- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Vizient Predicts 7.5% Humira Price Increase Before Biosimilars Arrive

In its annual drug price guide, Vizient predicts that US annual adalimumab (Humira) revenues could reach $24 billion before biosimilars enter the marketplace.

In various therapeutic areas, biosimilars have gained significant ground on reference products, providing greater access to medicine and savings for health care in general, "yet the feeling that we have not fully realized the value of these medications persists,” says a new pharmaceutical trends report from Vizient.

The report identifies the adalimumab market as the most important potential growth area for biosimilars, given that in the United States, there are no biosimilars available for this product (Humira) and the originator company, AbbVie, could soon reap $24 billion in US annual sales from adalimumab, up from $14.9 billion in full-year 2019 US sales.

“The target of greatest interest remains adalimumab, for which biosimilars will be launched in 2023,” the report says.

Vizient, in its new report, predicts an adalimumab price increase of 7.5% before adalimumab biosimilars have a chance to enter the US market, as AbbVie capitalizes on the long-running domestic monopoly it still enjoys with this product for rheumatologic and gastrointestinal disorders.

In general, Vizient’s drug market price predictions tend to be 1 or 2 percentage points above the actual increases, although in recent years it has been accurate in forecasting large upward swings in pharmaceutical prices.

“These trends, compounded by [the coronavirus disease 2019] pandemic, have created even greater need for cost savings for patients and health care organizations. Therefore, providers must press forward with adoption of biosimilars,” the report said.

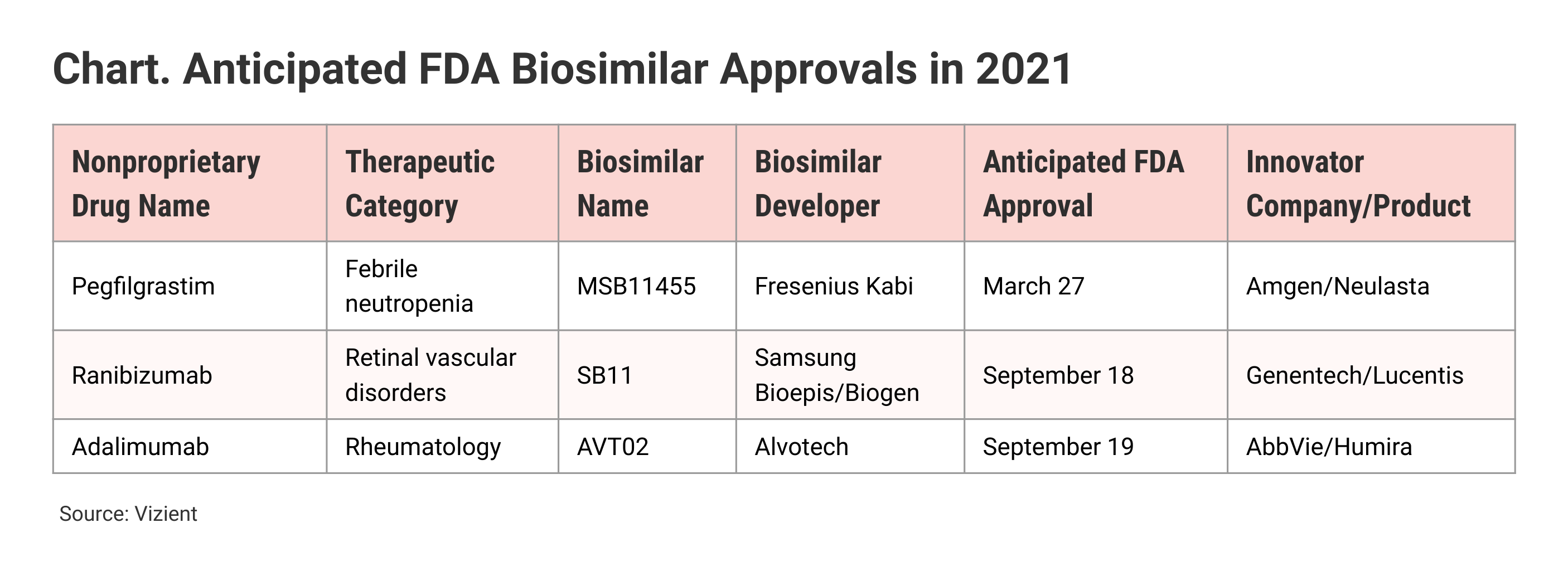

Vizient is anticipating FDA approval of individual biosimilar products in 2021 for pegfilgrastim (referencing Neulasta), ranibizumab (Lucentis), and adalimumab (Chart). Biologics license applications for each of these products were filed in 2020.

Click to enlarge

Of the 29 biosimilars approved by the FDA so far, 9 are not being marketed because of patent settlements or other business reasons. The biosimilars launched so far saved roughly $18 billion between 2010 and 2014 and $19 billion between 2015 and 2019, Vizient said. However, “the greatest savings” are expected to occur in the 5-year span ending in 2024, the company noted, citing IQVIA data projecting up to $104 billion in biosimilar savings between 2020 to 2024, “driven largely by biosimilars for adalimumab that are expected in 2023.”

Trastuzumab biosimilars accounted for an overall 24% market share from October 2019 to September 2020, but the national market share for trastuzumab biosimilars had expanded to 39% by September 2020, as by that point, 5 were on the market and competing with the originator product, Herceptin.

“This finding suggests that as the number of competitors continues to grow, biosimilars are gaining greater acceptance. The same trends hold for other products such as biosimilars for rituximab and bevacizumab,” Vizient said.

The company urged health care providers to improve their understanding of biosimilars in order to position themselves for successful uptake of these products. “It is also important to engage clinicians whose acceptance of biosimilars has been limited (such as gastroenterologists) and those who will soon have the option available to them for the first time (eg, endocrinologists).”

Vizient also noted that payer formulary decisions continue to be a trouble spot in securing access to biosimilars and urged pharmacy organizations to work closely with finance departments and others to combat coverage denials and better coordinate coverage for biosimilars. “Pharmacy departments at several Vizient member organizations have begun to provide their financial colleagues with language to include in payer negotiations to secure biosimilar coverage at parity with the originator drug or with other biosimilars.”

Vizient predicted an overall 2.67% drug price increase over the year ending June 30, 2022. Among drugs ranked highest in total amount spent by Vizient’s health organization network, adalimumab was in the top spot, and rituximab and infliximab in third and fourth.; biosimilars are available for the 2 latter drugs. In second, fifth, and sixth places are pembrolizumab (Keytruda), ustekinumab (Stelara), and nivolumab (Opdivo), for which biosimilars are being developed and not yet approved.

In the new report, adalimumab ranks No. 1 on Vizient’s list of drugs by highest projected price increase. Ustekinumab is third, and etanercept (Enbrel), for which biosimilars are approved but not launched, ranks fourth. Pembrolizumab is fifth.

Interestingly, vasopressin (Vasostrict), a low blood pressure medication, is second on that list. Vizient noted that this drug has been on the market for decades but because of a regulatory fluke, the manufacturer, Par Pharmaceutical Companies, was able to obtain exclusivity and raise the price of this product. The FDA’s Unapproved Drugs Initiative (UDI) allowed manufacturers of legacy medications to seek formal approval and rewarded them with 3 to 5 years of market exclusivity. The emergence of a new formulation of vasopressin, however, enabled Par Pharmaceutical Companies to gain patent exclusivity until 2035. Realizing the problem, HHS terminated UDI, but the die was cast and vasopressin soared in price.

For biologics in general, Vizient is anticipating a 3.96% price increase in the year from July 1, 2021 to June 30, 2022.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.