- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

BioRationality: How Developers Can Expand Their Monoclonal Antibody Biosimilar Portfolio

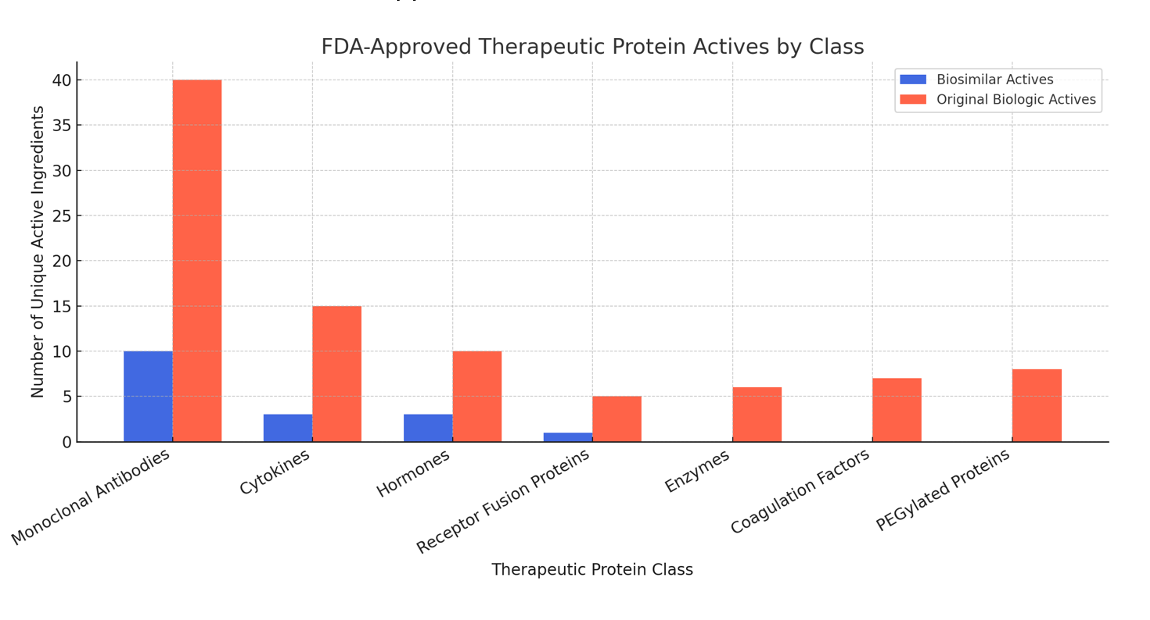

Monoclonal antibodies lead biosimilar approvals because of their large market size, well-defined regulatory pathways, and technological feasibility, whereas other biologics encounter development challenges but may see increased adoption as regulatory frameworks advance.

The FDA has approved many therapeutic proteins (as entities), and they do not correlate with the number of biosimilars approved.

There are many reasons why monoclonal antibodies are the most popular category of biosimilars. First, they are among the highest-revenue biologics with broad therapeutic use in autoimmune disorders and oncology. Drugs like Humira (adalimumab) and Herceptin (trastuzumab) generated billions annually, making them attractive biosimilar targets. Many first-generation blockbuster monoclonal antibodies had patents expiring post-2015, opening a large window for biosimilar development.

The FDA and European Medicines Agency (EMA) have developed more detailed guidance for monoclonal antibody biosimilars, including analytical, nonclinical, and comparative clinical pathways, making these more feasible to create. Advances in analytical characterization tools (mg, mass spectrometry, glycan profiling) have made it more practical to demonstrate biosimilarity for large, complex molecules like monoclonal antibodies. There is limited incentive for other classes; for example, enzymes and coagulation factors are niche products with smaller patient populations, offering lower commercial incentives.

Many recombinant cytokines or hormones (eg, insulin analogs) are now regulated under Federal Food, Drug, and Cosmetic Act section 351(a) as biologics only since 2020, limiting earlier biosimilar pathways. Fusion proteins, such as etanercept, pose intellectual property barriers and complex structural challenges that have delayed biosimilar development. Some classes, like enzymes or fusion proteins, require highly specialized expression systems, complex post-translational modifications, and higher immunogenicity risk, complicating biosimilar development.

While biosimilars encompass a range of biologics—including cytokines, hormones, and fusion proteins—monoclonal antibodies dominate FDA approvals due to market size, technological readiness, and regulatory clarity. Other biologic types will likely increase biosimilar representation as more patents expire, regulatory pathways evolve, and analytical and manufacturing technologies advance.

