- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

BioRationality: A Dr Sarfaraz Niazi Column—Biosimilar Gene Therapy to Resolve the Most Critical Affordability Issue

In his column, Sarfaraz K. Niazi, PhD, chronicles the potential for biosimilars referencing some of the biggest cell and gene therapies as well as why companies should begin looking into biosimilar development efforts in this space.

Greetings to my dear readers; may the new year bring new thinking, a fresh perspective, and a stronger resolve to make more biologicals affordable. But biologics are more than therapeutic proteins. So, today, I present, in the new year, biosimilar gene and cell therapy products—not a pipedream, but a reality.

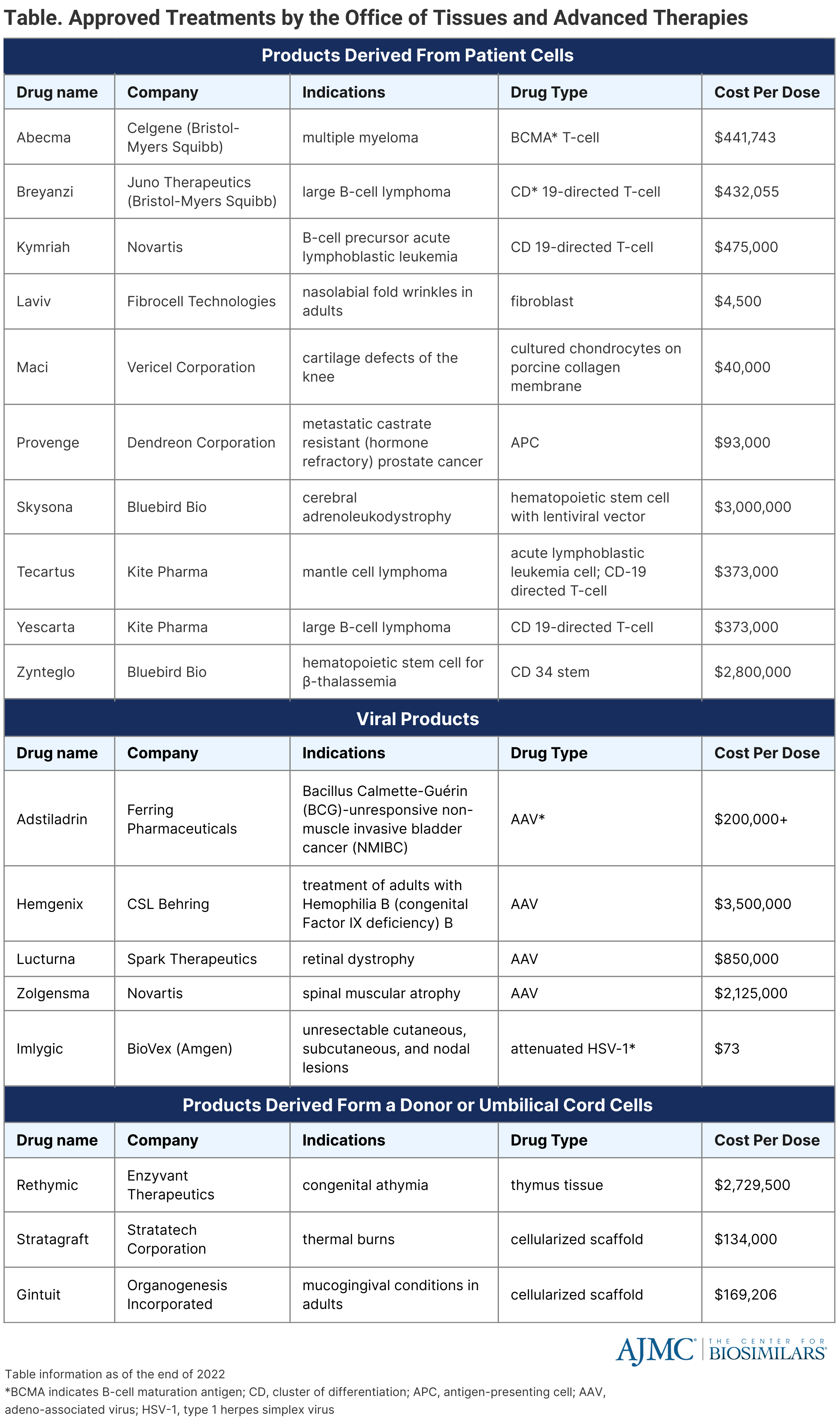

Once a paradoxical idea, gene therapy has become a clinical reality in the United States. The FDA has approved 20 cellular and gene therapy products, with treatment costs ranging from millions of dollars per dose. (Table) It is estimated that more than 1 million patients will be treated by gene therapy from January 2020 to December 2034, costing over $306 billion and growing at a rate of 16%, most conservatively.

