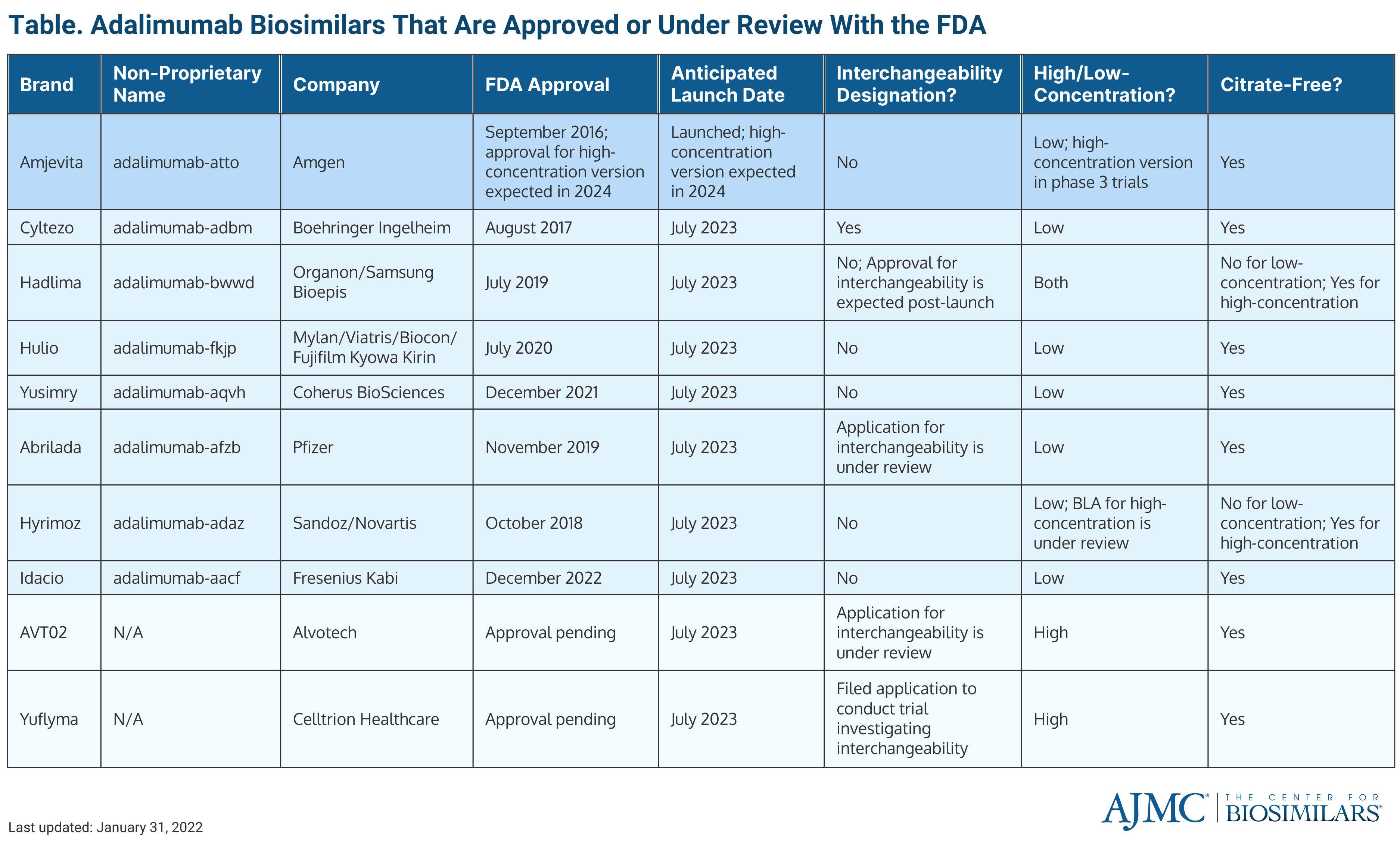

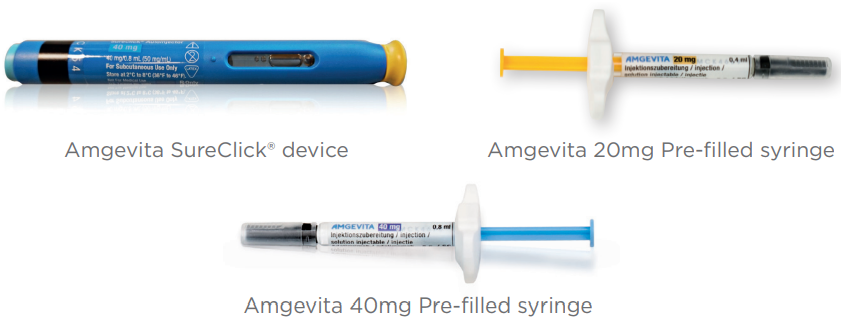

The biosimilar is 1 of 10 adalimumab biosimilars expected to launch in 2023 and it will be the only adalimumab product competing against the originator until July 2023 (Table). There are currently 8 FDA-approved biosimilars and 2 others are under review. Amjevita will be offered in a prefilled syringe and an auto-injector pen.