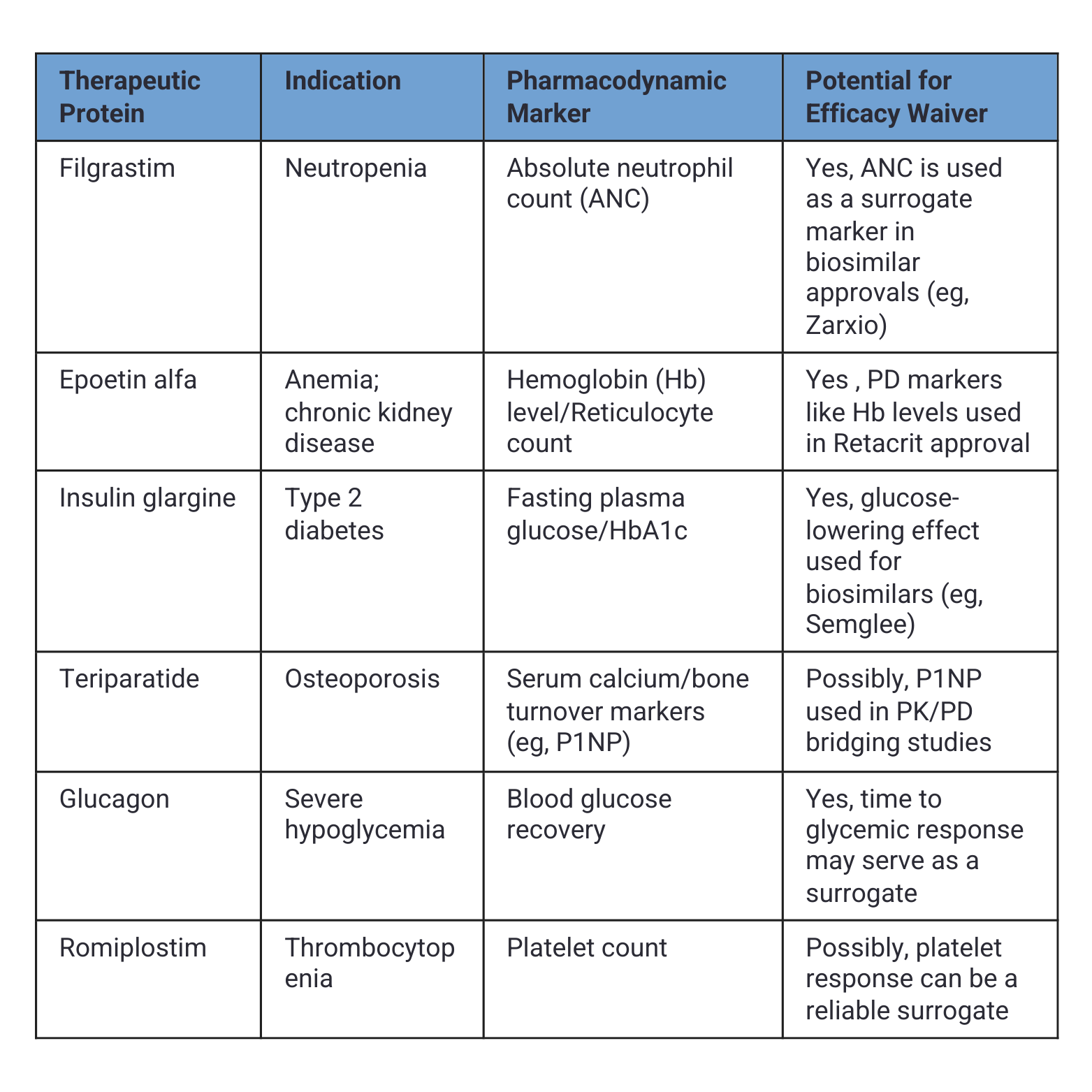

However, the developers need to consider a significant shift in the regulatory pathways for biologics other than monoclonal antibodies. Here is a table of therapeutic proteins that demonstrate measurable pharmacodynamic (PD) parameters, which in some cases have supported waivers of efficacy trials during biosimilar development. These PD markers serve as reliable surrogates to demonstrate comparable clinical activity. One perplexing example is that darbepoetin, with a market worth over $8 billion, has no biosimilar. I anticipate the FDA to enable efficacy waivers for all biosimilars soon, just as the UK’s Medicines and Healthcare products Regulatory Agency has done, and EMA is expected within the next few weeks. However, the language of waivers will not state it; it will follow the guidelines that the FDA has issued for interchangeable status. It will be up to the developers to request such a waiver and argue why it is unnecessary.

I look forward to developers becoming creative and challenging the FDA.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.