Biosimilars have arrived to make biological therapeutic proteins affordable, and they continue to do so, albeit at a slower rate than anticipated. However, the affordability of these drugs appears to be a minor issue when we look at the price structure of the gene therapy products—it is way beyond any imagination of affordability. The high cost of these products comes from the regulatory compliance since the FDA treats them like any other new biological product, with its enormous development cost. Since the market of these products is limited to a minuscule number compared to other biological drugs, the amortization of the development cost takes gene therapies out of the reach of everyone.

Click to enlarge

Gene therapy strategies are applicable in ex vivo and in vivo formats. In vivo gene therapy involves the systemic injection of viral or nonviral vectors into the blood or local injection into tissues like muscles.[1] Ex vivo gene therapy involves cell extraction, genetic engineering of the cells, and transplantation of the manipulated cells back into the body. The cell-based immunotherapy, the chimeric antigen receptor (CAR) T-cells, mainly rely on lentivirus-mediated ex vivo gene therapies.[2]

So far, over 1,600 interventional gene therapy trials have been completed, 579 terminated, withdrawn, or suspended, and over 2,000 ongoings. No other field of biological therapy is so active.

Between 2030 and 2035, we will see the first wave of cell and gene therapies lose market exclusivity when most biosimilar companies enter the arena, just as they did with antibody-based biosimilars. It is noteworthy that Investigational New Drug (IND)-enabled cell therapies (CAR-T) are already available in some hospitals. The in-house CAR-T manufacturing provides a roadmap for generics to create biosimilars. These hospitals use similar genetic constructs as approved constructs. They spend years developing manufacturing and clinical protocols before offering IND-enabled cell therapies to patients for a 10-fold reduction in price.

Gene therapy manufacturing will become more affordable as more Contract Development and Manufacturing Organizations come online to meet the high demand for development services. The economies of scale will continue to lower manufacturing costs. The regulatory requirements will also become more rational as the FDA develops confidence, no different than what it did with therapeutic protein biosimilars. The biosimilar gene therapy product will likely be required to demonstrate consistent manufacturing and animal data; short patient trials with 5 to 10 participants may also be required. Viral-based gene therapy makes an excellent choice for biosimilars.

Biosimilar gene therapy with a "twist."

A novel approach to bringing "biosimilar" gene therapy products before the expiry of the exclusivity period is to file them as new biologics under the 351(a) pathway and take advantage of the public domain information (essentially the reference product filing) to support biosimilarity as suggested by the FDA in guidance for COVID-19 products: "COVID-19 vaccine development may be accelerated based on knowledge gained from similar products manufactured with the same well-characterized platform technology, to the extent legally and scientifically permissible.

Similarly, with appropriate justification, some aspects of manufacture and control may be based on the vaccine platform and, in some instances, reduce the need for product-specific data." This approach eliminates exclusivity but not patent protection. Fortunately,of all patents issued to protect gene therapy, only 27% remain valid as of the end of 2022.[3]

Let us get ready for another wave of genius biosimilars that will fulfill a greater humanitarian need, much larger than what the present biosimilars offer to do.

References

[1] Pardi N, Secreto AJ, Shan X, et al. Administration of nucleoside-modified mRNA encoding broadly neutralizing antibody protects humanized mice from HIV-1 challenge. Nat Commun. 2017;8:14630-14630. doi:10.1038/ncomms14630

[2] Zheng D. Antibody gene therapy: an attractive approach for the treatment of cancers and other chronic diseases. Cell Res. 2007;17(4):303–306. doi:10.1038/cr.2007.13

[3] Zhou W, Wang X. Human gene therapy: A patent analysis. Gene. 2021;803:145889. doi: 10.1016/j.gene.2021.145889

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.