In September 2016, Amjevita became the first adalimumab biosimilar to be approved by the FDA. It is also available in the European Union and Canada, where it is marketed as Amgevita. It was approved by the European Medicines Agency in March 2017 and launched on the Canadian market in May 2021. Amjevita does not have an interchangeability designation, but Amgen has said that it is conducting a switching study to obtain the interchangeability label post launch.

Click to enlarge.

Although the initial launch is for a citrate-free, low-concentration formulation, Amgen’s high-concentration version of the biosimilar is currently being evaluated in a phase 3 trial. The US approval and launch of the high-concentration version of Amjevita are expected in 2024.

Amjevita is approved for all indications of the reference product except hidradenitis suppurativa. The biosimilar was approved for the treatment of a variety of rheumatic conditions, including:

- Rheumatoid arthritis in adults

- Polyarticular juvenile idiopathic arthritis in children 2 years of age and older

- Psoriatic arthritis in adults

- Ankylosing spondylitis in adults

- Crohn disease in adults and children 6 years and older

- Ulcerative colitis in adults and children 5 years and older

- Chronic plaque psoriasis in adults

The wholesale acquisition cost of Amjevita (40 mg) is 55% lower than Humira, and the list price of the biosimilar is 5% below the current list price of Humira. Amgen's biosimilar portfolio contains 11 biosimilar products, 5 of which are FDA-approved and 3 are approved in the European Union.

"Biosimilars are extensively studied, FDA-approved treatments that have the potential to reduce costs to the healthcare system.... Amjevita provides another treatment option for patients and their doctors," said Steven Taylor, president and chief executive officer at the Arthritis Foundation, in Amgen's announcement.

Although most European markets have had extensive adalimumab biosimilar portfolios for several years, 2023 marks the year when biosimilar competitors to Humira are allowed to enter the US market. This is because the maker of Humira, AbbVie, has sued every manufacturer of adalimumab biosimilars in patent infringement lawsuits, which have all resulted in settlement agreements where biosimilar manufacturers have agreed to postpone their launch timelines until 2023.

A case filed in August 2022 that claimed AbbVie’s use of patent infringement lawsuits constituted antitrust behavior was thrown out after the court decided that AbbVie’s so-called “weak patents” are valid and that the company has a right to defend them. It also said that AbbVie allowing companies to launch their adalimumab biosimilars in Europe while holding off in the United States did not constitute a pay-for-delay scheme.

The EU's Amgevita and the US' Amjevita can be administered using a prefilled syringe (20 mg or 40 mg doses) or an auto-injector pen (SureClick device). Source: Amgen

In light of the historic launch, biosimilar advocacy organizations such as the Biosimilars Forum are calling for policy changes to hold pharmacy benefit managers (PBMs) accountable for ensuring that all FDA-approved biosimilars for Humira are listed on formularies for Medicare Part D and commercial plans.

PBMs are third-party “middlemen” whose practices influence formulary decisions and determine which products are eligible for reimbursements, oftentimes in favor of reference products.

The Forum said that biosimilars will be unable to achieve the forecasted $133 billion in aggregate savings over the next 3 years without fair and equal accessibility for all adalimumab biosimilars. Currently, Humira can cost upwards of $84,000 annually, and its price is 470% higher than when it was first introduced to the US market.

During an interview with The Center for Biosimilars®, Julie Reed, the executive director of the Biosimilars Forum, talked how PBMs’ business model has changed since the introduction of generics, when PBMs were very encouraging of lower-cost products.

So far, 3 major PBMs (Optum Rx, Express Scripts, and Prime Therapeutics) have announced that they will add adalimumab biosimilars to formulary tiers at parity with the reference product. However, only 1 (Optum Rx) has disclosed how many it will initially add (n = 3), and none have said which biosimilars will be added.

“Their model has changed to make choices for formulary access based on the rebates they get. And that's a real issue because if you've got a lower list price, like with insulin biosimilars, you get no market access…. So, if there's 8 or more [adalimumab biosimilars] and only 2 or 3 have access, what about the others? What happens there? And that's going to be very telling,” she said.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.