- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Xbrane Seeks to Bring Keytruda and Darzalex Biosimilars to Market

Xbrane Biopharma of Stockholm, Sweden, said its next biosimilar candidates will target the demand for oncology and hematology therapeutics.

Xbrane Biopharma, a 13-year-old startup, said it will initiate the development of biosimilar candidates referencing Keytruda (pembrolizumab) and Darzalex (daratumumab).

Pembrolizumab is a monoclonal antibody programmed death inhibitor (PD-1) used in the treatment of melanoma, lung cancer, head and neck cancer, Hodgkin lymphoma, stomach cancer, and cervical cancer. It works by preventing tumor cells from shutting down the immune system attack on cancerous growth.

Daratumumab is used in the treatment of multiple myeloma (bone marrow cancer) and light chain amyloidosis (blood disease). It functions by binding to a glycoprotein on tumor cells (CD38) and causing apoptosis, or cell death.

Keytruda is one of Merck’s best-selling drugs, having generated $14.4 billion in 2020, up 30% from the previous year. Sales of Darzalex in 2020 totaled $4.19 billion. The product was developed by Genmab and is distributed under license by Johnson & Johnson.

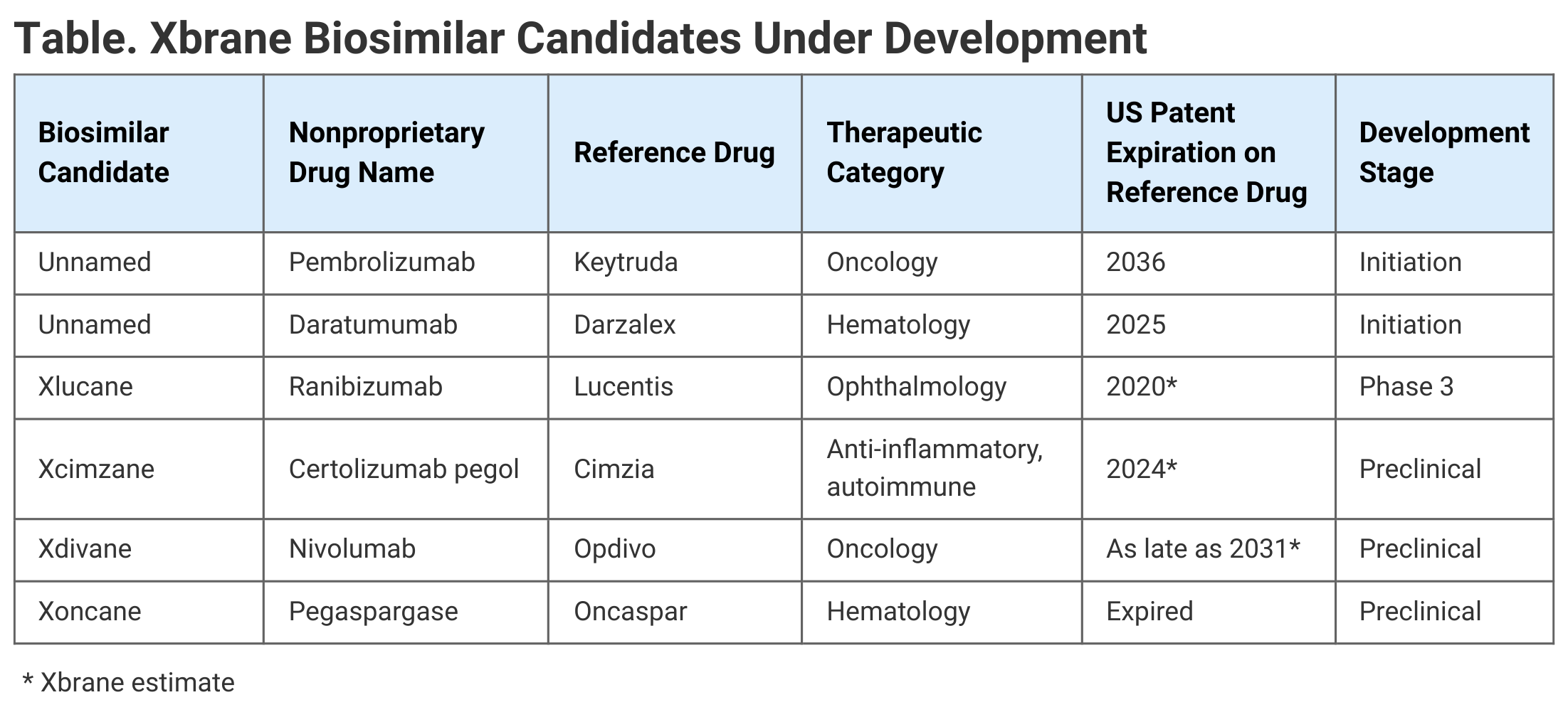

Patent expirations on reference products are key to when biosimilar competition may enter the market, and the multiplicity of patents issued for individual drugs on a rolling basis makes it difficult to pinpoint those entry points on a timeline. However, the Generics and Biosimilars Initiative estimated in 2017 that the key US patents for Keytruda and Darzalex would expire in November 2036 and February 2025, respectively (Table).

Click to enlarge.

Xbrane has other biosimilars in development, though none on the market currently. These include Xlucane (ranibizumab), which references the blockbuster ophthalmology drug Lucentis for wet age-related macular degeneration, diabetic-related macular edema, and retinal vein occlusion. This biosimilar candidate is in phase 3 development.

Two others are Xcimzane (certolizumab pegol), referencing Cimzia, for rheumatoid arthritis, axial spondylarthrosis, psoriasis, and Crohn disease; and also Xdivane (nivolumab), referencing Opdivo, for melanoma, lung cancer, renal cell carcinoma, head and throat cancer, and bladder and urinary tract cancer. These biosimilar candidates are in preclinical development.

“With our high-yield platform technology, experienced team, and recently established development lab, we believe we are well positioned to accelerate the development of our portfolio,” said Martin Amark, CEO of Xbrane, in a statement.

Company Development

Founded in 2008 at Stockholm University, the company has worked with MedImmune, Eli Lilly, and Daiichi Sankyo to develop cost-efficient production platforms for new drugs; but it decided the risk inherent in developing new drugs was too high and switched to a focus on biosimilars.

The company anticipated that the market for biosimilars would grow larger over time and that it could step in with its already-developed production platform and potentially compete successfully.

The company did develop 1 nonbiosimilar product: Spherotide (triptorelin), which is used in the treatment of prostate cancer, endometriosis, uterine fibroids, precocious puberty, and breast cancer. This product was first authorized for sale in Iran in 2017.

The company went public in 2016 with a listing on Nasdaq First North, a Nordic exchange, and later on Nasdaq Stockholm, in 2019.

In line with the theory that biosimilars are lower-risk products to develop than novel agents, the company states on its website that analysis of 108 biosimilar development programs in the Informa Pharma Biomedtracker database suggests an average probability for success of 78% for biosimilars, encompassing all progress from phase 1 development to marketing authorization from a regulatory authority.

“This stands in sharp contrast to the probability of success for novel drug development programs, estimated to be about 10% from entering phase 1 to marketing authorization,” the company says, basing this assumption on data from more than 10,000 novel drug development programs, also from the Informa Pharma Biomedtracker database.

“The probability of success of a biosimilar program entering phase 3 is about 95% compared with about 50% for a novel drug,” the company claims.

Development costs are also significantly lower for biosimilars, Xbrane officials state on their website. They estimate $56 million to $113 million for biosimilar development, vs roughly $1.13 billion for a novel drug.

The biosimilars estimate is low by industry standards. The Association for Accessible Medicines (AAM), a trade association of generics and biosimilars producers, has estimated between $100 million and $300 million on average for biosimilar development costs. Litigation costs, which are very much a fact of life in bringing biosimilars to market against reference company opposition, may add to that total, the AAM has stated.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.